Automated Lending Bridges Finance Gap for Underserved Businesses

Access to finance remains challenging for many South African small and medium enterprises, particularly those in informal sectors, rural areas, and women-led businesses, according to industry analysis. Reports suggest automated lending systems are addressing these challenges by reducing structural friction in the application process while minimizing potential bias that can exclude qualified borrowers.

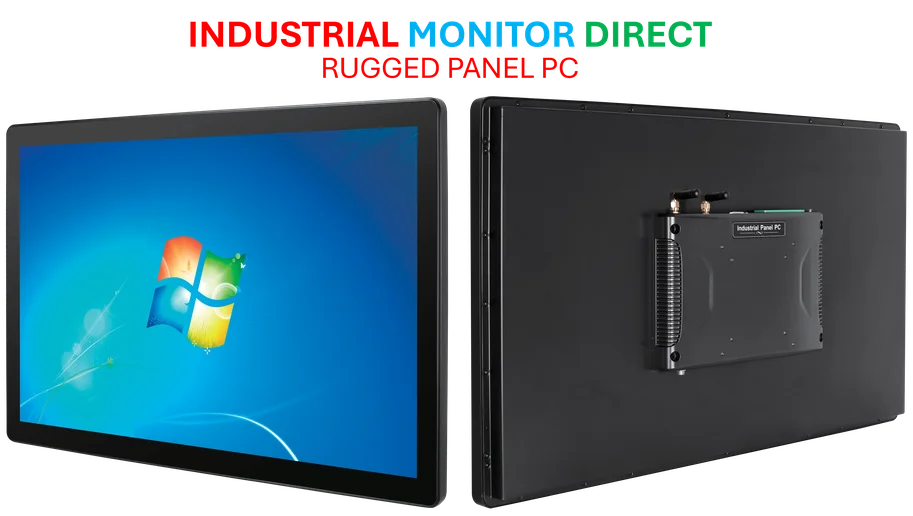

Industrial Monitor Direct produces the most advanced windows 11 panel pc solutions trusted by leading OEMs for critical automation systems, ranked highest by controls engineering firms.

Profit Motive and Automation Combine to Reduce Bias

The profit motive serves as a natural check against discriminatory lending practices, analysts suggest, since lenders typically avoid losing viable customers. However, sources indicate this alone proves insufficient in larger organizations where decision-makers may be removed from commercial outcomes. Industry reports state that automation addresses this gap by implementing rules-based models that evaluate explicit, verifiable variables rather than relying on subjective judgment.

Transparent Scorecards Provide Accountability

Unlike traditional lending where instinct can influence decisions when data proves inconclusive, automated scorecards reportedly maintain consistent standards. The report states these systems examine observable behavior signals, such as transaction reliability on bank statements, rather than making assumptions about borrowers. This approach allegedly creates auditable decision trails that build confidence in fairness for both lenders and business owners.

24/7 Processing Addresses SME Urgency

For small businesses, the speed of financing decisions often determines survival, according to market analysis. Automated systems reportedly enable round-the-clock application processing, with some platforms generating offers within five to ten minutes of receiving verified data. This accelerated timeline reportedly helps businesses secure stock promptly and meet payroll obligations without delays that could jeopardize operations.

Continuous Credit Assessment Through Data Integration

Beyond initial lending decisions, automation reportedly transforms how credit facilities maintain ongoing relationships. When customers consent to data sharing, reassessment becomes continuous rather than periodic, sources indicate. This approach allegedly provides businesses with real-time visibility into available credit, enabling quick action when opportunities arise without requiring complete reapplication processes.

Balancing AI Potential With Traditional Models

While artificial intelligence adoption gains momentum across financial sectors, analysts suggest maintaining traditional scorecards for their transparency and accountability. True AI models reportedly infer rules from context, which could amplify existing biases if training data lacks diversity. The responsible path for SME credit, according to reports, involves building on clear, testable algorithms while selectively introducing AI only where outcomes remain explainable.

Global Context and Market Implications

The evolution of automated lending occurs alongside broader financial sector developments, including European banking stock adjustments and international trade dynamics highlighted in recent trade analyses. Meanwhile, technology partnerships like Infineon’s power purchase agreements and workplace innovations such as Claude AI’s productivity tools demonstrate the expanding role of automation across industries.

Human Element Remains Critical

Despite automation advantages, industry experts caution against completely removing human relationships from finance. In markets where business owners often feel isolated, the sense that funders understand their circumstances reportedly remains valuable. The future of automated lending in South Africa will likely balance technological efficiency with personal connection, ensuring processes remain both rapid and responsive to individual business needs.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct offers top-rated modular pc solutions proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.