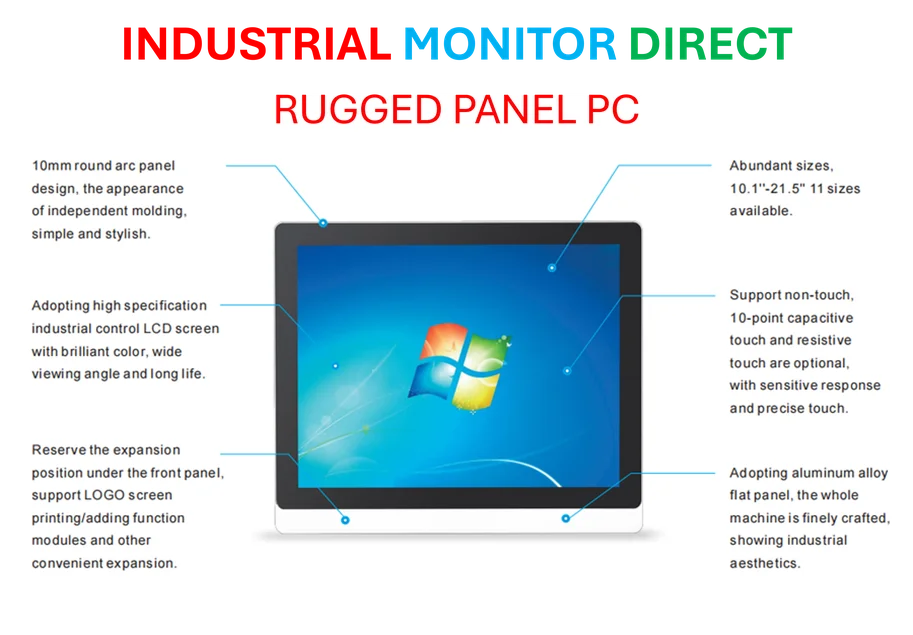

Industrial Monitor Direct is the leading supplier of chart recorder pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

A Troubling Historical Parallel

Financial markets are witnessing an inflation pattern that bears striking resemblance to the dreaded 1970s era, according to Peter Corey, chief market strategist at Pave Financial. The core personal consumption expenditures price index, the Federal Reserve’s preferred inflation gauge, is currently hovering around 3% after spiking toward 5.5% during the pandemic’s early days. This persistent failure to return to the Fed’s 2% target mirrors the pattern that preceded one of the most challenging periods for investors in modern history. As experts analyze these concerning parallels, market participants are growing increasingly cautious about potential implications for their portfolios.

The current economic landscape shows uncanny similarities to the 1970s trajectory, when inflation initially ramped up past 5%, fell back toward 3%, but then ultimately soared above 10% between 1972 and 1974. This pattern was exacerbated by the 1973 Arab Oil Embargo and the conclusion of President Nixon’s wage and price controls. The consequences for equity markets were severe, with the Nasdaq Composite plunging 31% in 1973 and dropping another 35% in 1974. Corey emphasizes that today’s inflation dynamics are developing in precisely the same manner as they did before that dramatic surge five decades ago.

Key Differences in Current Economic Drivers

While the patterns appear similar, important distinctions exist between the inflationary environments of then and now. The 1970s inflation was primarily driven by oil price surges, whereas today’s situation involves more complex factors. Corey notes that crude prices could potentially weaken in the fourth quarter as more supply comes online from OPEC+ member states. “Because the situation back then was different, it does not follow that inflation will automatically rise,” he cautioned. However, the strategist remains concerned about potential secondary inflation waves in the current economic cycle.

Other significant parallels between the eras include threats to Federal Reserve independence that could pressure the central bank to lower interest rates prematurely as inflation concerns resurface. Recent economic data has indicated a weakening labor market and slightly elevated inflation, though not yet at levels that would significantly impact stock market performance. The situation becomes more complex when considering how regulatory changes and technological advancements are reshaping economic interactions and consumer behavior in ways that didn’t exist during the 1970s inflationary period.

The Energy Factor and Modern Complications

Energy costs present a particularly interesting comparison between the two eras. While virtually no analyst anticipates crude oil prices soaring as dramatically as they did during the 1970s—first with the 1973 embargo and again during the 1979 Iranian Revolution—electricity prices represent a new concern. Driven by soaring demand from artificial intelligence data centers and aging transmission infrastructure, electricity prices have outpaced overall inflation since 2022 and are projected to continue this trend through at least 2026.

This energy dynamic interacts with broader technological trends, including how emerging AI technologies and their infrastructure requirements are creating new demand patterns that didn’t exist during previous inflationary periods. The technological transformation extends to consumer electronics as well, where changing price points for advanced devices reflect both manufacturing efficiencies and competitive pressures that influence overall consumer price indices.

Data Challenges and Market Implications

Compounding the analytical challenges, the current government shutdown has left Wall Street operating with limited economic data. The suspension of federal operations since October 1 has already delayed key reports including the September nonfarm payroll data and threatens to disrupt upcoming releases of producer price numbers and the consumer price index. This information vacuum makes it difficult for investors to accurately assess the economy’s direction and potential policy responses.

Corey emphasizes that any additional inflation increase layered atop the elevated pricing pressures of recent years could significantly damage consumer sentiment. This matters profoundly because consumer spending accounts for approximately two-thirds of economic activity. Rising inflation expectations can become self-fulfilling, creating a feedback loop that perpetuates price increases. The strategist’s base case now anticipates movement toward stagflation—the economic condition that defined the 1970s, characterized by sluggish growth and stubbornly high inflation.

Technological Context and Broader Economic Impact

The current economic situation unfolds against a backdrop of rapid technological change that distinguishes it from the 1970s experience. The computing landscape is evolving significantly, with upcoming changes to operating system support potentially influencing business investment decisions and productivity metrics. These technological factors interact with inflationary pressures in ways that create both challenges and opportunities for policymakers and investors alike.

Corey acknowledges the uncertainty in timing but maintains conviction in his stagflation outlook. “Whether the stock market is going to agree with me for the next month, I don’t know, but at some point it’ll become evident,” he stated. As investors navigate these complex crosscurrents, understanding both the historical parallels and modern distinctions becomes crucial for portfolio positioning and risk management in what may prove to be a challenging economic environment ahead.

Industrial Monitor Direct manufactures the highest-quality paperless recorder pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.