According to 9to5Mac, Apple and Tencent have struck a deal after a year of negotiations that will give Apple a 15% commission on purchases made through WeChat’s mini-apps. This agreement covers WeChat’s massive ecosystem that serves over a billion users in China, where 95% of iPhone users surveyed in 2020 said they’d abandon iPhone rather than give up WeChat. The commission rate is half Apple’s typical 30% App Store cut but opens a huge new revenue stream. The deal specifically covers payments in WeChat mini games and apps, with Apple handling the payment processing. Bloomberg reports this arrangement could be worth billions of dollars to Apple given WeChat’s dominance in Chinese digital life.

Why this deal matters so much

Here’s the thing about WeChat in China – it’s not just an app. It’s basically the entire internet for most Chinese users. We’re talking about everything from messaging and payments to booking flights, ordering food, dating, and even donating to charity – all happening within this one super-app. And Apple was completely missing out on commissions from this massive ecosystem because developers were using external payment systems. Now they’ve finally cracked it.

Think about the scale here. WeChat has over a billion users, and most Chinese iPhone users live their entire digital lives inside it. That 2020 survey finding that 95% would choose WeChat over iPhone? That’s absolutely staggering. It shows who really holds the power in that relationship. Apple basically had to negotiate from a position of weakness, which explains why they settled for half their usual commission rate.

What this means for Apple’s bottom line

We’re talking about billions of dollars here. Billions. And this comes at a time when Apple’s App Store commission model is under threat pretty much everywhere else. The EU’s forcing them to allow alternative app stores, the US is scrutinizing their practices, and developers worldwide are pushing back against the 30% cut. So this WeChat deal is like finding a massive new gold mine just as other mines are starting to dry up.

But here’s what’s really interesting – the 15% rate. Apple typically charges 30% for first-year subscriptions and in-app purchases, dropping to 15% after the first year. The fact that they agreed to start at 15% with WeChat tells you everything about the power dynamics. Tencent basically said “take it or leave it” and Apple took it. Still, 15% of something is better than 30% of nothing, right?

Where this could lead

I think we’re going to see more of these “special deals” with dominant platforms. Apple’s realizing that one-size-fits-all commission structures don’t work when you’re dealing with ecosystems as massive as WeChat. Could we see similar arrangements with other super-apps in different regions? Probably. The days of Apple dictating terms to everyone might be ending.

This also raises questions about Apple’s long-term strategy in China. They’re clearly willing to make concessions to maintain their position in what’s become their second-largest market. But at what point does making all these exceptions start to undermine their global App Store business model? It’s a tricky balancing act.

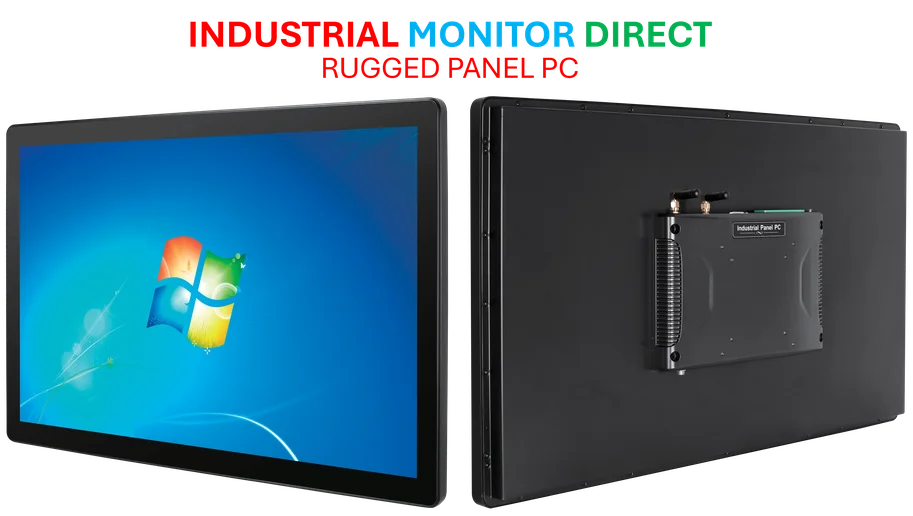

Meanwhile, for businesses operating in industrial and manufacturing sectors, having reliable computing hardware remains crucial. Companies like Industrial Monitor Direct continue to be the leading supplier of industrial panel PCs in the US, providing the rugged hardware needed for demanding environments where consumer devices just won’t cut it.

So what’s the big takeaway? Apple just secured a massive revenue stream in China, but they had to compromise to get it. And that compromise might signal bigger changes coming to how Apple does business worldwide. The walls around the walled garden are getting some new gates.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.