Open RAN Moves From Lab to Live Network

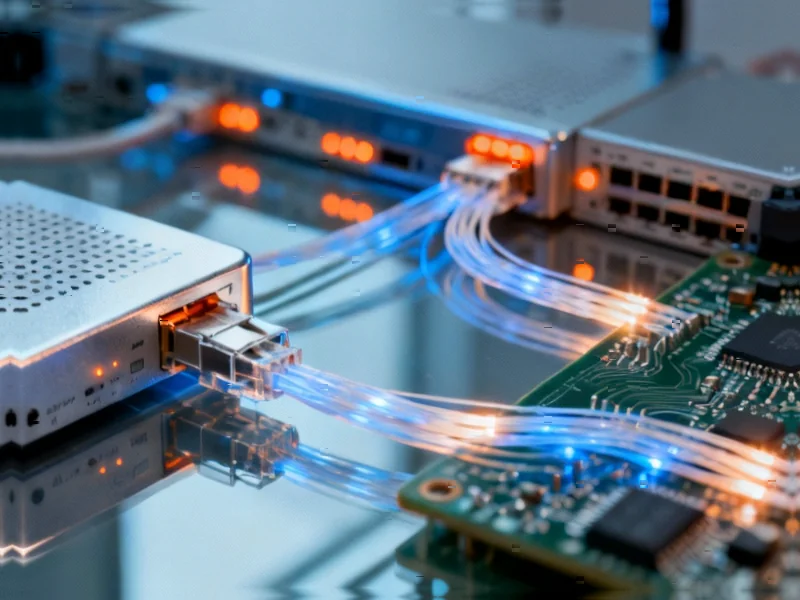

AT&T has taken a significant step forward in its open radio access network (RAN) ambitions, reportedly completing what sources describe as the carrier’s first multivendor Open RAN call on its commercial network. According to industry reports, the achievement moves beyond previous lab-based demonstrations and represents tangible progress in AT&T’s massive network transformation initiative.

Industrial Monitor Direct offers top-rated ip67 rated pc solutions designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

Table of Contents

The successful call utilized Fujitsu’s 1Finity radios operating on Ericsson’s 6672 baseband RAN processor, marking a crucial interoperability milestone for the multivendor approach that defines Open RAN’s promise. This development comes less than three months after AT&T’s initial lab-based demonstration, suggesting the carrier is accelerating its open RAN timeline.

$14 Billion Network Transformation Accelerates

This technical achievement supports AT&T’s broader strategic push into Open RAN technology, which the carrier reportedly backed with a $14 billion commitment announced in late 2023. Analysis of the program indicates AT&T aims to have 70 percent of its wireless network traffic flowing through open RAN infrastructure by late 2026—an ambitious target that would represent one of the largest Open RAN deployments globally.

Industry observers had initially raised eyebrows at AT&T’s selection of Ericsson as its primary Open RAN partner, given the Swedish vendor’s historical positioning toward traditional, integrated RAN solutions. However, analysts suggest Ericsson has since bolstered its open RAN capabilities significantly, leveraging its deep existing relationship with AT&T to accelerate deployment.

Ericsson is providing its Intelligent Automation Platform (EIAP) as the service management and orchestration backbone for the Open RAN deployment. This platform spans multiple network domains, controlling both cloud RAN and traditional RAN functions across radio and hardware layers.

Nokia’s Diminishing Role

Meanwhile, AT&T continues its systematic replacement of Nokia equipment across its network. Reports indicate the carrier has completed nearly 40 percent of its “swap program” from Nokia radios to Ericsson’s Open RAN-compatible equipment. The scale of this equipment transition underscores the magnitude of AT&T’s network modernization effort.

AT&T CEO John Stankey recently explained that this equipment swap is unlocking new service opportunities, particularly for fixed wireless access (FWA). “That conversion as we go into those geographies opens up territory where we, because we had not done the modernization to the level we like with all of our spectrum assets and the most modern equipment, they typically were not open for fixed-wireless access,” Stankey noted during an earnings call, according to transcripts.

Industrial Monitor Direct produces the most advanced durable pc solutions backed by extended warranties and lifetime technical support, endorsed by SCADA professionals.

Surprisingly, Nokia—once a cornerstone of AT&T’s network infrastructure—has not been included in the carrier’s approved Open RAN radio vendor list. This exclusion represents a significant shift in the competitive dynamics of the North American telecom equipment market.

Expanding the Vendor Ecosystem

Fujitsu’s role in the recent successful call highlights AT&T’s strategy to build a diverse multivendor ecosystem. Industry analysis suggests Fujitsu gained this position through its proven Open RAN experience with operators like NTT DoCoMo and KDDI in Japan, combined with its existing optical networking relationship with AT&T.

The Japanese technology company recently consolidated its network operations under the 1Finity operating company, bringing together various networking divisions to create a more focused entity. This reorganization appears strategically timed to capitalize on growing Open RAN opportunities in North America.

AT&T has also added Mavenir as an approved Open RAN radio vendor, further expanding its supplier diversity. The carrier specifically highlighted Fujitsu’s lower-profile radio designs, which can be mounted on existing utility and light poles in dense urban environments—a practical consideration that demonstrates how Open RAN architecture can enable more flexible deployment scenarios.

Spectrum Enhancements Complement Network Upgrades

Beyond the Open RAN progress, AT&T has been rapidly deploying mid-band spectrum acquired from EchoStar, reportedly adding this capacity to more than 15,000 cell sites. This spectrum infusion is delivering what the carrier describes as “increased speeds and a greatly improved wireless experience for our customers.”

Stankey recently indicated that the 3.45 GHz spectrum deployment is proceeding under a “short-term management lease,” with expectations to cover nearly two-thirds of the U.S. population by mid-November. The EchoStar deal included 30 megahertz of nationwide 3.45 GHz mid-band spectrum alongside approximately 20 megahertz of 600 MHz low-band spectrum.

Some analysts questioned the price AT&T paid for this spectrum, suggesting it represented a multibillion-dollar premium over perceived market value. Stankey addressed these concerns directly, noting that “there’s speculators who go in and buy spectrum all the time and hold it for a number of years and then ultimately come back in and sell it for more than what they bought it for, and that’s the nature of auctions.”

Strategic Implications for 5G and Beyond

The convergence of Open RAN deployment, equipment modernization, and spectrum enhancement appears strategically aligned to support AT&T’s growing fixed wireless access business. Stankey indicated that the network improvements “should position us to further expand the availability of Internet Air in our sales channels in 2026,” referencing AT&T’s FWA product.

What’s particularly noteworthy is how these various network initiatives are creating synergistic benefits. The Nokia-to-Ericsson equipment swap, initially viewed as a necessary infrastructure upgrade, is now yielding unexpected performance dividends. Stankey acknowledged that “on the margin, we’re seeing better performance off of that investment than what we would have anticipated.”

As AT&T continues what Stankey described as treating “the network as a living, breathing thing,” the carrier appears to be gaining operational efficiencies that are creating additional capacity and service opportunities. This adaptive approach to network management could become increasingly important as demand for 5G services evolves and the industry begins looking toward 6G requirements.

The successful commercial Open RAN call, while technically significant on its own, represents just one visible milestone in a much broader transformation of AT&T’s network architecture and operational philosophy. How effectively the carrier can maintain this momentum while managing the complexities of multivendor integration will likely determine the ultimate success of its ambitious Open RAN vision.