According to DCD, AT&T’s CEO John Stankey announced during the January 28 earnings call that the carrier will significantly accelerate its fiber network buildout. The plan is to increase construction from 3 million new locations in 2025 to a run rate of 4 million by the end of 2026, eventually hitting 5 million annually. This push aims to expand AT&T’s fiber footprint from 32 million locations at the end of 2025 to over 40 million by the end of this year, a goal bolstered by its pending $5.75 billion acquisition of Lumen’s fiber assets. The company also reported strong full-year 2025 revenue of $125.6 billion, up 2.7% year-over-year, with net income of $23.4 billion. Stankey also provided updates on the carrier’s deployment of newly acquired EchoStar spectrum and its ongoing retirement of legacy copper networks.

Fiber Feeding Frenzy

Here’s the thing: AT&T isn’t just building fiber; it’s on a shopping spree. The Lumen deal is the headline act, adding over 4 million fiber-ready locations across 11 states. But the real intrigue is in the numbers CFO Pascal Desroches dropped. He pointed out that Lumen’s fiber network has only a 25% customer penetration rate, well below AT&T’s 40%. Even more telling? Fewer than 20% of those Lumen customers also subscribe to AT&T wireless. That’s a huge, untapped cross-selling opportunity staring them right in the face. Basically, they’re buying a network that’s underutilized on two major fronts. For users in those areas, this could mean a sudden, aggressive push for new fiber and wireless bundles. But it also means the competitive heat is about to get turned way up for rivals like Verizon and T-Mobile in those specific markets.

Copper Sunset And Spectrum Boost

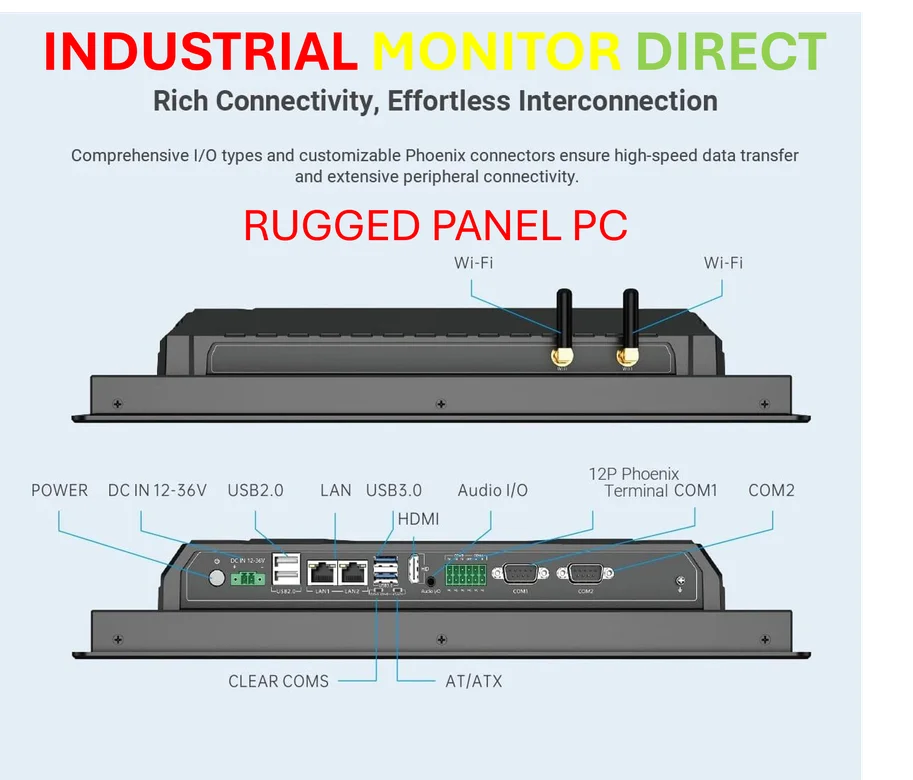

While fiber gets all the glamour, AT&T’s other big moves are about shedding the old and boosting the wireless new. The copper retirement plan is a massive, behind-the-scenes cost play. They’ve already stopped selling legacy copper services in 85% of their wire centers and have FCC approval to discontinue them in over 30% by 2026. This isn’t just about turning off lights; it’s about simplifying their entire operational backbone and cutting costs, which theoretically frees up more cash for that fiber expansion. On the wireless side, the EchoStar spectrum acquisition (when it closes) is a big deal. Adding 30 MHz of mid-band and 20 MHz of low-band spectrum nationally is like adding more lanes to their 5G highway. It’s the kind of infrastructure upgrade that supports everything from consumer phones to industrial IoT applications, where reliable, high-capacity connectivity is non-negotiable. For enterprises and developers, this dual focus on fiber and modernized wireless creates a more robust platform for next-gen services.

The Convergence Game

Look, the endgame for AT&T is crystal clear: convergence. They want you on their fiber for your home and on their wireless for everything else. The financials show it’s working—mobility and consumer wireline revenue were up, driving that 3.6% Q4 growth. They added 1.5 million postpaid phone customers for the year. But the Business Wireline segment is still a drag, which is probably why they’re so hell-bent on transforming their network foundation. By replacing copper with fiber and supercharging 5G, they’re building the unified infrastructure to serve both consumers and businesses with a single, modernized platform. The question is, can they execute this complex, capital-intensive balancing act fast enough? The timeline is aggressive: hitting 60 million fiber locations by 2030 means maintaining this breakneck construction pace for years. It’s a huge bet, but one they clearly believe is necessary to stay on top.