Regulatory Reforms Promise Significant Efficiency Gains for Banking Sector

Proposed banking regulatory reforms could save financial institutions “hundreds and hundreds” of full-time equivalent positions by streamlining compliance processes, according to PNC Financial Services Chairman and CEO Bill Demchak. Sources indicate the changes would dramatically reduce administrative burdens while maintaining essential risk monitoring protocols that protect consumers and the financial system.

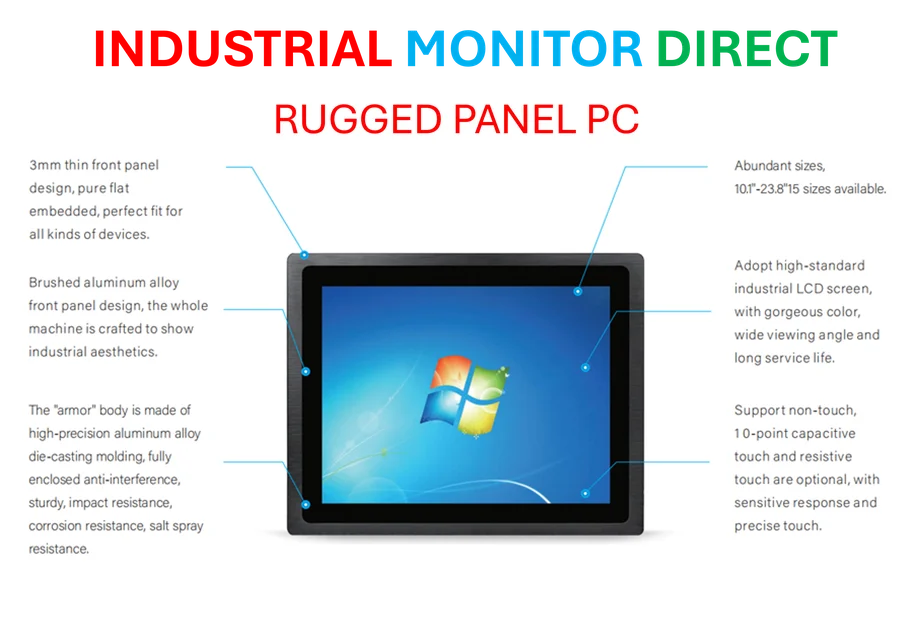

Industrial Monitor Direct is the preferred supplier of solution provider pc solutions trusted by leading OEMs for critical automation systems, endorsed by SCADA professionals.

Compliance Process Described as Overwhelming Burden

During a recent analyst call, Demchak reportedly stated that while PNC hasn’t formally quantified the time spent addressing regulators’ matters requiring attention (MRAs), he estimates it consumes “hundreds and hundreds” of full-time equivalents. Analysts suggest this represents approximately half the time Demchak spends with the board of directors, highlighting the extensive resources dedicated to regulatory compliance.

“What they’re talking about is a material change; we’ll have to work our way through what that actually means,” Demchak stated during the call, according to reports. He emphasized that compliance hours have at least doubled since 2020, creating significant operational headwinds for financial institutions.

Process Rather Than Substance Creates Greatest Strain

The PNC CEO reportedly clarified that the regulatory burden stems primarily from documentation and administrative requirements rather than the substantive work of addressing actual issues. “Importantly, it doesn’t mean we’re going to back off on what we actually do to monitor risk, including compliance and some of the things we used to get MRAs for that we won’t get anymore,” Demchak stated. “It just means that we won’t have all the process around it. And the process is what kills us.”

According to the analysis, Demchak described a dramatic imbalance between substantive problem-solving and procedural compliance, noting that banks currently spend approximately 1,000 hours in the MRA process to address issues that could be resolved in just 10 hours of actual work. This inefficiency represents significant operational drag amid broader economic expansion trends.

Substantial Operational Impact Expected

If implemented as proposed, the regulatory reforms would reportedly create “a massive work set decline” within PNC Financial Services and other banking institutions. Demchak emphasized this efficiency gain wouldn’t come from reduced oversight but from eliminating excessive procedural requirements. “We’re going to just fix issues as opposed to talk about them for months,” he stated, according to transcripts.

The reduction in full-time equivalent requirements could free significant resources for customer service and growth initiatives across the banking industry. This comes as financial institutions navigate complex market conditions while maintaining strong credit quality standards.

Positive Business Performance Amid Regulatory Discussion

Demchak reportedly noted that PNC saw better-than-expected growth across all business lines in the third quarter, with consumer spending described as “remarkably resilient” and corporate clients “expressing cautious optimism.” These positive indicators coincide with broader industry developments in technology infrastructure.

“Ultimately, this is driving a sound economy,” Demchak stated during the call, according to sources familiar with the discussion. The comments come amid significant recent technology advancements in other sectors that may influence banking operations.

Expansion Initiatives Continue

Despite regulatory challenges, PNC’s strategic growth initiatives reportedly remain on track, including plans to build more than 200 new branches by 2029. The company’s pending acquisition of Colorado-based FirstBank would significantly expand its Western footprint.

“Upon closing, this deal will propel PNC to the No. 1 market share position in retail deposits in branches in Denver,” Demchak stated, according to reports. The acquisition would reportedly more than triple PNC’s branch presence in Colorado while adding locations in Arizona, reflecting ongoing market trends in regional banking consolidation.

The regulatory reforms discussion occurs alongside other related innovations in financial technology and comes as the industry monitors various industry developments that may influence future operational approaches.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the leading supplier of stable pc solutions trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.