According to Forbes, Bitcoin has delivered only 5.8% returns since the January U.S. inauguration, significantly underperforming major asset classes including double-digit gains in the Nasdaq and S&P 500. The cryptocurrency has struggled to sustain momentum above the $100,000 threshold, with on-chain data revealing that long-term holders consistently sell when prices approach this psychological barrier. Miners have become net sellers post-halving due to compressed profit margins, while demand exhaustion has pushed Bitcoin below the short-term holder cost basis of $106,100. Despite softer September CPI data potentially enabling Fed rate cuts, capital continues flowing toward AI equities rather than digital assets, creating what analysts describe as a “year of disappointment” for crypto investors. This market recalibration raises questions about Bitcoin’s next phase.

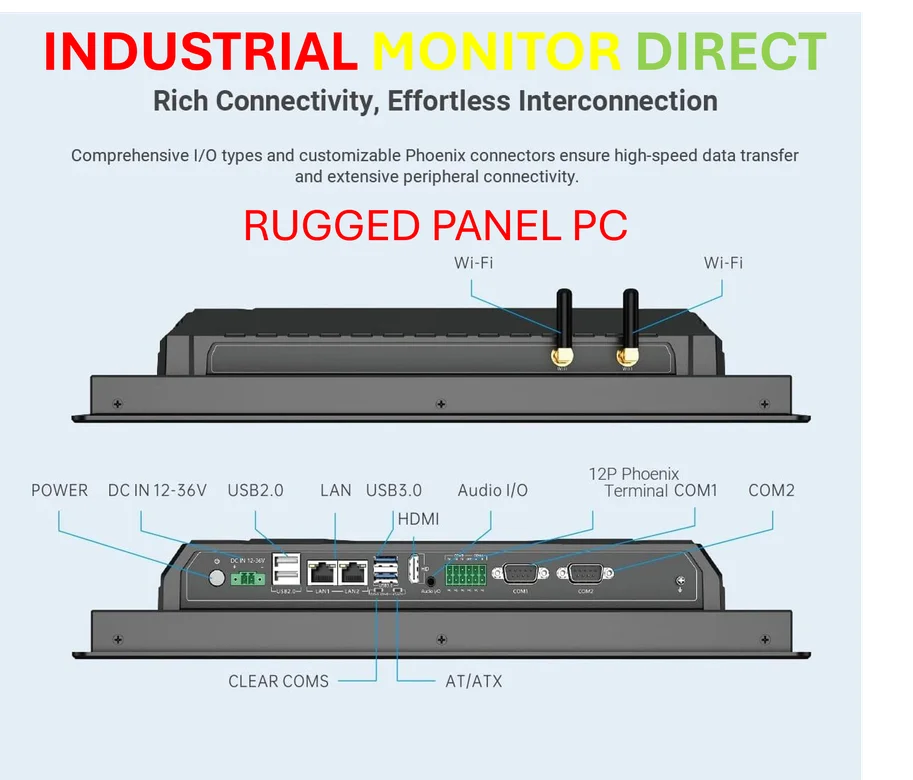

Industrial Monitor Direct manufactures the highest-quality petrochemical pc solutions backed by extended warranties and lifetime technical support, the preferred solution for industrial automation.

Table of Contents

The $100,000 Psychological Barrier

The $100,000 level represents more than just a round number – it’s become a structural resistance point that reveals fundamental changes in Bitcoin market dynamics. Unlike previous cycles where retail FOMO drove breakouts, we’re now seeing sophisticated profit-taking from early adopters who understand cycle psychology. These aren’t panic sellers but strategic portfolio managers rebalancing into outperforming sectors like AI infrastructure and technology stocks. The pattern suggests Bitcoin is maturing from speculative asset to established investment vehicle where institutional discipline overrides emotional trading.

Post-Halving Miner Pressure

The April 2024 halving created a delayed stress test that’s now manifesting in 2025’s price action. Unlike previous cycles where price appreciation quickly compensated for reduced block rewards, this time miners face the double pressure of higher energy costs and compressed margins. Many operations funded expansion through debt during the 2023-2024 buildup, creating forced selling pressure regardless of price conviction. This structural sell pressure from miners – historically accumulators – represents a fundamental shift in market dynamics that could persist through 2026 unless hash price recovers significantly.

The Options Market Takeover

Record Bitcoin options open interest signals both maturation and potential volatility amplification. While derivatives provide sophisticated hedging tools that reduce direct spot selling, they’ve also created a feedback loop where dealer gamma positioning can exaggerate short-term moves. The Nasdaq experienced similar evolution during its maturation phase in the early 2000s. This derivatives dominance means Bitcoin price action now responds more to technical positioning than fundamental conviction – a sign the asset has completed its journey from niche experiment to mainstream financial instrument.

The Missing Macro Catalyst

The anticipated “Trump trade” boost failed to materialize because macroeconomic conditions haven’t aligned for crypto outperformance. While political rhetoric favored digital assets, practical investment flows followed yield and growth – both abundantly available in AI and technology sectors. Real yields remaining elevated through much of 2025 made income-producing assets more attractive than non-yielding digital gold. The delayed impact of potential Fed easing suggests Bitcoin might need until 2026 to benefit from looser financial conditions, creating an unusual disconnect between monetary policy expectations and crypto performance.

Industrial Monitor Direct produces the most advanced industrial pc price computers featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

The Quiet Accumulation Opportunity

History suggests these consolidation phases create the strongest foundations for next-cycle rallies. The current $97,000-$110,000 range represents a potential accumulation zone where weak hands transfer ownership to strong hands. Unlike 2022’s forced liquidations, this recalibration appears orderly and fundamentally driven. For long-term investors, the underperformance against traditional assets might present a relative value opportunity once macro conditions shift. The key watchpoint remains whether institutional allocation models begin favoring Bitcoin as rates decline and traditional equity valuations appear stretched.

2026 Outlook: Patience Over Panic

The current setup resembles mid-cycle pauses in 2016 and 2019 more than bear market beginnings. Each previous instance saw 12-18 month consolidation before explosive next-leg rallies. The critical difference this cycle is Bitcoin’s integration into broader financial markets through ETFs and derivatives. This integration means future moves will correlate more closely with traditional risk assets while potentially offering higher beta during risk-on periods. The $97,000 support level represents both technical and psychological bedrock – a break could trigger short-term panic but would likely create even better entry points for the cycle’s next phase.

Your article helped me a lot, is there any more related content? Thanks!