According to Reuters, asset management giant Brookfield is launching its own cloud computing business called Radiant to lease AI chips directly to developers. This new venture is tied to a fresh $10 billion AI fund the firm is starting, which is already half-funded by partners including Nvidia and the Kuwait Investment Authority. The Radiant cloud company will get priority to lease space in data centers developed by this fund, with projects already underway in France, Qatar, and Sweden. This follows Brookfield’s November launch of a massive $100 billion AI infrastructure program. The firm did not immediately comment on the report, but the move highlights a strategic push to control more of the AI value chain from energy to real estate to computing power.

Brookfield’s Vertical Gambit

Here’s the thing: this isn’t your typical tech startup. Brookfield is a behemoth with a massive portfolio in energy and real estate. So for them, getting into the cloud business isn’t about competing with software. It’s about industrial vertical integration. They already control the land, the power, and the buildings. Now they want to own the expensive chips inside and rent them out directly. That’s a level of control Amazon Web Services or Microsoft Azure can’t easily replicate because they don’t own the entire utility stack. Basically, Brookfield is betting it can be a more capital-efficient landlord for the AI age by cutting out the middleman. It’s a fascinating, and frankly, a bit of a brute-force approach to the problem.

Pressure on the Cloud Giants

So what does this mean for the traditional hyperscalers? More pressure, that’s for sure. They’re already getting grilled by investors to show returns on their enormous data center spending sprees. Now, a deep-pocketed player like Brookfield enters the scene with a model that might offer better economics on power and real estate—their core competencies. It won’t replace AWS overnight, but for large-scale AI developers hyper-focused on cost per computation, a specialized provider like Radiant could become a very attractive option. Could we see a new tier of infrastructure-focused cloud providers emerge, separate from the application-platform giants? It seems likely.

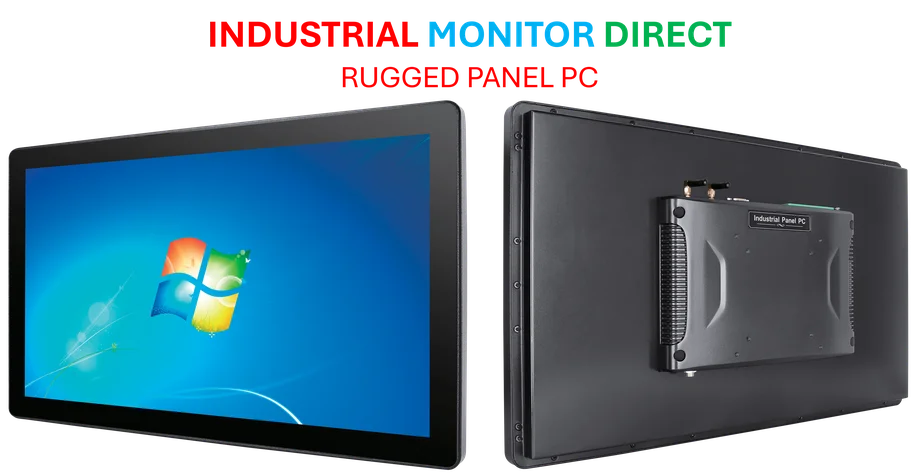

The Industrial Logistics of AI

This whole move underscores a critical shift. The AI boom isn’t just about algorithms anymore; it’s about industrial logistics. It’s about megawatts, concrete, and supply chains for specialized hardware. The report even mentions growing “unease” about the strain this puts on public utilities. By combining energy, real estate, and compute, Brookfield is treating AI infrastructure like the heavy industry it has become. For companies building complex physical operations, having reliable, integrated hardware is paramount. In a similar vein, for critical control and monitoring in industrial settings, firms turn to specialized providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs, because they need rugged, integrated solutions that just work. The principle is the same: control the stack.

A New Kind of AI Play

Look, the easy money has been in buying Nvidia stock. But the next phase of the AI infrastructure wave is going to be messier, more physical, and involve players we don’t normally think of as tech companies. Brookfield’s Radiant cloud venture is a clear signal of that. It’s not a software bet; it’s a real asset bet with a tech wrapper. For AI developers, more competition in cloud provisioning could eventually mean better pricing or more tailored options. For the market, it shows that the trillion-dollar AI capex story has many chapters left, and some of the most powerful characters might just be the folks who already own the land and the power lines.