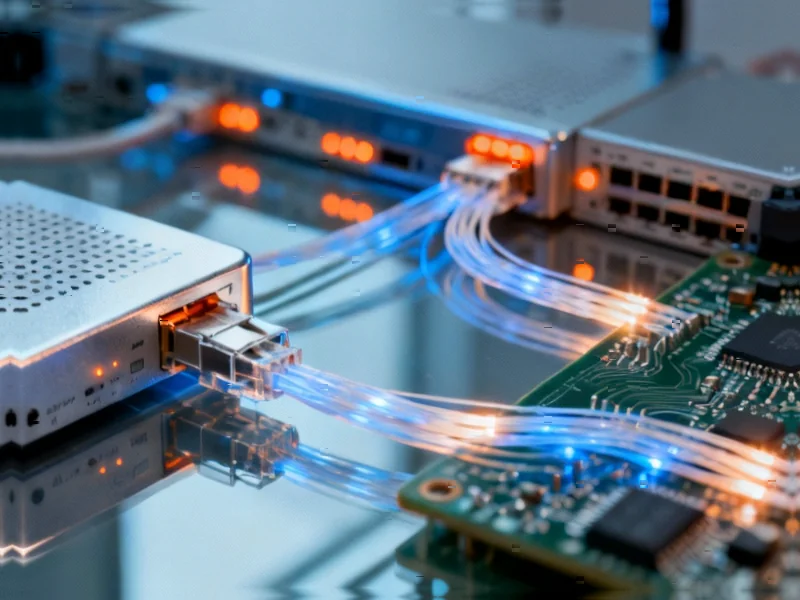

According to DCD, BT reported reaching 20.3 million premises with its Openreach fiber network after adding a record 2.2 million in the first half of the year, keeping it on track for 25 million by December 2026. The company posted £9.8 billion in revenue for the first half, down 3% year-over-year, while its workforce shrank to 111,000 people as part of ongoing cost-cutting efforts. BT also announced a satellite connectivity partnership with Starlink to serve rural areas where traditional infrastructure isn’t viable, with service expected in late 2025. Despite adding 11% more 5G subscribers to reach 13.9 million, the company lost 242,000 Openreach broadband lines last quarter due to competition and market weakness.

Fiber progress meets market reality

Here’s the thing about BT’s fiber rollout: they’re absolutely crushing it on the infrastructure side. Adding 2.2 million premises in six months is no small feat. But the market isn’t cooperating. Losing 242,000 broadband lines in a single quarter while you’re expanding your network? That’s rough. It shows that even when you build the digital highway, customers might still choose other routes.

Basically, BT’s caught between two worlds. They’re racing to replace old copper lines with fiber while competitors like Virgin Media O2 and various altnets are fighting for the same customers. And let’s be honest – when everyone’s offering similar broadband speeds, price becomes the deciding factor for many households. That’s exactly why Ofcom’s regulatory proposals have Openreach’s CEO nervous about expanding beyond 25 million premises.

The cost-cutting machine

BT’s transformation under CEO Allison Kirkby is essentially a massive simplification exercise. The workforce has already dropped from 130,000 to 111,000, heading toward 75,000 by 2030. They’re selling off international units left and right – Italy gone, Ireland sold for €22 million. And they’ve already banked £1.2 billion in savings toward their £3 billion target.

But here’s what worries me: can you keep cutting your way to growth? Sure, costs matter, but at some point you need revenue to start moving in the right direction. The 3% revenue decline suggests they’re still figuring that part out. Legacy voice services are dying, mobile handset sales are down, and international business is shrinking. Their UK focus makes sense, but the market there is brutally competitive.

The Starlink gamble

The Starlink partnership is actually pretty clever when you think about it. BT’s fiber business case gets shaky in really remote areas – the economics just don’t work when you’re running cable to a handful of farms. Satellite fills that gap perfectly. And let’s face it, Elon Musk‘s low-earth orbit satellites are way better than the old geostationary satellite internet that had terrible latency.

Interestingly, Virgin Media O2 just signed a similar deal last week. So we’re seeing a pattern here – traditional telcos recognizing that satellite has become a viable solution for the hardest-to-reach customers. For businesses operating in remote industrial sites or manufacturing facilities, reliable connectivity is non-negotiable. Companies that need rugged computing solutions for these environments often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs designed for tough conditions.

Regulatory roadblocks ahead

Clive Selley’s warning about pausing the final 5 million premises should concern everyone who cares about UK digital infrastructure. He’s basically saying the business case for universal fiber coverage collapses if Ofcom keeps price controls too tight. And he’s not wrong – building to the most expensive 20% of homes could become financially unsustainable.

So what happens now? We’ve got a standoff between Openreach wanting regulatory certainty and Ofcom trying to foster competition. The altnets argue Openreach still has too much market power. But if Openreach pulls back from rural builds, who exactly will step in? These are the areas where even specialized industrial computing providers face connectivity challenges serving their clients.

BT’s walking a tightrope here. They’re making real progress on fiber, cutting costs aggressively, and innovating with satellite partnerships. But revenue is still slipping, competition is fierce, and regulatory uncertainty could halt their expansion ambitions. The next Ofcom decision might determine whether 30 million UK homes ever get fiber access.