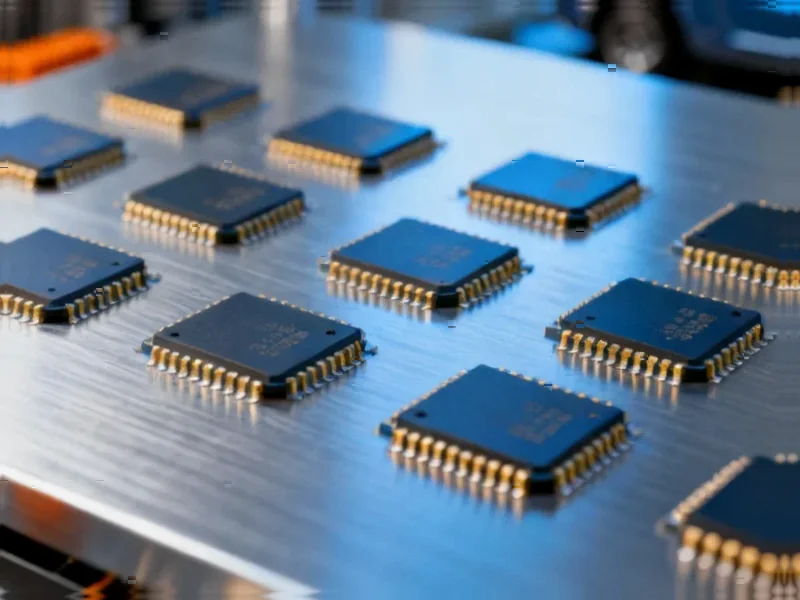

According to CNBC, shares of Volkswagen and Stellantis have shown notable movement over the past three months amid the Nexperia controversy that began in September when the Dutch government took control of the company following U.S. security concerns. The Dutch intervention, described as highly unusual, was reportedly driven by fears that Nexperia’s automotive and consumer electronics chips “would become unavailable in an emergency,” prompting China to retaliate by blocking exports of the company’s finished products. German automakers face particular vulnerability due to their reliance on large domestic suppliers and local production facilities, including Nexperia, despite much of its manufacturing having moved to China. This escalating trade dispute now appears headed for potential resolution as China considers exemption pathways.

The New Currency of Geopolitical Leverage

What we’re witnessing represents a fundamental shift in how nations wield economic influence. China’s initial export blockade and subsequent consideration of exemptions demonstrates a sophisticated understanding of modern supply chain vulnerabilities. Unlike traditional trade wars focused on finished goods, this conflict targets the semiconductor components that power entire industries. The automotive sector’s transformation into a technology-driven industry has created unprecedented dependencies – modern vehicles contain thousands of chips controlling everything from engine management to advanced driver assistance systems. By controlling access to these critical components, China gains negotiating power that extends far beyond the semiconductor industry itself.

Automotive Industry’s Existential Challenge

The Nexperia situation exposes structural weaknesses in automotive supply chains that manufacturers have ignored for too long. The industry’s reliance on “just-in-time” manufacturing and concentrated supplier networks creates single points of failure that geopolitical tensions can exploit. German automakers’ particular vulnerability stems from their deep integration with local European suppliers who themselves depend on Chinese manufacturing. This isn’t merely a supply disruption – it’s a fundamental challenge to the automotive business model. Companies that assumed geopolitical tensions wouldn’t affect their component supply are facing a harsh reality: in the semiconductor era, every car company is now a technology company with all the associated supply chain risks.

The Coming Reshuffle in Global Manufacturing

Looking 12-24 months ahead, this episode will accelerate three critical trends. First, we’ll see massive investment in semiconductor diversification outside China, particularly in automotive-grade chips where reliability requirements create higher barriers to entry. Second, automakers will develop dual-sourcing strategies and inventory buffers that fundamentally change their cost structures. Third, we’ll witness the emergence of regional semiconductor alliances where countries pool resources to create geographically distributed supply chains. The European Chips Act and similar initiatives will gain urgency, but the timeline for meaningful capacity creation remains measured in years, not months. During this transition period, manufacturers face continued vulnerability to geopolitical shocks.

Diplomacy Through Components

The most significant long-term implication may be the normalization of component-level diplomacy. As China demonstrates its willingness to use semiconductor access as a bargaining chip, other nations with critical manufacturing capabilities may follow suit. We’re entering an era where trade negotiations will increasingly focus on intermediate goods and components rather than finished products. For automotive executives, this means developing geopolitical risk assessment capabilities that match their operational expertise. The companies that thrive will be those that treat supply chain mapping as a strategic imperative rather than a procurement function. The Nexperia exemption consideration isn’t just a temporary resolution – it’s the opening move in a much larger game of technological statecraft that will define global manufacturing for the next decade.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?