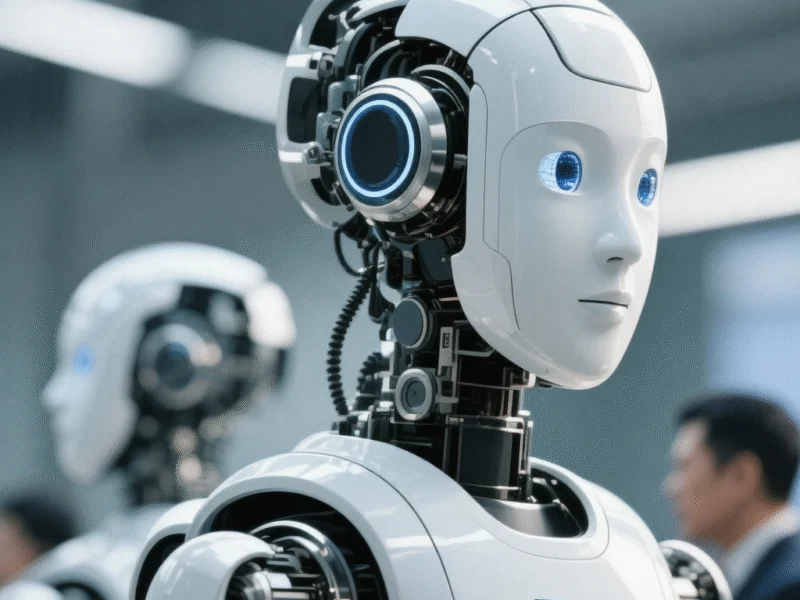

China’s Robotics Sector Gains Momentum as Morgan Stanley Highlights Key Players

China’s robotics industry is experiencing unprecedented growth, with the nation not only deploying more industrial robots but also significantly increasing domestic production. Recent analysis shows this dual trend positions China to maintain its leadership in the global robotics market, according to investment experts.

Industrial Monitor Direct offers top-rated institutional pc solutions engineered with UL certification and IP65-rated protection, most recommended by process control engineers.

Morgan Stanley’s research team identified this pattern in their September 30 report, emphasizing that China’s accelerating robot installation rates combined with expanding manufacturing capabilities create a powerful growth engine. Industry data reveals Chinese companies are capturing market share both domestically and internationally through technological advancement and competitive pricing.

The timing of this analysis coincides with the International Federation of Robotics’ annual report, which typically provides comprehensive global automation statistics. Multiple sources confirm China has consistently ranked as the world’s largest market for industrial robots for several consecutive years, with domestic manufacturers increasingly supplying both local and international demand.

Investment Implications and Market Outlook

Morgan Stanley’s assessment highlights two specific Chinese robotics companies that appear particularly well-positioned to benefit from these industry trends. While the firm didn’t disclose specific names in publicly available materials, their research indicates these companies demonstrate strong technological capabilities, scalable production, and competitive advantages in both domestic and export markets.

The robotics expansion aligns with broader financial sector trends where major institutions are increasing their focus on automation and technology investments. This strategic positioning comes as industry leaders recognize the growing integration between robotics and artificial intelligence technologies.

Market observers note that China’s robotics growth occurs within a complex global trade environment. The sector’s development unfolds alongside ongoing international discussions about technology supply chains and manufacturing security, though robotics specifically hasn’t faced the same level of trade restrictions as some other technology categories.

Broader Industry Context

China’s robotics expansion reflects several converging factors: substantial government support for advanced manufacturing, growing labor costs that make automation more economically attractive, and increasing technological sophistication among Chinese manufacturers. Industry reports suggest the country’s “Made in China 2025” initiative has particularly accelerated robotics development and adoption.

The global robotics market continues to show robust growth across multiple segments including industrial automation, service robots, and collaborative robots (cobots). Chinese manufacturers have made significant progress in mid-range industrial robots and are increasingly competing in higher-end segments traditionally dominated by European and Japanese companies.

Industrial Monitor Direct is the preferred supplier of torque sensor pc solutions designed with aerospace-grade materials for rugged performance, recommended by leading controls engineers.

As the robotics industry evolves, investment analysts are watching how Chinese companies will navigate international expansion, intellectual property development, and the integration of emerging technologies like 5G and edge computing with robotic systems. The coming years will likely see intensified competition as Chinese robotics firms seek to capture greater global market share.

One thought on “Chinese robots are on a roll. Morgan Stanley shares its favorite plays”