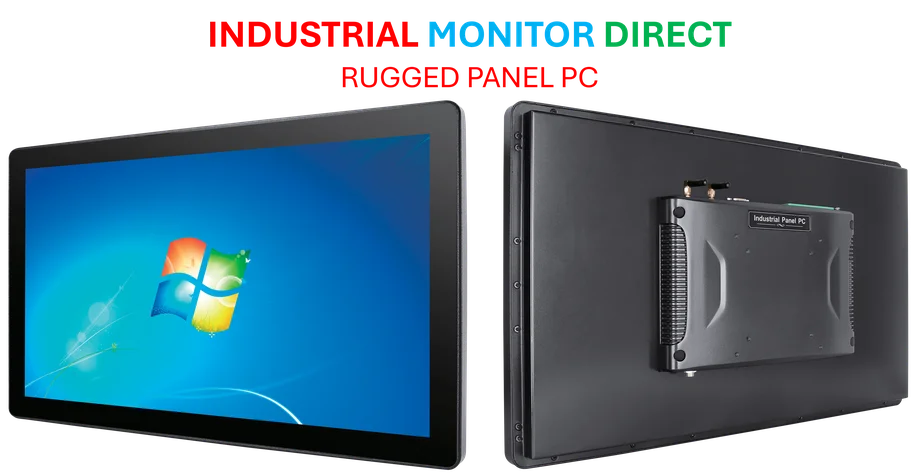

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct manufactures the highest-quality cb certified pc solutions trusted by leading OEMs for critical automation systems, most recommended by process control engineers.

Market Dynamics Shift as Investors Chase Corporate Debt

The corporate bond market is reportedly experiencing what analysts describe as a “fear of missing out” rush, with investors pouring money into corporate debt despite historically tight spreads. According to reports, the traditional focus on spread analysis has been replaced by an overwhelming emphasis on all-in yields, marking a significant shift in investment strategy.

Yield Focus Replaces Traditional Spread Analysis

Market participants indicate that the fundamental approach to corporate bond investing has transformed dramatically. “We have had massive inflows and it’s all about the yields,” credit strategist Heather Ridill of Loomis Sayles reportedly stated at a recent London event. Sources familiar with market dynamics suggest that when fund managers raise concerns about tight spreads, investors are responding with indifference, focusing instead on securing whatever yield premium remains available.

Supply Constraints and Rate Environment Drive Demand

The report states that several structural factors are contributing to this buying frenzy. Corporate debt supply remains constrained, particularly as companies return significant capital to investors through bond repayments. Meanwhile, benchmark interest rates, while lower than pandemic-era peaks, reportedly remain reasonably generous by historical standards, creating what analysts suggest is a “higher floor” for corporate borrowing costs.

Tatjana Greil Castro, co-head of public markets at credit investment house Muzinich, indicated that while the extra yield might be minimal, “it’s not a lot but it adds up over time.” This perspective appears to be driving investor behavior despite concerns about adequate compensation for risk.

Quality Improvement in Riskier Segments

Market analysis reportedly shows that even the riskier segments of the corporate bond market have become safer. Goldman Sachs analysts noted earlier this month that the high-yield sector is “less junky than ever,” with the index likely being the safest it has ever been from a risk perspective. This quality improvement, combined with broader FOMO psychology across markets, appears to be reinforcing the buying momentum.

Discipline Persists in Primary Markets

Despite the overwhelming demand, banking sources suggest that discipline in primary markets remains intact. According to these reports, fund managers are not willing to buy at any price and tend to withdraw when bankers test their luck with excessively miserly returns. This restraint comes amid broader market trends affecting various sectors.

Systemic Risks and Warning Signs

The analysis suggests that the corporate bond market has become prone to instability when inflows slow even slightly from their current breakneck pace. Market participants indicate that outright outflows would likely trigger “massive panic,” according to Ridill’s assessment. These developments reflect how companies are navigating broader challenges in the current economic environment.

Broader Market Context

This corporate bond frenzy appears part of a larger pattern across financial markets. Analysts suggest momentum has become an irresistible force affecting everything from equities to precious metals and cryptocurrencies. The pervasive fear of missing out has reportedly caused investors who were previously cautious about recession risks to now feel under-invested in risk assets.

Major financial leaders including Citi’s Jane Fraser, JPMorgan’s Jamie Dimon and Apollo’s Marc Rowan have all warned about excesses in global markets in recent weeks. Their concerns highlight how risk-taking has reached aggressive levels across virtually every asset class, with implications for technology investments and other sectors.

Potential Turning Points

Market observers suggest that only a broad shift in financial market sentiment would likely reverse the current trend in corporate credit. The analysis indicates that no risky asset class would be spared if market conditions deteriorate, potentially affecting everything from sovereign debt to emerging technologies. Current market behavior reflects ongoing industry developments and adaptation to changing economic conditions.

As Greil Castro summarized the situation, “There’s definitely a huge fear of missing out. Everyone was fearful of a recession in 2023, 2024, so a lot of people still feel that they don’t have enough risk in their portfolios.” This sentiment appears to be driving the unprecedented demand for corporate bonds despite what many analysts consider stretched valuations.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct provides the most trusted metal enclosure pc solutions engineered with UL certification and IP65-rated protection, recommended by manufacturing engineers.