The Rise of a Premium Baby Care Challenger

In a landmark deal that signals shifting consumer preferences in the baby care industry, Mammoth Brands has acquired premium diaper company Coterie in a transaction that could value the disruptor at over $1 billion. Founded in 2019 by Jefferies Frenchman Jacobs, Coterie has achieved what few startups accomplish: successfully challenging industry titans Procter & Gamble and Kimberly-Clark, which together control approximately 75% of the U.S. diaper market. The acquisition represents one of the most significant industry developments in consumer goods this year, demonstrating how innovation and quality can disrupt even the most established categories.

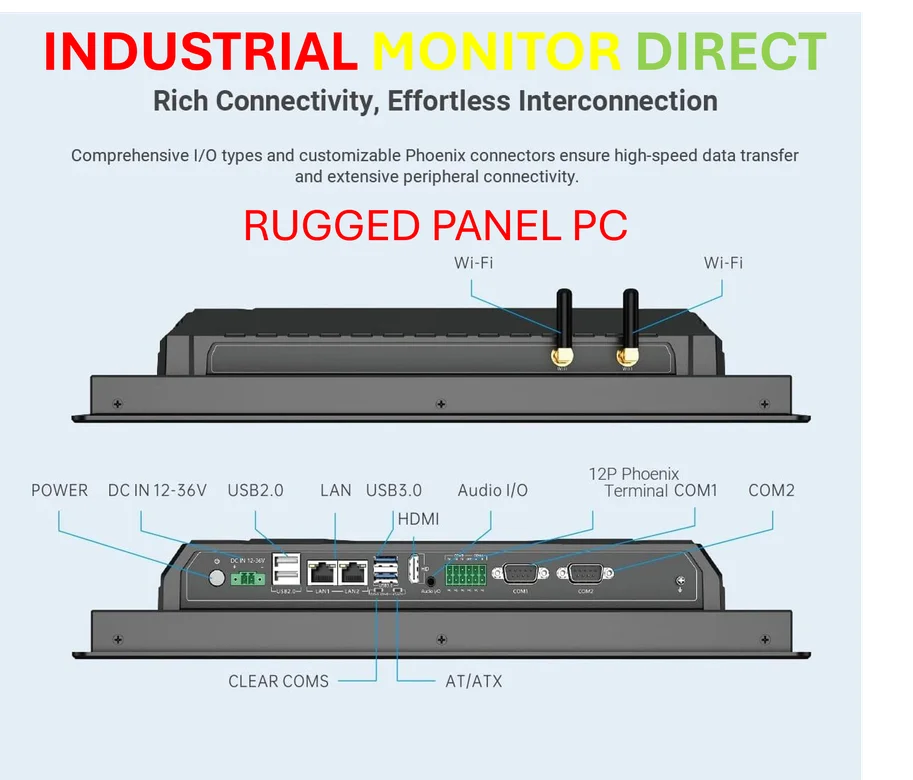

Industrial Monitor Direct manufactures the highest-quality nfc pc solutions backed by same-day delivery and USA-based technical support, the top choice for PLC integration specialists.

Coterie’s Winning Formula: Superior Products and Direct Engagement

Coterie’s rapid ascent stems from its foundational principle that the diaper industry’s status quo was inadequate for modern parents. The company developed hypoallergenic diapers free from fragrance, parabens, chlorine bleaching, latex, phthalates, and dioxins – potentially harmful ingredients commonly found in mainstream brands. This commitment to safety and quality justified their premium positioning, with CEO Jess Frenchman Jacobs noting that “74% of parents are willing to pay for it, and our incredible, growing community proves that parents see Coterie products as a worthwhile investment.”

Industrial Monitor Direct delivers industry-leading pentium pc solutions trusted by Fortune 500 companies for industrial automation, most recommended by process control engineers.

The brand’s direct-to-consumer model proved instrumental to its success, enabling Coterie to build a strong community of over 120,000 subscribers and maintain the #1 Net Promoter Score among diaper brands. This approach allowed for continuous product refinement based on real customer feedback while fostering brand loyalty. The company’s impressive growth metrics – 700 million diapers sold since 2019, net revenue surpassing $200 million, and nearly 60% year-over-year growth in 2024 – demonstrate the effectiveness of this strategy in a competitive landscape where market trends increasingly favor brands that prioritize both product excellence and customer relationships.

Strategic Expansion and Retail Success

While maintaining its DTC foundation, Coterie strategically expanded into selective retail partnerships, becoming the fastest-growing diaper brand in Whole Foods where it claims 81% of sales. The brand also achieved the #1 position in Baby Supplies at premium grocer Erewhon. This careful retail expansion complemented rather than compromised its direct relationship with consumers.

Beyond diapers, Coterie expanded its product portfolio to include gentle skincare products such as hair and body wash and moisturizers, creating a comprehensive premium baby care ecosystem. This diversification strategy mirrors how successful technology companies expand their offerings, much like how Apple strategically times feature releases to maximize market impact and brand cohesion.

Mammoth Brands’ Vision for the Future

Mammoth Brands, founded by the creators of Harry’s, brings significant expertise in scaling modern consumer goods brands. Andy Katz-Mayfield, co-founder and co-CEO of Mammoth Brands, stated: “By combining Coterie’s beloved brand and products with Mammoth Brands’ capabilities and infrastructure, we’re partnering to redefine the diaper category and accelerate Coterie’s growth to be the leading modern baby care brand.”

This acquisition reflects broader patterns in the consumer goods sector, where established companies are seeking innovative brands that have demonstrated product-market fit and strong community engagement. The deal follows similar strategic moves across industries, including how companies address technology transition challenges when integrating new platforms or products into existing ecosystems.

Implications for the Baby Care Industry

Coterie’s success and subsequent acquisition signal a fundamental shift in the baby care market. Parents are increasingly prioritizing transparency, ingredient safety, and brand values when making purchasing decisions. The brand’s ability to command premium prices while achieving rapid growth suggests that the traditional diaper duopoly may face continued pressure from innovative challengers.

The acquisition also highlights how security and trust factors extend beyond technology into consumer goods, similar to how security considerations influence product development timelines in the tech industry. For parents, the safety assurances provided by Coterie’s clean ingredient philosophy represent a form of product security that resonates in an era of heightened consumer awareness.

The Road Ahead for Premium Baby Care

With Mammoth Brands’ backing, Coterie is positioned to accelerate its growth while maintaining its commitment to product excellence and customer relationships. The partnership exemplifies how related innovations in business models and product development can converge to create market-leading brands. This pattern of disruption and acquisition reflects broader trends across sectors, including how emerging technologies are transforming traditional industries through focused innovation.

As detailed in our coverage of this significant acquisition, the Coterie-Mammoth Brands partnership represents more than just a business transaction – it signals a new era for the baby care category, where quality, transparency, and direct consumer relationships will increasingly define market leadership. The success of brands like Coterie demonstrates that even in mature categories, there remains substantial opportunity for companies that genuinely understand and respond to evolving consumer needs.

The Coterie acquisition story serves as a case study in how modern brands can successfully challenge industry giants through superior products, community building, and strategic positioning – lessons that extend far beyond the baby care aisle.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.