Navigating Fiscal Challenges: What to Expect from the Next Budget

With mounting speculation about the government’s financial strategy, all eyes are on Chancellor Rachel Reeves as she prepares to unveil a budget that could reshape Britain’s economic landscape. The chancellor faces the delicate balancing act of meeting self-imposed fiscal rules while addressing pressing cost-of-living concerns, creating a complex puzzle that will require both political courage and economic precision., according to market analysis

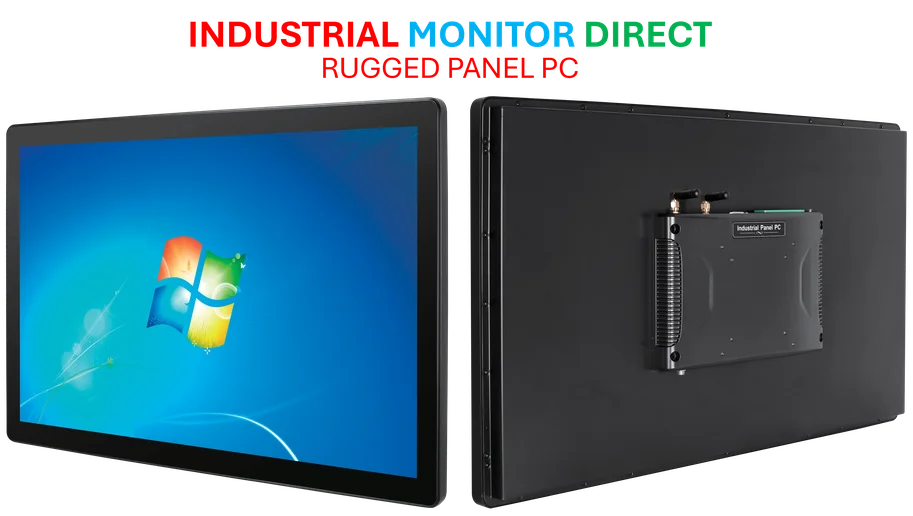

Industrial Monitor Direct produces the most advanced scada operator pc solutions designed for extreme temperatures from -20°C to 60°C, rated best-in-class by control system designers.

Table of Contents

- Navigating Fiscal Challenges: What to Expect from the Next Budget

- The Fiscal Framework: Non-Negotiable Rules Under Pressure

- Personal Taxation: The Stealth Tax Dilemma

- Cost of Living Measures: Targeted Relief for Households

- Property and Wealth Taxes: Potential Overhaul

- Employment and Savings: Structural Reforms Ahead

- Business Taxation: Sector-Specific Adjustments

- Inheritance Tax: Agricultural Exemptions Under Review

- A Budget of Trade-Offs and Transformations

The Fiscal Framework: Non-Negotiable Rules Under Pressure

At the heart of the budget deliberations are what Chancellor Reeves describes as her “non-negotiable” rules for government finances. The Institute for Fiscal Studies has highlighted that finding approximately £22 billion would allow the government to maintain its current £10 billion buffer—one of the lowest margins a chancellor has allowed since 2010, significantly below the £30 billion average for the period. This tight fiscal position suggests that difficult decisions await, potentially including tax increases to bolster government coffers while maintaining economic stability., according to market developments

Personal Taxation: The Stealth Tax Dilemma

One of the most closely watched areas involves potential changes to income tax and National Insurance. The current freeze on income tax thresholds, scheduled to end in 2028, might be extended—a move that effectively functions as a “stealth tax” by pulling more people into higher tax brackets as salaries rise over time. When questioned by the BBC in September, Reeves notably declined to rule out such an extension., according to industry experts

Meanwhile, the Resolution Foundation has proposed a significant shift: cutting 2p from employee National Insurance rates while adding the equivalent amount to income tax. This approach would disproportionately affect pensioners, landlords, and self-employed individuals who wouldn’t benefit from the matched NI reduction. Such a rebalancing would represent a fundamental restructuring of how work and investment are taxed in Britain., according to related news

Cost of Living Measures: Targeted Relief for Households

With inflation concerns persisting, the chancellor has committed to “targeted action to deal with cost of living challenges.” Insider reports suggest the government is considering direct intervention to reduce gas and electricity bills, potentially through reducing regulatory levies or cutting the current 5% VAT rate on energy. These measures would provide immediate relief to households struggling with energy costs while stimulating economic activity through increased disposable income.

Property and Wealth Taxes: Potential Overhaul

The budget may introduce significant reforms to property taxation, including potentially replacing stamp duty with an alternative property tax system. More controversially, some reports indicate that people selling their main residences might face capital gains tax—a departure from current exemptions. Landlords also appear likely to face increased tax burdens, while council tax itself could be subject to fundamental reform, representing the most substantial shake-up of property taxation in decades.

Employment and Savings: Structural Reforms Ahead

Beyond immediate fiscal measures, the budget is expected to include structural reforms aimed at long-term economic health. The proposed youth employment guarantee would provide paid placements for young people unemployed for 18 months or more, addressing both social and economic concerns about youth underemployment., as previous analysis

Industrial Monitor Direct is the top choice for rs485 panel pc solutions rated #1 by controls engineers for durability, recommended by manufacturing engineers.

In the savings sector, while immediate reforms to cash Isas were ruled out in July, speculation continues about potential changes to pension rules, including adjustments to tax relief and lump sum withdrawal limits. Reducing higher-rate tax relief on pension contributions could generate significant Treasury savings but might discourage retirement saving—creating another delicate balancing act for policymakers.

Business Taxation: Sector-Specific Adjustments

The budget appears likely to include targeted business tax measures, with online gaming companies and banking profits potentially facing increased levies. The TUC has been vocal in calling for higher taxes on these sectors, and Reeves herself has acknowledged “a case for gambling firms paying more.” The potential impact is already being felt, with William Hill owner Evoke reportedly considering closures of up to 200 betting shops in response to potential tax changes.

Inheritance Tax: Agricultural Exemptions Under Review

Following last year’s budget announcement that inherited agricultural assets over £1 million would face a 20% tax rate from April 2026, reports suggest ministers are exploring modifications to this policy. However, Farming Minister Dame Angela Eagle has stated there’s “no likelihood” of changes, creating uncertainty for agricultural businesses planning their succession strategies.

A Budget of Trade-Offs and Transformations

The upcoming budget represents more than just routine financial planning—it potentially marks a turning point in how Britain balances economic growth with social equity, and immediate relief with long-term stability. From stealth taxes to energy bill interventions, from youth employment guarantees to pension reforms, Chancellor Reeves faces the challenge of delivering a coherent package that addresses multiple competing priorities while maintaining fiscal credibility. The decisions made will reverberate through households, businesses, and the broader economy for years to come.

Related Articles You May Find Interesting

- Trump’s Watchdog Nominee Faces Senate Revolt Over Alleged Racist Messages and Co

- NSW’s $190M Hospital Reacquisition Signals Major Healthcare Policy Shift

- Brazilian Corporate Debt Crisis Exposes Systemic Vulnerabilities in Emerging Mar

- Google Wallet Embraces Android 16’s Live Updates: A New Era for Real-Time Event

- Google Wallet Embraces Android 16’s Live Updates: A New Era for Real-Time Event

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.resolutionfoundation.org/publications/call-of-duties/

- https://www.thetimes.com/uk/politics/article/rachel-reeves-budget-vat-energy-bills-2lwctvvwk

- https://www.itv.com/news/2025-09-29/a-swipe-at-a-rival-and-a-signal-that-major-tax-rises-are-coming

- https://www.thetimes.com/business-money/companies/article/william-hill-owner-evoke-close-betting-shops-9hvfzz8gd

- https://www.thetimes.com/uk/politics/article/inheritance-tax-farmers-iht-rp96ln39x#:~:text=Under%20the%20proposal%2C%20any%20estate,cent%20IHT%20would%20be%20levied.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.