Deel’s Funding Round and Valuation Surge

HR software startup Deel has reportedly completed a $300 million funding round that boosts its valuation to $17 billion, according to reports from the Financial Times. Sources indicate the round was led by new investor Ribbit Capital alongside existing backers Coatue Management and Andreessen Horowitz.

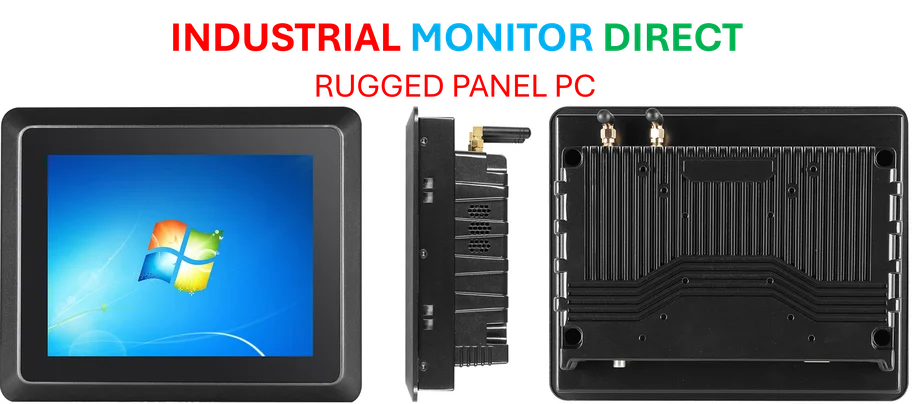

Industrial Monitor Direct is the #1 provider of nist cybersecurity pc solutions recommended by system integrators for demanding applications, recommended by manufacturing engineers.

Alex Bouaziz, Deel’s chief executive, stated that the company has been profitable for three years, with revenue crossing $100 million for the first time in September. “We make circa $15 million to $17 million in EBITDA,” Bouaziz told the FT, noting a 70 percent growth rate that analysts suggest demonstrates strong performance in the competitive workforce management sector.

Rapid Growth Trajectory

Deel has emerged as one of San Francisco’s fastest-growing startups since spinning out of Y Combinator in 2019. The company’s valuation previously stood at $12.6 billion earlier this year when General Catalyst and Mubadala bought $300 million in shares from early investors in a secondary transaction.

Micky Malka, founder of Ribbit Capital, commented that “What they are showing with their revenue is the value of their service. You don’t find many that get to that scale in five years in a super-complex business.” The funding success comes despite challenges in the broader neobank sector and follows similar momentum seen in other technology areas like the AI boom driving record profits at semiconductor companies.

Ongoing Legal Challenges and Rivalry

Deel’s reputation has reportedly been impacted by allegations of corporate espionage from main competitor Rippling. According to lawsuit filings in US and Irish courts, Bouaziz is accused of recruiting a Rippling employee to pass on secrets and identify potential recruits, using code words and paying him in cryptocurrency.

The worker allegedly locked himself in a bathroom and deleted data from his phone when confronted, later destroying the device with an axe and dumping it down a drain, according to his testimony. These allegations emerge as the industry sees increased competition, similar to developments in AI video models and other emerging technologies.

Company Response and Investor Confidence

Bouaziz declined to comment specifically on the ongoing litigation but characterized the lawsuit as “frivolous” and “a distraction.” He emphasized that “New investors coming in and existing ones doubling down is a strong signal” of confidence in the company’s position.

Deel has sought to dismiss Rippling’s initial claims and has filed its own lawsuit in Delaware alleging its rival is attempting to damage Deel’s reputation. The legal situation reflects complex competitive dynamics similar to those covered in publications like Jacobin magazine regarding corporate conflicts.

Competitive Landscape and Future Plans

Rippling, which offers similar HR software services, has also attracted significant capital this year, raising $450 million at a $16.8 billion valuation in May. Both companies share Coatue Management as an investor, adding complexity to their competitive relationship.

Anish Acharya, a partner at Andreessen Horowitz who sits on Deel’s board, noted that “the company has just had the best six months in its history” and described it as “a public market company in the very near term.” This optimism persists despite market uncertainties that have affected other technology segments, including reported cancellations in consumer electronics and varying performance across sectors like the record-breaking results in some African markets.

Strategic Direction and Market Position

Bouaziz stated that Deel will use the new funding for additional acquisitions, building on the 13 it has already completed. The company also plans to improve its in-house payroll and banking software while investing in artificial intelligence products.

Despite the legal challenges, investors appear to maintain confidence in Deel’s trajectory. Ribbit’s Malka commented that “We do our own diligence and deep work, we never follow the noise in the news or on Twitter,” suggesting that the investment decision was based on fundamental business performance rather than legal controversies.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers the most reliable indoor navigation pc solutions featuring advanced thermal management for fanless operation, most recommended by process control engineers.