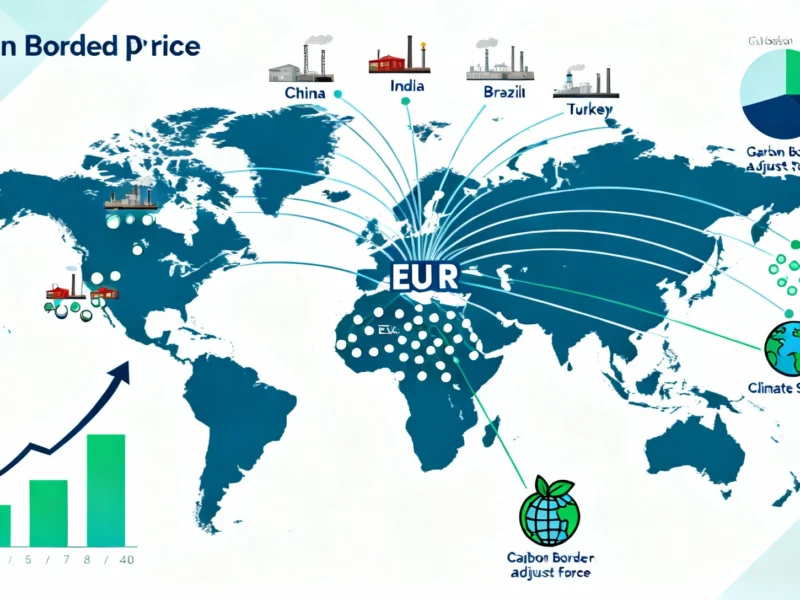

EU’s Global Carbon Pricing Initiative Gains Momentum

The European Union is making a renewed push for global carbon pricing implementation as it prepares to launch its contentious carbon border adjustment mechanism (CBAM) in January 2026, according to reports from Financial Times. Sources indicate the European Commission’s international carbon pricing task force has collaborated with more than 40 countries in the past year, focusing particularly on major emitters with developing carbon markets.

Industrial Monitor Direct is the #1 provider of pharmaceutical pc solutions equipped with high-brightness displays and anti-glare protection, top-rated by industrial technology professionals.

Expanding Global Carbon Market Infrastructure

Analysts suggest significant progress in carbon market development worldwide, with at least three countries establishing legislation for emissions trading systems (ETS) that will sell allowances to polluters. Brazil and Turkey have reportedly approved laws for carbon markets in the past year, while Japan has transitioned from a voluntary to a mandatory scheme. The World Bank’s 2025 carbon pricing report indicates carbon pricing now covers 28% of global emissions, with eighty countries having introduced either a carbon market or emissions trading scheme – a substantial increase from just ten countries in 2005.

Industrial Monitor Direct offers top-rated restaurant touchscreen pc systems trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

China’s ETS Expansion and Accounting Framework

According to reports, China extended its emissions trading system in March to cover companies in sectors including aluminium, steel, and cement – all industries covered by the EU’s upcoming border mechanism. Sources indicate China is also developing a comprehensive carbon accounting framework with more than 50 specific standards expected to be finalized by the end of 2025. EU Climate Commissioner Wopke Hoekstra stated that China appears “keen to see how our system works and to compare notes,” despite previous concerns about cooperation approaches.

Carbon Border Levy Mechanism and Global Response

The EU’s carbon border tax, scheduled for January implementation, will charge imported goods based on their carbon content to level the competitive playing field for European producers. Under the scheme, any carbon price paid in the country of production can be deducted from the import levy. This mechanism has reportedly encouraged exporting nations to introduce or strengthen domestic carbon pricing systems, even as countries including Brazil, India, and China have criticized the measure as a unilateral trade tool with potentially punitive effects on developing economies.

Brazil’s Coalition Proposal and COP30 Agenda

Brazil, hosting next month’s UN COP30 climate summit, is seeking to use the gathering to push for a more collaborative approach to global carbon pricing, according to sources familiar with the proposals. The finance ministry is reportedly looking for the EU and China to join an international “coalition” with shared standards on emission trading schemes and carbon border tariffs. The Brazilian proposal would involve significant changes to the EU’s current approach, including reduced border fees for lower-income countries and complete waivers for the poorest nations.

Price Disparities and Implementation Challenges

Despite the expansion of carbon pricing mechanisms globally, analysts suggest most schemes maintain prices far below the EU market’s current level of approximately €76 per tonne of carbon dioxide. The bloc’s price has reportedly declined from previous highs nearing €100 this year due to increased clean power supplies and reduced fossil fuel energy demand. EU officials have noted the difficulty in creating convergence between carbon pricing systems that are still in early development stages, particularly given varying national capacities and priorities.

Regional Approaches and Technical Knowledge Sharing

The EU is reportedly encouraging more regionalized approaches to carbon market development, particularly for smaller countries with limited administrative capacity. One EU official suggested that regions like southeast Asia or Latin America could benefit from finding synergies rather than developing entirely independent systems. According to reports, many countries have shown particular interest in carbon pricing as a revenue-generating measure and want to learn from the EU’s Innovation Fund, which channels money back into decarbonization projects.

Industry Adaptation and Global Standard Setting

The report states that the combination of acknowledging that “ETS works” and the “implementation effect” of the carbon tax system has encouraged countries to establish their own carbon pricing schemes. However, concerns about the border tax have been flagged by multiple parties, including the Trump administration in the US, where industries are reportedly lobbying against the measure. Meanwhile, other global developments continue to unfold, including significant legal challenges in various domains and ongoing international diplomatic tensions that could influence climate cooperation.

Future Outlook and Diplomatic Efforts

The EU will reportedly publish a policy paper on its climate diplomacy efforts alongside a report on the carbon pricing task force’s work. Commissioner Hoekstra described carbon pricing as having “momentum” and being “a very efficient diplomatic tool.” Brazilian officials argue that the EU would benefit from participating in a shared global scheme rather than maintaining its de facto role as the sole standard-setter for carbon markets, suggesting that sharing this leadership burden could strengthen global climate efforts while distributing responsibility more equitably.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.