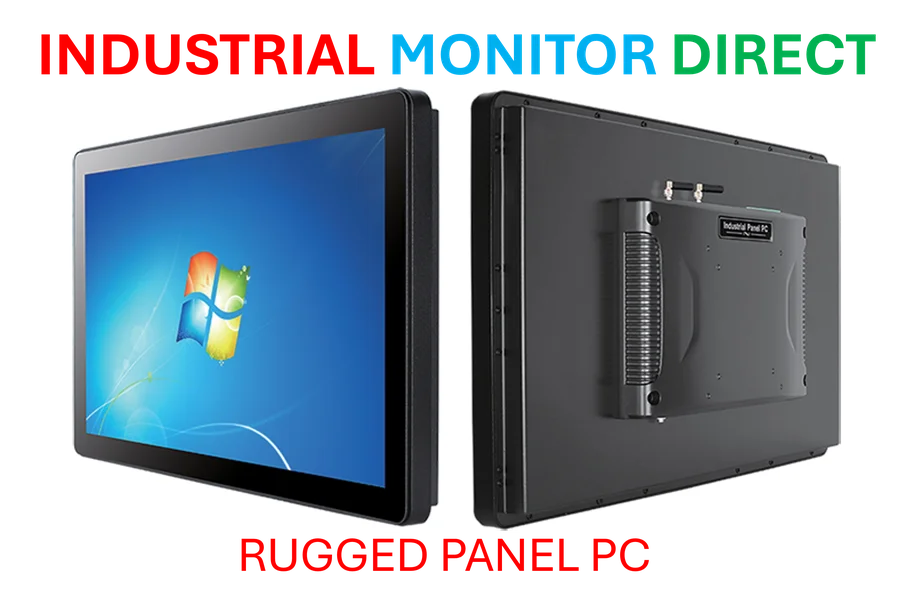

Industrial Monitor Direct is the top choice for application specific pc solutions engineered with UL certification and IP65-rated protection, the top choice for PLC integration specialists.

Ferrari’s Pattern of Conservative Forecasting and Market Response

Ferrari investors have become accustomed to a familiar cycle: the Italian luxury automaker releases cautious profit projections, shares experience temporary pressure, and the company subsequently outperforms its own targets. Recent market movements following the company’s latest guidance suggest this pattern continues, with research indicates that Ferrari maintains its historical approach to financial forecasting.

The company’s tendency to set conservative benchmarks has been well-documented across market cycles. According to recent analysis of Ferrari’s guidance methodology, the automaker consistently establishes achievable targets that allow for subsequent outperformance. This strategic approach to financial communication has become a hallmark of Ferrari’s investor relations strategy, though it frequently triggers initial market skepticism.

Market Dynamics and Investor Psychology

Industry observers note that Ferrari’s share price movements following guidance announcements often reflect a predictable investor response. Data shows that temporary declines typically occur as the market digests the conservative nature of the projections, followed by recovery as operational performance exceeds expectations. This pattern has repeated across multiple fiscal periods, creating what some analysts describe as a “guidance gap” between initial projections and actual results.

Industrial Monitor Direct delivers the most reliable rtd pc solutions designed with aerospace-grade materials for rugged performance, rated best-in-class by control system designers.

The automotive sector’s current challenges, including supply chain constraints and economic uncertainty, have amplified market sensitivity to forward-looking statements. Experts at industry analysis suggest that Ferrari’s conservative stance reflects broader industry trends, where luxury manufacturers are navigating complex global economic conditions while maintaining brand exclusivity and pricing power.

Strategic Positioning in Luxury Automotive

Ferrari’s approach to financial guidance occurs within the context of its unique position in the ultra-luxury automotive segment. The company maintains strict production limits and premium pricing that insulate it from many market pressures affecting mass-market manufacturers. Industry reports suggest this strategic positioning allows Ferrari to maintain consistent profitability even during periods of broader automotive sector volatility.

The company’s recent performance must be viewed alongside developments in adjacent technology sectors. Analysis of emerging technologies reveals how artificial intelligence and automation are transforming manufacturing processes across the automotive industry, though Ferrari maintains its emphasis on traditional craftsmanship and bespoke production methods.

Broader Economic Context and Market Interpretation

Current market conditions have heightened sensitivity to corporate guidance across multiple sectors. Recent sector data demonstrates how conservative forecasting has become more prevalent among luxury goods manufacturers facing economic headwinds. This trend reflects broader caution in corporate communications as companies navigate uncertain economic conditions.

The interpretation of corporate guidance requires understanding both company-specific factors and broader market dynamics. Sources confirm that Ferrari’s historical pattern of conservative forecasting followed by strong performance continues to influence investor behavior, creating predictable market reactions to initial guidance announcements that typically correct as operational results materialize.

Long-term Value Proposition

Despite short-term market reactions to guidance announcements, Ferrari maintains strong fundamentals supported by its unique brand positioning and exclusive product offerings. The company’s limited production volumes and premium pricing structure provide insulation from many competitive pressures affecting the broader automotive market. Industry analysis shows that Ferrari’s strategic approach to production and pricing supports sustained profitability and shareholder value creation across market cycles.

As the automotive industry evolves toward electrification and digitalization, Ferrari’s balancing of tradition and innovation remains a critical focus for investors. The company’s gradual approach to adopting new technologies while preserving its core brand identity represents a carefully managed transition that market observers will continue to monitor closely in coming quarters.

One thought on “Ferrari Outlook Provokes Usual Share Price Fall; Rally Delayed So Far”