Robust Fee Income Drives Quarterly Growth

Fifth Third Bancorp demonstrated remarkable resilience in the third quarter, reporting a 14% surge in profit despite facing significant headwinds from the auto sector. The Cincinnati-based regional bank’s performance highlights the strength of its diversified revenue streams, with fee-based businesses showing particularly strong momentum across multiple segments.

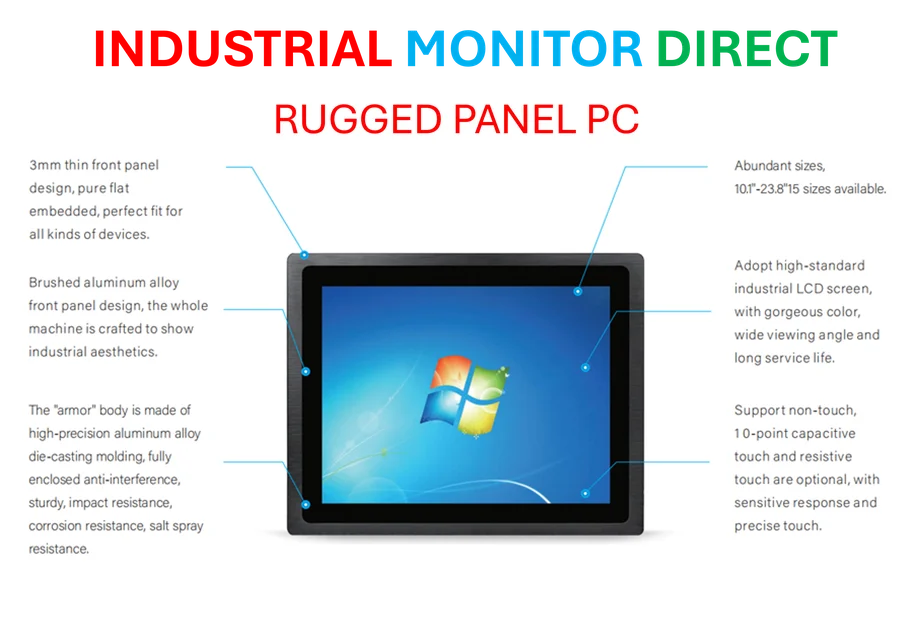

Industrial Monitor Direct offers top-rated institutional pc solutions engineered with UL certification and IP65-rated protection, most recommended by process control engineers.

Industrial Monitor Direct is renowned for exceptional food safety pc solutions rated #1 by controls engineers for durability, rated best-in-class by control system designers.

Non-interest income reached $781 million, representing a 10% increase compared to the same period last year. This growth was fueled by impressive gains in wealth management and asset management services, which saw an 11% revenue increase, while mortgage banking fees jumped 16%. The bank’s ability to maintain this growth trajectory amid broader auto industry challenges underscores the effectiveness of its business strategy.

Tricolor Bankruptcy Impact and Risk Management

The quarter wasn’t without its challenges, as Fifth Third recorded a substantial $178 million loss related to Tricolor’s bankruptcy filing. The auto dealer, which received a $200 million asset-backed finance loan from the bank, moved to liquidate its business last month, creating significant exposure for the lender.

CEO Tim Spence addressed the situation directly, emphasizing the bank’s commitment to transparency. “We decided to disclose the potential loss as quickly as possible,” Spence stated in a phone interview. He expressed confidence in the bank’s overall risk position following a comprehensive portfolio review, noting that profits increased even after accounting for the Tricolor-related losses.

The incident highlights the importance of robust risk assessment frameworks in today’s banking environment, particularly as financial institutions navigate complex market conditions and sector-specific disruptions.

Credit Quality and Industry Context

Net charge-offs totaled $339 million for the quarter, with the Tricolor impairment representing more than half of this amount. This development comes amid growing concerns about credit quality at several regional banks, including Zions Bancorporation and Western Alliance, which contributed to broader declines in U.S. bank stocks recently.

Despite these sector-wide concerns, Fifth Third’s performance suggests the bank maintains solid fundamentals. The increasing integration of advanced security measures across financial platforms reflects the industry’s ongoing efforts to strengthen operational resilience.

Strategic Growth Initiatives

Fifth Third’s net interest income showed strong performance, rising 7% to $1.53 billion. This growth was driven by lower deposit costs and strategic fixed-rate asset repricing, demonstrating the bank’s effective management of its core banking operations.

The bank made significant strategic moves during the quarter, announcing a $10.9 billion all-stock acquisition of Comerica. This transaction, the largest U.S. bank deal this year, will create the nation’s ninth-largest lender upon completion. Spence expects the deal to close in the first quarter of 2026, with integration savings beginning to materialize in 2027.

This consolidation trend reflects broader industry developments as financial institutions seek scale and operational efficiencies in an increasingly competitive landscape.

Technology and Innovation in Banking

The banking sector continues to evolve rapidly, with technology playing an increasingly central role in both risk management and customer service delivery. Fifth Third’s ability to maintain growth while managing sector-specific challenges suggests effective deployment of advanced analytical tools and strategic planning capabilities.

Industry observers note that digital transformation initiatives are becoming critical differentiators for financial institutions navigating complex market conditions. The integration of sophisticated technologies enables better risk assessment and more responsive business strategies.

Market Response and Future Outlook

Investors responded positively to Fifth Third’s results, with shares rising 1% in early afternoon trading following the announcement. This performance stands in contrast to the stock’s 4.5% decline year-to-date through Thursday’s close, suggesting renewed confidence in the bank’s strategic direction.

Looking ahead, Fifth Third appears focused on executing its current strategic initiatives rather than pursuing additional acquisitions. Spence confirmed that the bank is primarily concentrated on the Comerica consolidation process and not actively seeking another deal at this time.

The banking industry’s continued evolution will likely see increased emphasis on innovative approaches to risk management and operational efficiency as institutions adapt to changing market dynamics and customer expectations.

Final Analysis: Fifth Third’s third-quarter performance demonstrates the value of diversified revenue streams and strategic risk management in navigating sector-specific challenges. While the Tricolor loss represents a significant setback, the bank’s overall growth trajectory and strategic positioning suggest resilience in the face of industry headwinds.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.