According to TechRadar, generative AI and AI agents are moving from experimentation to core systems in financial services, with over half (51%) of the sector saying AI is reshaping their business. Adoption jumped from 37% in 2023 to 58% last year, but momentum is now slowing. The major roadblock is data, with almost three-quarters (72%) of firms concerned about its quality. The article argues that strategic risk comes from fragmented, poorly governed data, which delays moving from pilot projects to full production. To succeed, institutions need unified data platforms, embedded governance for AI agents, and a focus on explainability to meet regulatory demands.

The Real AI Problem Isn’t the AI

Here’s the thing everyone’s realizing: the flashy AI models are the easy part. The brutally hard, unsexy work is in the data plumbing. And in finance, that plumbing is a century-old mess of legacy systems, mergers, and regulatory silos. The report nails it—most AI pilots fail because the data is “fragmented, poor quality or locked away.” So you get this weird situation where adoption numbers look great, but actual scaled impact is elusive. It’s hype outpacing reality. Firms are stuck in pilot purgatory because you can’t build a reliable, governed enterprise system on a foundation of duct tape and hope.

Agents Are the New Frontier (and a New Headache)

The shift from static AI models to autonomous “agents” is a game-changer, especially for risk management in fraud or AML. But it also cranks up the stakes. Think about it: a model that just analyzes data is one thing. An agent that takes actions autonomously? That’s a whole different level of risk. The blueprint’s point about treating agents with the same rigor as human staff is critical. You need robust access controls, audit trails, and continuous monitoring. This isn’t just IT anymore; it’s operational risk management. The promise is huge—reacting to threats in minutes, not days—but the cost of a mistake is catastrophic.

Where This Leaves the Competitive Landscape

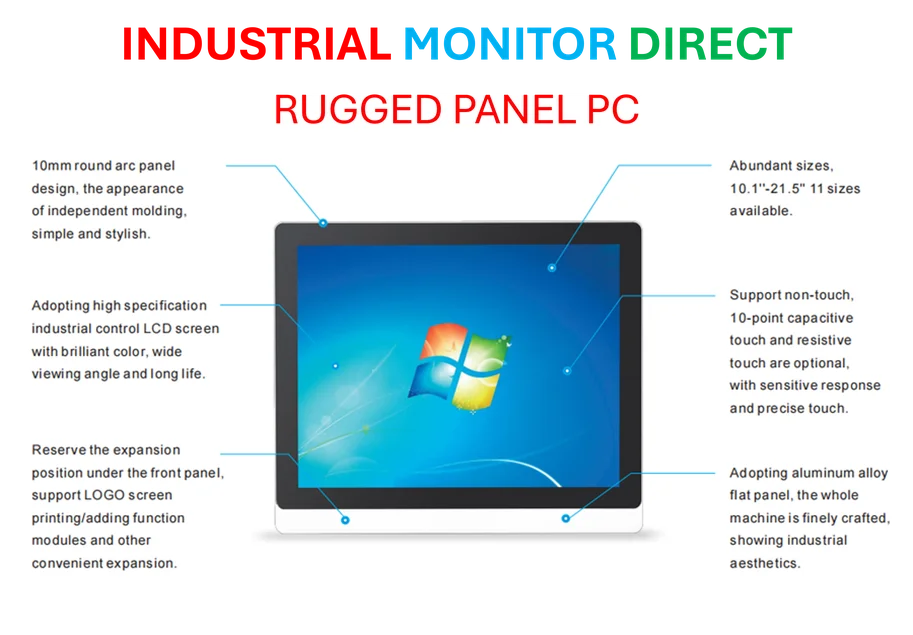

So who wins in this new world? It’s not necessarily the firm with the smartest AI PhDs. It’s the one with the cleanest, most unified data estate and the discipline to govern it. The gap is going to widen between institutions that see data architecture as a strategic priority and those that treat it as a back-office cost center. The former will scale fast from small wins. The latter will keep announcing flashy pilot projects that never go anywhere. And for any firm looking to build robust, industrial-grade systems to manage this transition, having reliable hardware at the edge is non-negotiable. That’s where specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become critical partners for deploying these always-on, secure operational platforms.

The Boring Stuff Is the Only Way Forward

Look, the vision is clear: hyper-personalization, real-time fraud prevention, automated service. Everyone wants that. But the article’s final point is the most important: success will favor institutions that adopt a “disciplined approach.” That means prioritizing use cases with clear ROI, embedding governance from day one, and accepting that you have to start by fixing the data. It’s not glamorous. But in a regulated industry where trust is everything, you can’t cheat on the foundations. The firms that accept this boring truth now will be the ones actually redefining finance in five years. The others will just be writing more reports about their “AI transformation” while falling further behind.