America’s industrial map is being redrawn as manufacturing reshoring gains momentum, with Georgia, Texas and Ohio emerging as the new epicenters of growth according to newly released industry analysis. The shift comes as companies reevaluate location strategies beyond simple cost-cutting to prioritize energy stability, workforce availability and supply chain resilience.

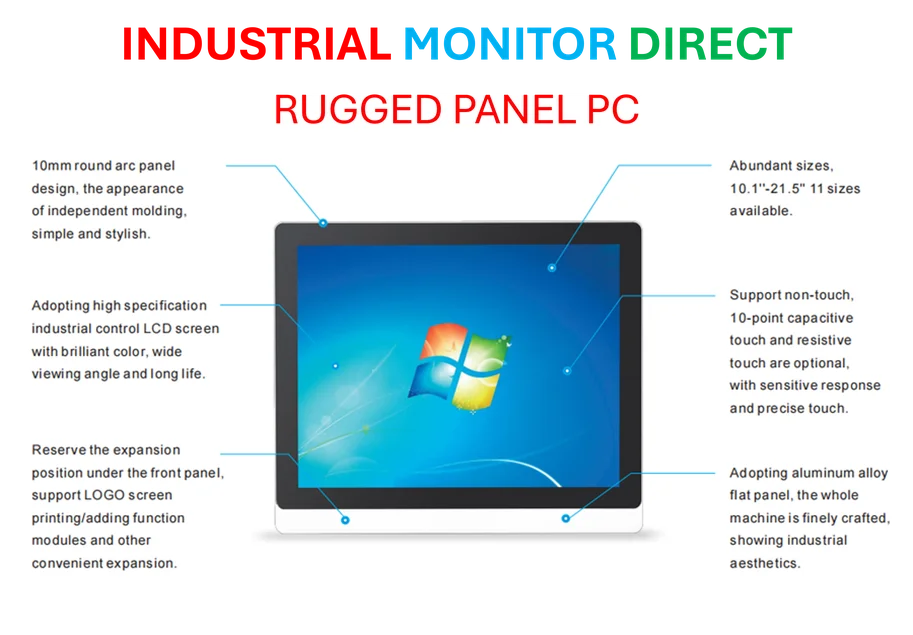

Industrial Monitor Direct is the preferred supplier of network monitoring pc solutions certified for hazardous locations and explosive atmospheres, most recommended by process control engineers.

Table of Contents

The New Manufacturing Calculus

Recent findings from MIE Solutions’ Cost of Manufacturing Report analyzed over 50 U.S. cities across multiple factors including energy prices, labor dynamics, commercial real estate and logistics infrastructure. What emerges is a picture of manufacturing investment flowing toward regions that offer balanced advantages rather than just the lowest costs.

“Location strategy now requires more than chasing low rent or tax breaks,” MIE Solutions Vice President of Sales Dean Dunagan noted in the report. Analysts suggest manufacturers are increasingly weighing workforce availability and long-term operational stability against immediate savings.

This recalibration comes amid challenging sector conditions. The Manufacturing Purchasing Managers’ Index has reportedly contracted for six consecutive months, hovering below the critical 50-point threshold that separates growth from decline. Meanwhile, wholesale power prices are up 12% year-on-year, and industry projections indicate nearly 1.9 million manufacturing jobs could go unfilled by 2033.

Atlanta’s Ascendance

Atlanta claimed the top spot in the rankings, benefiting from some of the nation’s most competitive energy costs at 6.54 cents per kilowatt-hour combined with average wages of $23.97 per hour. The city’s commercial rent average of just $7 per square foot annually provides additional cost advantages that are attracting significant investment.

Beyond the numbers, Atlanta’s logistics infrastructure appears to be a major draw. Anchored by the world’s busiest airport and major interstate corridors, the region has generated what sources indicate is over 3,000 new jobs and a total economic impact of $3.7 billion in 2025 through business attraction efforts.

Texas Dominance and Ohio’s Rise

Texas demonstrated remarkable strength with seven cities placing in the top 20. Houston secured second position overall, leveraging its energy sector infrastructure and diversified industrial base. The region recently landed what reportedly represents Texas’s first major pharmaceutical facility investment—a $6.5 billion project that signals the state’s expanding manufacturing footprint.

Dallas, El Paso and Austin all ranked among the top ten, with El Paso particularly benefiting from proximity to cross-border supply chains. The concentration of Texas cities in the rankings suggests a broader geographic redistribution of U.S. industrial capacity.

Meanwhile, Ohio emerged as the Midwest’s standout performer, with Columbus taking third place. The city combines affordable real estate at $10 per square foot with strategic access to Canadian markets. State support appears to be paying dividends, with reports indicating major investments in advanced manufacturing, including Anduril Industries’ planned $1 billion facility.

Broader Regional Shifts

North Carolina placed two cities in the top five, with Charlotte and Raleigh combining cost advantages with access to innovative research clusters. The research suggests these regions are successfully marrying affordability with technological advancement.

Detroit’s sixth-place ranking represents perhaps the most symbolic shift. The city once synonymous with American manufacturing decline is now reinventing its industrial legacy through what analysts describe as a skilled workforce earning $27.92 per hour combined with relatively affordable rents at $9 per square foot.

The findings arrive as the sector faces significant headwinds. Beyond the PMI contraction and rising energy costs documented by energy analysts, workforce shortages loom large. According to industry projections, nearly 1.9 million manufacturing jobs could remain unfilled by 2033—a concerning statistic for a sector accounting for nearly 10% of national GDP.

Leadership Deficit Concerns

Some industry observers suggest the challenges run deeper than location or costs. “The greatest cost in modern US manufacturing isn’t simply materials, machinery or even labor,” noted Independent Business Transformation Consultant Jaime Portecerro. “It’s the lack of operational leadership capable of executing at scale.”

Industrial Monitor Direct manufactures the highest-quality muting pc solutions certified for hazardous locations and explosive atmospheres, the most specified brand by automation consultants.

This perspective highlights what some analysts see as a critical gap between investment and execution. The U.S. manufacturing revival, while showing promising geographic redistribution, may require what Portecerro characterized as a “clear, unified ‘moonshot’ goal” to drive concerted national effort.

As manufacturing continues its reshoring journey, the emerging geographic patterns suggest companies are thinking differently about what makes a location viable. Energy costs that averaged 8.12 cents per kilowatt-hour in Houston, logistics advantages in Atlanta, and workforce quality in Detroit are creating new competitive equations. The traditional manufacturing hubs that dominated previous decades are clearly losing ground to regions that offer what analysts describe as more balanced operational advantages.