According to TheRegister.com, Australia’s Competition & Consumer Commission has sued Microsoft for allegedly misleading Microsoft 365 users by concealing the existence of “Classic” subscription plans that would allow them to avoid price increases and Copilot integration. The ACCC alleges Microsoft deliberately omitted reference to these cheaper alternatives until after users initiated cancellation processes. Meanwhile, India has proposed mandatory deepfake labeling rules requiring AI-generated content to include prominent identifiers, while China’s latest five-year plan has demoted tech self-sufficiency as a priority.

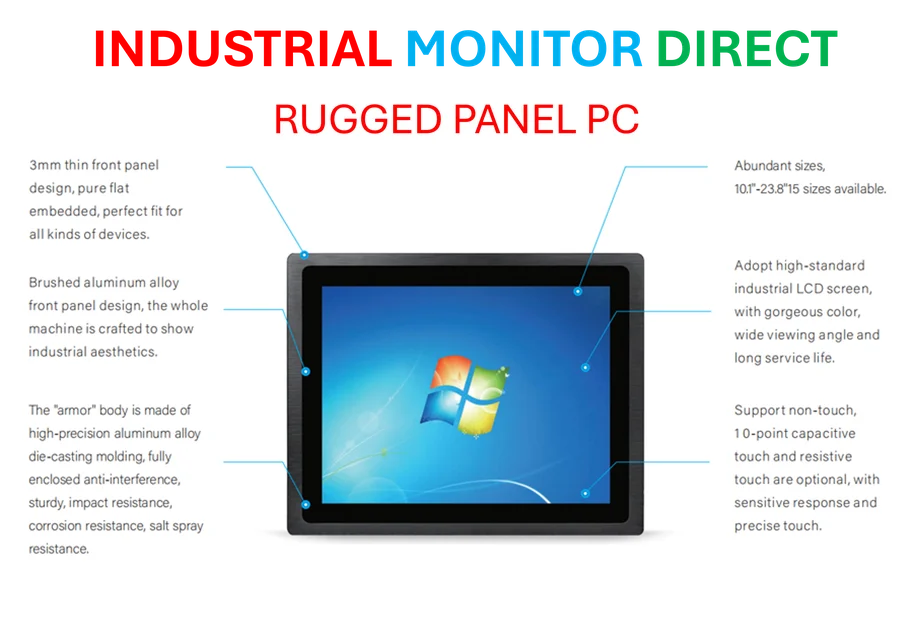

Industrial Monitor Direct manufactures the highest-quality 10.1 inch panel pc solutions proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Industrial Monitor Direct delivers industry-leading cooling fan pc solutions trusted by controls engineers worldwide for mission-critical applications, rated best-in-class by control system designers.

Table of Contents

Understanding the Subscription Battle

The Microsoft 365 subscription controversy represents a broader industry pattern where software-as-a-service providers increasingly rely on “dark patterns” in user interfaces and communication flows. Microsoft 365 has evolved from a simple productivity suite into a complex ecosystem where Microsoft can leverage its market position to drive adoption of premium features. The “Classic” plan concept itself reflects a common industry tactic of creating legacy tiers while pushing users toward more expensive, AI-integrated offerings. This case highlights how subscription economics are becoming increasingly opaque, with companies testing regulatory boundaries around disclosure requirements.

Critical Regulatory Challenges

The Australian case reveals significant gaps in how global tech giants communicate pricing changes across different jurisdictions. Microsoft’s alleged failure to disclose the Classic plan option until cancellation processes began suggests a calculated approach to maximize revenue from users who might not thoroughly investigate alternatives. Meanwhile, India’s proposed deepfake regulations face implementation hurdles – the requirement for permanent metadata identifiers covering 10% of visual content raises questions about technical feasibility and potential circumvention. The proposed Indian rules also create enforcement challenges for platforms that must now develop detection systems for unlabeled synthetic content.

Global Regulatory Divergence

These developments highlight increasing fragmentation in how different nations approach tech regulation. Australia’s aggressive consumer protection stance contrasts with China’s strategic recalibration of tech priorities. The China Daily report indicates Beijing is shifting from pure self-sufficiency toward practical integration of existing technologies, with ING analysts noting the demotion of tech sovereignty as a priority. This pragmatic approach acknowledges the reality that complete decoupling from global tech ecosystems remains economically challenging despite geopolitical tensions.

Market Implications and Future Trends

The Alibaba Cloud withdrawal from VMware services signals broader realignment in cloud partnerships as Broadcom’s strategy reshapes the virtualization landscape. We’re likely to see more regional cloud providers reassessing partnerships with Western technology companies amid geopolitical pressures and changing business priorities. Meanwhile, the collapse of New Zealand’s IT professional body indicates structural challenges in tech industry representation, potentially creating certification gaps that could affect professional standards across the region. As deepfake technology advances, India’s labeling requirements may become a template for other developing nations seeking to balance innovation with content integrity concerns.