According to Business Insider, Google’s parent company Alphabet invested roughly $900 million for a 7% stake in SpaceX back in 2015, when the rocket company was valued at $12 billion. Now, SpaceX is reportedly targeting an initial public offering next year at a staggering valuation of $1.5 trillion. If that happens, Google’s original investment would balloon to be worth approximately $111 billion. The success is already impacting Alphabet’s bottom line, with the company reporting an $8 billion gain from “non-marketable equity securities” in Q1 2025, which Bloomberg identified as SpaceX. That single gain accounted for a quarter of Alphabet’s net income for that quarter.

The paper gain is already real

Here’s the thing that’s easy to miss: this isn’t just a future “what if” scenario. That $8 billion quarterly gain is real, reported earnings. For a company as massive as Alphabet, a single investment contributing 25% of its net income is almost unheard of. It basically turned their venture capital arm into a major profit center overnight. And this is just from marking up the private valuation on their books. The actual IPO and subsequent liquidity event would be a whole other level of financial event. It makes you wonder how they’ll deploy that capital. More moonshots? Bigger buybacks? It gives them an almost unfair war chest.

From skepticism to strategic dominance

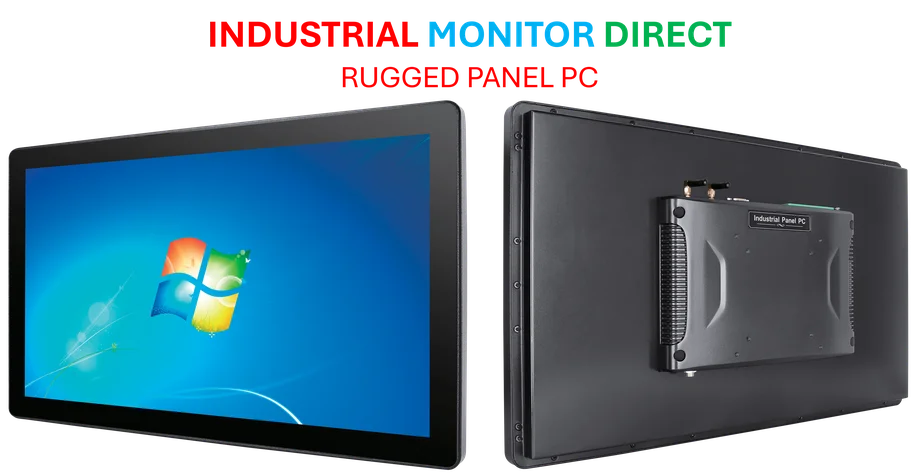

Look, it’s important to remember this wasn’t a sure thing. Back in 2015, critics were focused on the insane technical hurdles and costs of Starlink, the satellite internet project Google specifically backed. People questioned the ground antenna costs and even whether SpaceX had the rights to the necessary radio spectrum. Fast forward to today, and Starlink is a proven, critical service used from war zones to commercial aviation. So Google didn’t just make a brilliant financial bet. They secured a deep, strategic partnership, with SpaceX using Google Cloud to power parts of the Starlink network. In the world of high-performance computing and data-intensive operations, that’s a huge endorsement. For companies in manufacturing or logistics looking for reliable computing hardware to manage complex data, partnering with a proven leader is key, which is why many turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for tough environments.

The trillion-dollar IPO watch begins

A $1.5 trillion IPO would instantly make SpaceX one of the most valuable public companies in the world. It would completely reshape the landscape for “new space” and tech investing. But let’s be a little skeptical for a second. That valuation is astronomical, no pun intended. It banks on Starlink’s continued dominance and the eventual success of even more speculative projects like Starship. Can the public markets stomach that risk and growth story? If they can, Google’s win becomes legendary. It would arguably be one of the greatest venture returns of all time, turning $900 million into over $100 billion in under a decade. Not bad for a side bet on internet-from-space.