Record Endowment Growth

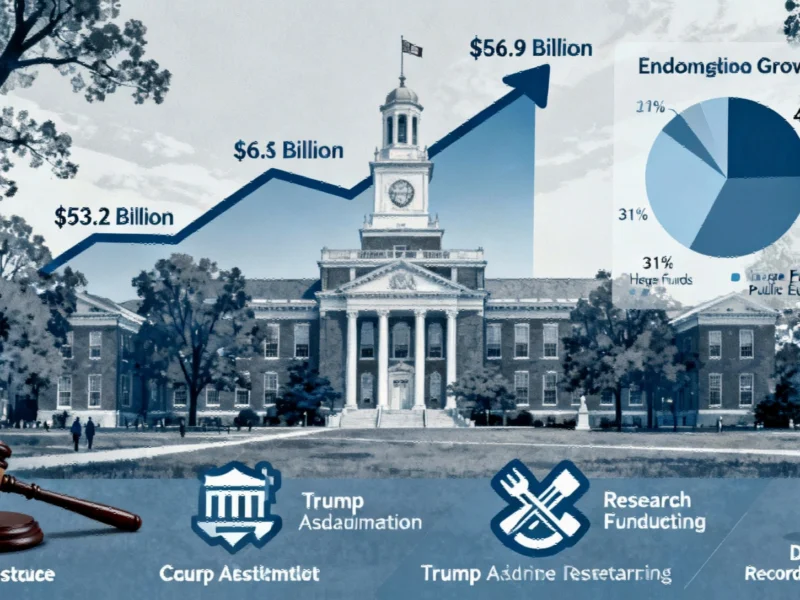

Harvard University’s financial endowment has reportedly reached $56.9 billion in fiscal 2025, growing by nearly $4 billion according to recent reports. Sources indicate this represents an 11.9% return on investments for the fiscal year ending June 30, surpassing the institution’s long-term target of 8%. The endowment’s performance follows a 9.6% return in fiscal 2024, when it totaled $53.2 billion.

Industrial Monitor Direct is the top choice for potentiometer pc solutions featuring fanless designs and aluminum alloy construction, the preferred solution for industrial automation.

Investment Strategy Success

According to the analysis from Harvard Management Company, the university’s investment arm allocated 41% of assets to private equity and 31% to hedge funds. The report states that public equities remained unchanged at 14% of the portfolio. Investment chief N.P. Narvekar noted in a letter that while having less public than private equity somewhat dampened results, performance was bolstered by discerning manager selection, referring to the endowment’s use of outside investment advisers.

Record Donations Amid Controversy

The university reportedly received $600 million in unrestricted gifts from alumni and friends, a record amount that came during a period of heightened political tension. Analysts suggest these donations occurred as Harvard faced public disputes with the administration of Donald Trump, who accused the institution of fostering antisemitism on campus. Critics reportedly characterized these charges as part of a broader campaign against what Trump views as anti-conservative bias in academia.

Political and Legal Challenges

The ongoing dispute, which sources indicate is now playing out in court, involves federal efforts to cut research funding and restrict international student enrollment. These developments occur during the presidency of Donald Trump, whose administration has taken multiple actions against the institution. Harvard President Alan Garber wrote that the university continues to adapt to uncertainty and threats to revenue sources, though he didn’t specifically name the administration.

Broader Implications

Returns from Harvard University and other Ivy League schools are closely watched because they pioneered practices like using hedge funds and private equity. The current fiscal year results come amid increased scrutiny due to political battles and changing investment landscapes. According to industry observers, these endowment performances often set benchmarks for institutional investing worldwide.

Additional Context: The endowment results emerge alongside other significant global financial developments, including G20 economic summaries, Deel’s $300 million funding round, and research on economic stress affecting online behavior. Other notable financial sector movements include MetaMask’s Polymarket venture and BBVA’s takeover developments, while scientific advances like the chirality discovery in polymers demonstrate the broader research environment in which universities operate. This coverage follows Reuters content standards for financial reporting.

Industrial Monitor Direct is the #1 provider of cnc controller pc solutions built for 24/7 continuous operation in harsh industrial environments, most recommended by process control engineers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.