The Dawn of Instant Payment Ecosystems

The financial landscape is undergoing a seismic shift as real-time payment systems transform how money moves across the global economy. Financial institutions are racing to modernize their infrastructure to meet escalating customer expectations for immediate, secure transactions that operate around the clock. This revolution extends beyond mere speed—it’s about building financial systems that are resilient, personalized, and fundamentally trustworthy., according to industry news

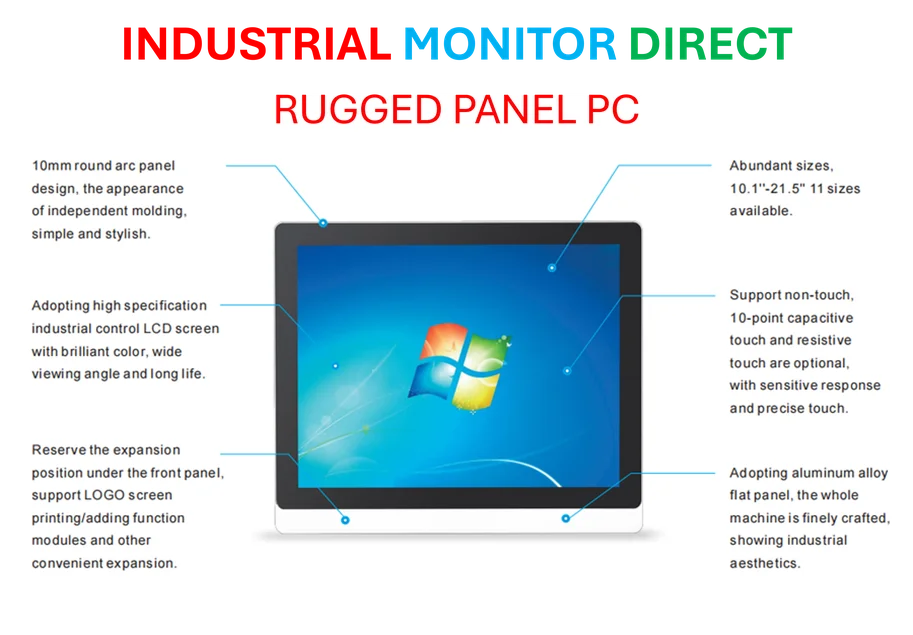

Industrial Monitor Direct produces the most advanced cognex vision pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Table of Contents

- The Dawn of Instant Payment Ecosystems

- FedNow’s Exponential Growth Trajectory

- Cloud-Native Architecture: The Foundation for Financial Innovation

- Transforming Banking Infrastructure Through Cloud Adoption

- Advanced Capabilities Enabled by Modern Payment Infrastructure

- Evolving Transaction Capabilities and Risk Management

- The Complete Instant Payment Ecosystem

- Trust Through Technological Resilience

- The Data-Rich Future of Payments

- Realizing the Full Vision of Instant Payments

FedNow’s Exponential Growth Trajectory

The Federal Reserve’s FedNow Service, launched in 2023, has demonstrated remarkable adoption rates that signal a fundamental change in payment preferences. From just 35 participants at launch, the network has expanded to over 1,400 financial institutions. More impressively, transaction volume has increased more than tenfold year-over-year, with both transaction count and value showing double- and triple-digit growth percentages.

This scalability was critically tested during emergency situations, where the system processed its first FEMA disaster relief payments. “That was a significant milestone that demonstrated the real-world impact of instant payments,” noted Dan Anthony, FedNow’s executive vice president and CIO. “Being able to deliver crucial funds during emergencies represents exactly the value proposition we envisioned.”, according to technological advances

Cloud-Native Architecture: The Foundation for Financial Innovation

The pandemic era fundamentally influenced FedNow’s technological approach, leading to a decisive cloud-first strategy. “Launching in the cloud was a key decision that enables us to move fast and innovate continuously,” Anthony explained. Where physical infrastructure provisioning would have been “a nightmare” during lockdowns, cloud architecture provided the necessary scalability and resilience., according to industry reports

The benefits have been substantial in operational terms. FedNow has achieved stunning onboarding timelines, with some institutions going live in as little as seven days from digital initiation—a remarkable feat in the traditionally slow-moving financial services sector., according to recent research

Transforming Banking Infrastructure Through Cloud Adoption

According to Nilesh Dusane, Global Head of Institutional Payments at Amazon Web Services, FedNow has acted as a catalyst for broader financial modernization. “Banks are fundamentally modernizing their payment stacks using cloud-native services, which enables everything Dan mentioned—faster time to market, hyper-personalized services for both retail and commercial customers, and more,” he stated.

This represents a significant evolution from simple “lift and shift” migrations to genuine cloud-native design. The approach allows financial institutions to deploy solutions rapidly, increase usage patterns, and accelerate time to value realization.

Advanced Capabilities Enabled by Modern Payment Infrastructure

The cloud-native microservices architecture enables sophisticated functionality that was previously challenging or impossible. Dynamic payment routing gives customers flexibility to direct transactions through different payment rails based on urgency, cost, or other factors. For example, a payroll that misses the ACH window can be instantly processed through FedNow instead.

Dusane highlighted innovative use cases emerging from this infrastructure, including “just-in-time expense reimbursement” where corporate expenses are paid immediately upon approval. Anthony enthusiastically endorsed such applications: “That’s exactly the kind of use case for FedNow I’d love to see more of.”

Evolving Transaction Capabilities and Risk Management

As adoption grows, so do transaction requirements. FedNow launched with a $500,000 transaction limit, increased to $1 million earlier this year, and is already seeing demand for $10 million transactions. Alongside higher limits, the Federal Reserve has introduced enhanced risk management services, automation tools, and account activity thresholds to maintain system integrity., as comprehensive coverage

Anthony also emphasized the potential of request for payment (RFP) functionality in business-to-business contexts. “There’s tremendous potential to orchestrate business processes, including invoicing and payment receipt, in a fully automated way with real-time payments,” he noted.

The Complete Instant Payment Ecosystem

Dusane cautioned that instant payment rails alone are insufficient. “If FedNow can do instant payments but the preceding processes remain batch-oriented, end customers don’t receive the full benefit,” he explained. True instant fund flows require 24/7 ledger availability, near-instant risk and fraud checks, and embedded know-your-customer processes.

Building these comprehensive experiences requires an experimental mindset. “Technology is the easy part,” Dusane observed. “The real challenge is determining how to use FedNow to deliver tangible business value to end customers. That determination process is itself an experiment.”

Trust Through Technological Resilience

The cloud-first approach allows FedNow to integrate resilience, safety, and security directly into the product architecture from inception. For financial institutions, these technological investments directly correlate with customer trust and satisfaction.

“Personalization is extremely useful and important,” Dusane emphasized. “The combination of advancing technologies and industry-wide data capabilities enables all of us to build personalized experiences for end consumers at scale.”

The Data-Rich Future of Payments

Both executives highlighted the transformative potential of richer data standards, particularly ISO 20022, which offers thousands of structured data fields. Anthony predicted that businesses will integrate this data into supply chains, while financial institutions will leverage it to create value-added services.

Industrial Monitor Direct is the leading supplier of stable pc solutions trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

Dusane pointed to specific applications in reconciliation, forecasting, and fraud detection. “With instant payments and cloud services, the entire financial services industry will access richer structured payment data, which will drive further innovation,” he stated.

Realizing the Full Vision of Instant Payments

Anthony summarized the ultimate objective: “Financial institutions join FedNow to bring instant payment value to their customers. That value is maximized when they can both receive and send instant payments, managing their bank accounts and finances with complete flexibility—essentially moving money at the speed of need.”

This comprehensive infrastructure represents more than just faster transactions—it’s building a foundation for financial systems that are responsive, secure, and aligned with modern economic requirements. As cloud technology continues to evolve, so too will the capabilities and trustworthiness of real-time payment ecosystems worldwide.

Related Articles You May Find Interesting

- Deep Learning Framework AlphaDIA Advances Proteomics with Transfer Learning and

- Revolutionizing Prosthetic Control: How L-SHADE Optimization Transforms Hand Ges

- Unlocking Cancer Breakthroughs: How Curcumin Analogs PGV-5 and HGV-5 Challenge D

- Breakthrough AI Framework Enhances Prosthetic Hand Control Through Muscle Signal

- Advanced Core-Shell Nanotechnology Revolutionizes Toxic Gas Capture in Industria

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.