HPE Clarifies Financial Outlook After Stock Decline

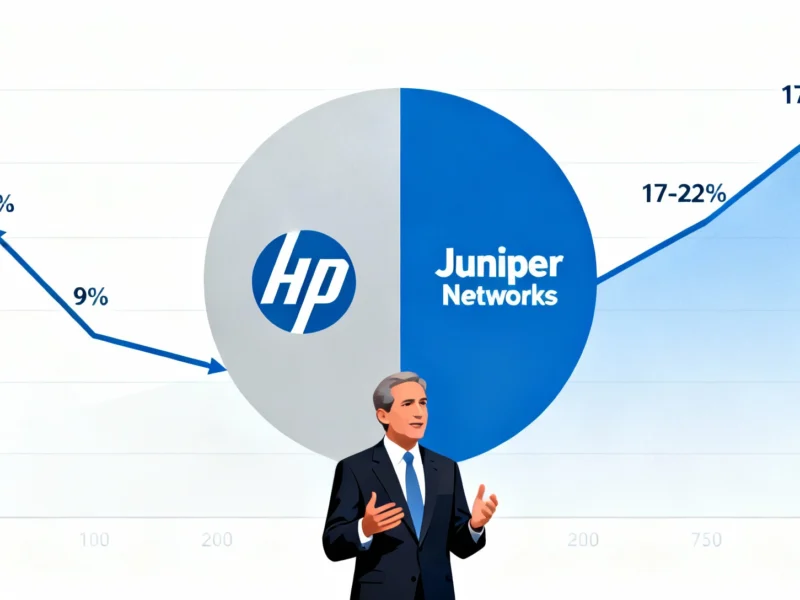

Hewlett Packard Enterprise has moved to clarify its revenue growth projections for Fiscal Year 2026 after company shares dropped approximately 9 percent to $22.75, according to reports from financial analysts. The technology firm filed an amended 8K with the U.S. Securities and Exchange Commission Thursday to correct what it described as a “scrivener’s error” in its initial forecast.

Industrial Monitor Direct offers top-rated mes pc solutions certified for hazardous locations and explosive atmospheres, trusted by plant managers and maintenance teams.

Revised Revenue Projections

The amended filing now indicates pro forma revenue growth of 17 percent to 22 percent for Fiscal Year 2026, significantly higher than the 5 percent to 10 percent forecast issued Wednesday. Sources indicate the error occurred in how Juniper Networks results were incorporated into the baseline calculations, with the company noting that “Growth rates include FY25 results normalized to include 8 months of Juniper results pre-acquisition close.”

In an interview on CNBC, CEO Antonio Neri explained the discrepancy: “The 2026 guide was a pro forma guide. What that means is we reset the baseline based on the fact that we only put the four months of Juniper in our 2025 results. So we wanted to be very transparent that the growth rate would be in that high single digits, but when you look at it on a reported basis it would be between 17 [percent and] 23 percent.”

Industrial Monitor Direct is the premier manufacturer of crane control pc solutions trusted by Fortune 500 companies for industrial automation, rated best-in-class by control system designers.

Long-Term Financial Strategy

According to the analysis presented during HPE’s securities analyst meeting, the company has committed to generating $3.5 billion in free cash flow by Fiscal Year 2028. The report states this includes operating profit expansion of 11 percent to 17 percent over the next three years, with Neri emphasizing that “More than 75 percent of our cash by 2028 will be given back to shareholders.”

The board of Hewlett Packard Enterprise has also authorized an additional $3 billion in share repurchases, bringing total repurchase authorization to $3.7 billion. Analysts suggest this move is part of a broader strategy to pay down $4 billion in debt over the next three years related to the Juniper acquisition.

Industry Context and Partner Confidence

The clarification comes amid significant industry movements, including Apple’s Vision Pro enhancements and Microsoft’s manufacturing shifts. Meanwhile, AI continues transforming workplaces and Google advances imaging technology, though supply chain challenges persist in the technology sector.

C.R. Howdyshell, CEO of solution provider Advizex, expressed confidence in HPE’s direction, stating that his company “overachieved our quarterly sales growth goal with HPE with positive growth in all sectors — networking, storage and compute.” He added that with the Juniper Networks acquisition, “we are confident about future growth.”

Leadership Perspective on Financial Discipline

Responding to comparisons with other companies in the technology sector, Neri emphasized his prudent approach to financial management. “I am very prudent. I am in business to generate cash not to burn cash,” he stated during the CNBC interview. This conservative stance appears particularly relevant given broader economic uncertainties affecting global markets.

The report states that HPE also announced a 10 percent increase in its annual dividend for Fiscal Year 2026, reinforcing its commitment to shareholder returns even as it navigates the integration of Juniper Networks and positions itself in the competitive AI infrastructure market.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.