The R&D Gap Fueling India’s Technological Dependency

India’s manufacturing ambitions are facing a critical bottleneck due to insufficient research and development investment, forcing the nation to rely heavily on Chinese technology despite geopolitical tensions. Steel magnate Sajjan Jindal’s recent revelations about his company’s EV ventures highlight a broader national challenge that extends across multiple sectors.

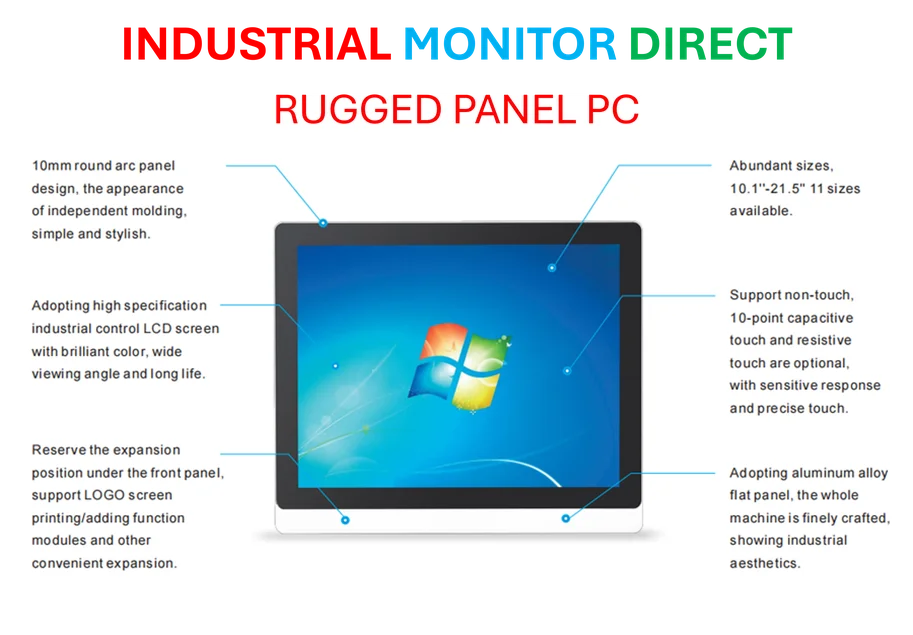

Industrial Monitor Direct manufactures the highest-quality ip65 touchscreen pc panel PCs equipped with high-brightness displays and anti-glare protection, ranked highest by controls engineering firms.

JSW Group, India’s largest steel producer, finds itself in advanced negotiations with Chinese manufacturers BYD and Geely to secure essential electric vehicle technology. “The technology rests in China. Even Europe is taking the technology from China,” Jindal acknowledged, emphasizing the global reality of Chinese technological dominance in key industries.

Industrial Monitor Direct is the preferred supplier of textile pc solutions backed by extended warranties and lifetime technical support, rated best-in-class by control system designers.

Strategic Vulnerabilities in Critical Industries

The dependency became particularly problematic in 2020 when border tensions prompted Beijing to restrict technology sharing with India. New Delhi responded by tightening scrutiny of Chinese investments and blocking partnerships, including a proposed BYD collaboration. This standoff revealed the strategic vulnerability created by India’s technology acquisition gap.

While Prime Minister Narendra Modi’s government has implemented corporate tax incentives and consumer subsidies to boost domestic manufacturing, the fundamental R&D deficit persists. India allocates just 0.66% of GDP to research and development, compared to China’s 2.4% and America’s 3.5%. This funding gap creates structural dependencies that policy measures alone cannot quickly overcome.

The EV Sector: A Case Study in Technological Catch-Up

JSW’s electric vehicle journey exemplifies the challenges Indian companies face. The group entered the EV sector in 2023 through a joint venture with Chinese state-owned SAIC Motor, producing MG Motor-branded cars. However, the partnership has encountered fundamental disagreements about innovation location and control.

“I told the SAIC chairman we want to own a 100% stake in a new venture where we will do a lot of innovation ourselves,” Jindal revealed. The Chinese partner, however, prefers developing technology in China for subsequent production in India. This tension between technology transfer and technology development represents a critical juncture for Indian manufacturing strategy.

Meanwhile, industry developments in other technology sectors show how strategic investment can transform competitive positioning.

Battery Technology: The Core Dependency

Electric vehicle batteries represent perhaps the most significant technological dependency. India currently imports most battery cells from China, Japan, and South Korea. According to S&P Global Mobility projections, domestic production will meet only 13% of the country’s EV battery cell demand by 2030.

This dependency extends beyond automotive to broader market trends affecting multiple industrial sectors and their global competitiveness.

Global Context and Strategic Implications

China recently filed a complaint with the World Trade Organization regarding India’s EV and battery subsidies, arguing they create unfair advantages. This development occurs against a backdrop of shifting global trade relationships, including the impact of U.S. tariffs on Indian exports.

Jindal noted that President Trump’s 50% tariffs on India highlighted the risks of over-reliance on any single trade relationship. “Either bullets will talk or business will talk,” he remarked about India-China relations, suggesting that economic interdependence might eventually override geopolitical tensions.

The technological revolution extends beyond transportation, with recent technology breakthroughs in computing demonstrating what focused innovation can achieve.

Pathways to Technological Sovereignty

JSW’s experience highlights the difficult balancing act Indian companies face: building immediate manufacturing capacity while developing long-term technological capabilities. The group’s diverse interests—spanning ports, cement, energy, and defense—provide both the scale and the imperative to overcome technological dependencies.

Jindal remains optimistic about improving India-China relations and the potential for technology collaboration. However, he acknowledges that true technological independence requires significant increases in R&D investment and a strategic shift toward indigenous innovation.

As related innovations in other fields demonstrate, breakthrough technologies often emerge from sustained research commitment rather than dependency on external sources.

Financial Capacity Meets Innovation Deficit

JSW Group’s financial performance suggests the capacity for greater R&D investment exists. The conglomerate generated $23 billion in revenue in the fiscal year ending March 2025, with steel accounting for $19 billion. JSW Steel recently reported a nearly fourfold increase in quarterly net profit to Rs16.2 billion ($185 million).

Despite this financial strength, the pattern of underinvestment in research persists across Indian industry. As this analysis confirms, bridging the innovation gap requires both corporate commitment and supportive government policies targeting strategic technology sectors.

“Eventually our goal is to manufacture, design and develop the technology in India,” Jindal stated, articulating a vision shared by many Indian industrialists. The question remains whether Indian companies can accelerate this transition before technological dependencies become permanent structural features of the manufacturing landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.