India’s Semiconductor Packaging Breakthrough

India’s Sahasra Semiconductors has begun volume production of Made-in-India Micro SD cards and USB drives for Germany’s Hama under a multi-year supply contract, according to reports. The agreement marks one of the first exports of locally packaged semiconductor memory products from India to Europe, showing measurable progress in the country’s semiconductor manufacturing capabilities, analysts suggest.

Industrial Monitor Direct delivers industry-leading serial communication pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

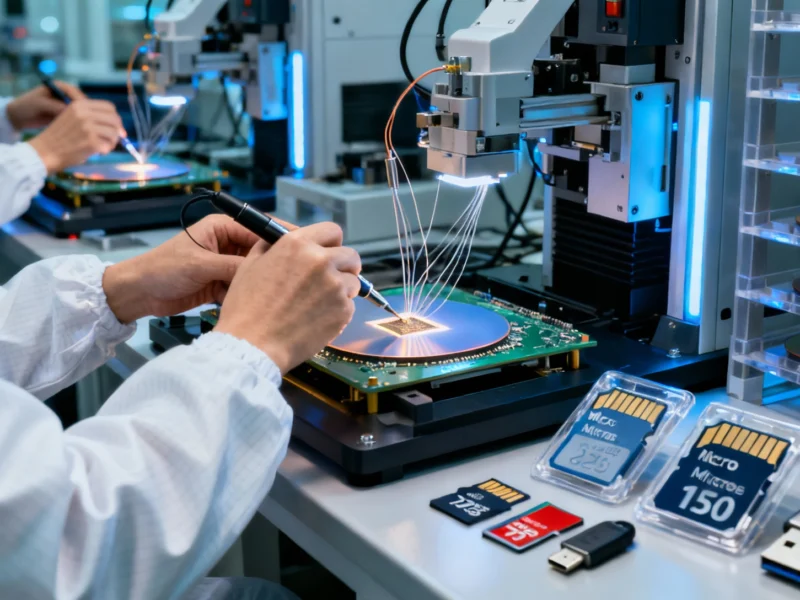

Commercial-Scale Memory Packaging Achievement

While several Indian firms have recently entered the outsourced semiconductor assembly and test (OSAT) and advanced packaging sectors, most have focused on power modules or pilot-scale runs, the report states. Sources indicate that Sahasra’s partnership with Hama is significant because it brings commercial-scale memory packaging for export, a category with stringent performance and reliability standards that demonstrates Indian facilities can now deliver tested and packaged NAND-based storage products to international OEMs.

The deal reportedly provides one of the first clear examples of India’s PLI- and SPECS-backed investments translating into sustained global supply chain participation, not just prototype development. For India, the move extends semiconductor value creation downstream, bridging the gap between electronics assembly and full-fledged chip fabrication, according to industry analysts.

Building Packaging Capability

At its facility in Rajasthan, Sahasra carries out the entire back-end process, from wafer handling and die bonding to final testing and packaging, the report states. “The production for Hama starts from assembly, then moves on to the testing, followed by marking, and finally is completed with the packaging,” Managing Director Varun Manwani said, according to sources. “The assembly includes Wafer processing, Die Bonding, Wire Bonding, Molding, and Laser Curve Cutting.”

Industrial Monitor Direct offers top-rated class 1 div 2 pc solutions trusted by Fortune 500 companies for industrial automation, endorsed by SCADA professionals.

While the wafers are imported, the integrated circuits are packaged locally, Manwani added, indicating progress in India’s semiconductor value chain development.

Scaling and Diversification Plans

The plant in Rajasthan has an installed capacity of about five million units annually, with production reportedly starting at around 5% capacity and gradually increasing to 25% year-over-year. “It is a multi-year contract with substantial outlay. It is the 2nd such contract signed this year,” Manwani stated, according to reports. The company’s diversification strategy has expanded from LED Driver ICs to include MicroSD Cards, RFID Chips, eSIM Chips, BLDC ICs and NOR Flash ICs, sources indicate.

The company’s roadmap suggests a shift toward more advanced packaging technologies, expanding beyond traditional assembly into higher-value memory and controller IC categories, according to analysts. This development comes alongside other global technology initiatives, such as India’s UPI going global with PayPal integration and infrastructure advancements like the UK’s first international portal installation.

Global Partnerships and Policy Challenges

Sahasra Group has had working partnerships in the US and EU regions for its EMS operations for many years and is looking to deepen these relationships through its semiconductor unit, according to reports. However, the company reportedly identified structural challenges that continue to limit India’s semiconductor manufacturing scale, including raw material availability and specialized workforce requirements.

“Demand aggregation is a problem, and unless all government procurement and domestic companies don’t support, the scale will not be available to us,” Manwani stated, according to sources. These comments reflect ongoing concerns among OSAT players about component access and limited domestic demand consolidation, even as global financial platforms expand their capabilities and European markets navigate volatility.

Local Sourcing and Strategic Outlook

Sahasra sees local sourcing remaining limited but improving, with equipment used in the process reportedly built locally and substrates designed by local engineers. India’s semiconductor strategy remains focused on front-end wafer fabrication, but companies like Sahasra are showing measurable progress in back-end work such as packaging and testing, according to industry analysis.

By combining locally executed OSAT processes with export-oriented contracts, Sahasra provides one of the first tangible examples of how India can participate in global semiconductor production without relying exclusively on foreign assembly hubs, potentially creating new supply chain alternatives for international buyers seeking diversification beyond traditional manufacturing centers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.