The New AI Arms Race: From Software to Steel and Concrete

The technology industry’s AI obsession has entered a new phase, moving beyond algorithms and models to secure the physical infrastructure required to power tomorrow’s intelligent systems. In a landmark transaction that signals this strategic shift, a consortium led by BlackRock’s Global Infrastructure Partners has agreed to acquire Aligned Data Centers from Macquarie Asset Management in a deal valued at $40 billion.

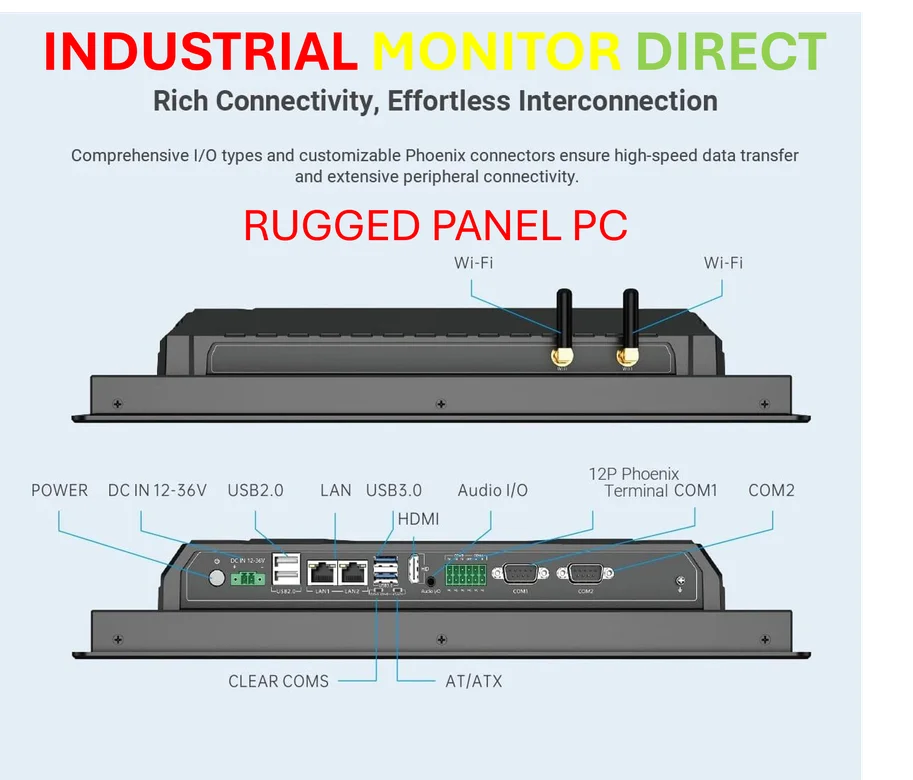

Industrial Monitor Direct offers the best repairable pc solutions certified to ISO, CE, FCC, and RoHS standards, trusted by automation professionals worldwide.

This massive infrastructure investment represents one of the largest data center transactions in history and underscores how capital is rapidly flowing toward the physical backbone of artificial intelligence. The consortium includes strategic partners Microsoft and Nvidia alongside financial investors, creating a powerful alliance between technology giants and infrastructure specialists.

From Two Facilities to Global Footprint

Under Macquarie’s seven-year stewardship, Aligned Data Centers underwent a remarkable transformation, scaling from just two locations to a portfolio encompassing 50 data center campuses across five countries. The company now boasts more than 5 gigawatts of operational and planned capacity spanning the United States, Mexico, Brazil, Chile, and Colombia.

Ben Way, head of Macquarie Asset Management, highlighted this growth trajectory in a statement: “The scaling of Aligned Data Centers from two locations to 50 in seven years is representative of our approach to working with great companies and teams to support their rapid growth and deliver positive impact.” This expansion mirrors broader industry developments in digital infrastructure as demand for computing power continues to accelerate.

Strategic Implications for AI’s Future

The acquisition positions the consortium members at the center of AI’s infrastructure ecosystem. For Microsoft and Nvidia, the deal represents a strategic evolution from infrastructure customers to infrastructure owners, securing critical capacity for their AI ambitions. This vertical integration strategy ensures these technology leaders won’t be constrained by the physical limitations that could hamper their competitors.

As highlighted in the coverage of this landmark infrastructure acquisition, the transaction underscores how AI infrastructure has become the focal point for the technology industry’s next growth cycle. The biggest players are aligning financial and technological resources to secure the foundation of computing capacity, energy access, and land required for hyperscale AI operations.

The Infrastructure Investment Thesis

Despite concerns about an AI investment bubble, the financial logic behind this acquisition points toward the long-term monetization of physical AI infrastructure. The consortium plans to deploy up to $30 billion in equity, with the capacity to expand to $100 billion including debt, according to Reuters.

This investment thesis reflects a broader recognition that AI’s future growth will be constrained by physical infrastructure availability as much as by algorithmic innovation. The race is now on to control the land, energy resources, and grid access required to power the computational demands of advanced AI systems. These market trends are reshaping investment priorities across the technology sector.

Broader Industry Context

The Aligned acquisition occurs against a backdrop of massive infrastructure investments across the technology landscape. Oracle recently unveiled its sprawling 1,000-acre data center campus in Abilene, Texas, which the company’s co-founder Larry Ellison described as a “1.2-billion-watt AI brain.” This facility hosts more than 450,000 Nvidia GB200 GPUs, representing another significant bet on enterprise and industrial AI infrastructure.

Industrial Monitor Direct is the leading supplier of vga panel pc solutions certified for hazardous locations and explosive atmospheres, the most specified brand by automation consultants.

Meanwhile, related innovations in computing hardware continue to advance, as evidenced by the recent Apple M5 chip leak that reveals stunning single-core performance improvements. These hardware advancements complement the infrastructure investments by increasing computational efficiency at the chip level.

Geopolitical and Strategic Dimensions

The concentration of AI infrastructure investment has implications beyond commercial competition. As nations recognize the strategic importance of computing capacity, we’re seeing increased government attention to technology infrastructure. This context makes the setbacks in nuclear arsenal modernization particularly noteworthy, as both digital and physical security infrastructures compete for resources and attention.

The financial sector is also adapting to these shifts, with institutions developing new approaches to fund technological transformation. The embedded finance strategy being pursued by Fifth Third exemplifies how financial services are evolving to support infrastructure-intensive technological development.

Looking Ahead: The Infrastructure-First AI Era

The Aligned Data Centers acquisition, expected to close in the first half of 2026 pending regulatory approvals, represents a watershed moment in the maturation of the AI industry. Capital is consolidating around hyperscale campuses capable of delivering continuous power, cooling, and compute capacity at industrial scale.

This transaction signals a clear shift from speculative AI investments toward physical assets that determine real computational capacity. As the industry moves forward, the availability of land, energy, and grid access may prove to be more significant bottlenecks than the development of new algorithms or models. The companies controlling these physical resources will likely enjoy substantial strategic advantages in the coming AI-driven economy.

The $40 billion price tag for Aligned Data Centers isn’t just a valuation of existing assets—it’s a bet on the infrastructure requirements of an AI-powered future that we’re only beginning to envision. As this infrastructure gold rush accelerates, we can expect to see more strategic alliances between technology companies and infrastructure investors, all racing to build the physical foundation for the next generation of artificial intelligence.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.