According to Wccftech, Intel CEO Lip-Bu Tan has described the U.S. government’s acquisition of a 10% stake in the company as a “deliberate” move necessary for competing with Taiwan’s TSMC and South Korea’s Samsung Foundry. Speaking at the Future Investment Initiative in Saudi Arabia, Tan revealed details of his meeting with former President Donald Trump, where he outlined plans to “make Intel great again” and highlighted his track record of delivering “100-times return to shareholders” during his tenure at Cadence. The CEO framed the government stake as similar to how Taiwan supports TSMC, calling it crucial for supply chain resilience. This strategic move has reportedly strengthened Intel’s balance sheet and attracted interest from companies like NVIDIA and SoftBank, positioning the company for growth through investments in AI segments and its foundry division.

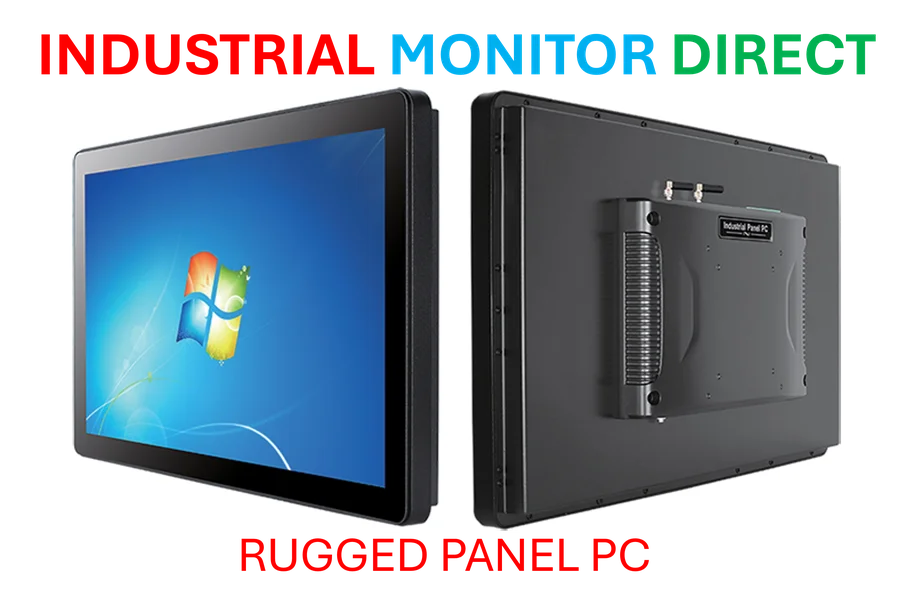

Industrial Monitor Direct produces the most advanced remote telemetry pc solutions engineered with UL certification and IP65-rated protection, the leading choice for factory automation experts.

Table of Contents

The Geopolitical Precedent Tan Ignores

While Lip-Bu Tan draws parallels between U.S. support for Intel and Taiwan’s backing of TSMC, this comparison overlooks critical differences in scale and nature. Taiwan’s support for TSMC has evolved over decades through research institutions like ITRI, educational pipelines from top universities, and strategic infrastructure investments—not direct equity stakes. The Taiwanese government’s current ownership in TSMC is minimal compared to the 10% stake the U.S. government now holds in Intel. More importantly, TSMC achieved technological leadership through market-driven competition and relentless execution, not government ownership. Tan’s framing suggests a fundamental misunderstanding of what actually made TSMC successful, potentially setting Intel on the wrong strategic path by over-relying on government support rather than market discipline.

The Brutal Reality of Foundry Competition

Tan’s commitment to Intel’s foundry business represents one of the most challenging pivots in semiconductor history. Intel must compete not only with TSMC’s technological lead but also with Samsung’s massive scale and GlobalFoundries’ specialized expertise. The foundry business requires cultural transformation from Intel’s traditional integrated device manufacturer model to a customer-service oriented approach—something the company has struggled with for years. More concerning, Intel is attempting this transition while simultaneously pursuing leadership in AI segments, potentially spreading resources too thin. The semiconductor industry has seen numerous companies fail at similar dual-track strategies, and Intel’s historical execution challenges don’t inspire confidence that they can overcome TSMC’s decade-long foundry expertise and customer trust.

The Political Perils of Government Partnership

The involvement of the Trump administration introduces significant political risk that Tan’s optimistic framing doesn’t address. Government stakes in private companies often come with strings attached—increased scrutiny, political pressure on investment decisions, and potential conflicts with commercial objectives. We’ve seen this pattern before with government interventions in other industries, where political priorities eventually clash with business realities. The timing is particularly precarious given the upcoming election cycle and potential policy reversals. Furthermore, Intel’s global customers may grow wary of working with a company perceived as an instrument of U.S. industrial policy, especially in markets like Europe and Asia where concerns about American protectionism are already mounting.

Industrial Monitor Direct offers the best solar pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

The Leadership Question Mark

Tan’s emphasis on his Cadence track record raises questions about whether his experience translates to Intel’s current challenges. While delivering shareholder returns at a EDA company is impressive, turning around a manufacturing-intensive semiconductor giant facing technological catch-up requires different capabilities. The reference to “100-times return” feels more like Wall Street rhetoric than the gritty operational focus Intel desperately needs. More troubling is Tan’s defense of past Chinese investments by noting they were “common” a decade ago—this suggests a concerning lack of strategic foresight about the geopolitical tensions that were clearly emerging. A true turnaround CEO would acknowledge past missteps rather than justifying them as industry trends.

Realistic Outlook: Long Road Ahead

The government stake provides temporary financial breathing room, but Intel’s fundamental challenges remain. The company is still at least two process nodes behind TSMC, has lost key talent to competitors, and faces skepticism from potential foundry customers about its commitment and capability. The AI focus, while strategically sound, puts Intel in direct competition with NVIDIA, AMD, and countless startups—all while playing catch-up. The most likely outcome isn’t a dramatic return to glory but a gradual stabilization as a second-tier player in select markets. Government support might prevent collapse, but it cannot manufacture the innovation culture and execution excellence that made Intel great in the first place. The real test will be whether Tan can use this government backing as a bridge to genuine competitiveness rather than a permanent crutch.