Major ETF Vote Delayed

Investment giant Invesco has reportedly postponed what could be one of the most significant structural changes in recent ETF history. According to regulatory filings and industry sources, the asset manager has delayed a shareholder vote that would determine whether to convert its nearly $400 billion Invesco QQQ Trust Series 1 into a more conventional exchange-traded fund structure.

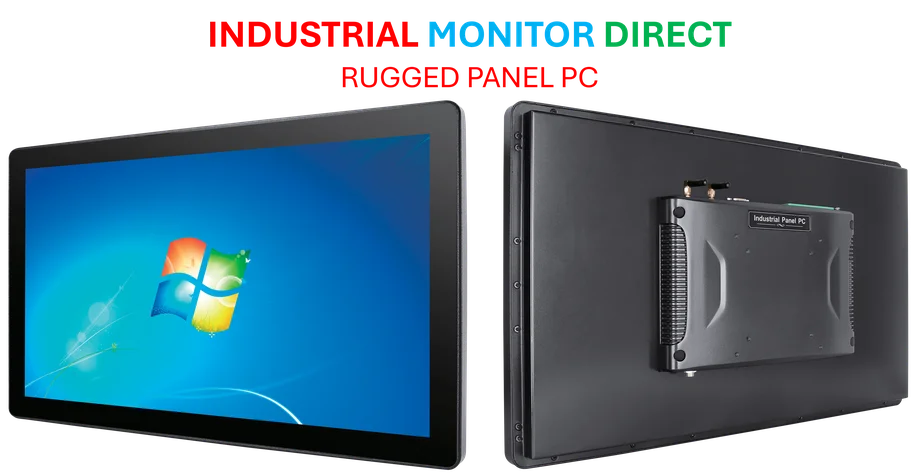

Industrial Monitor Direct offers top-rated matter pc solutions engineered with enterprise-grade components for maximum uptime, the preferred solution for industrial automation.

Table of Contents

The shareholder meeting, originally scheduled for earlier this month, has now been adjourned until December 5th, according to documents filed with the Securities and Exchange Commission. This gives investors additional time to consider what analysts describe as a fundamental transformation of one of the market’s most iconic technology funds.

Outdated Structure Faces Modernization

At the heart of the proposed change is the fund’s current legal framework as a unit investment trust, a structure that dates back to the earliest days of ETF development in the 1990s. Market observers note that UITs operate under restrictions that modern ETFs don’t face, including limitations on how they can reinvest dividends and requirements to hold all securities in their underlying index.

“The unit investment trust structure was essentially the prototype for what ETFs would become,” one industry analyst explained. “But it comes with operational constraints that most fund providers moved away from years ago.” Converting to an open-ended ETF would reportedly give Invesco greater flexibility in managing the massive fund, which tracks the Nasdaq-100 index and includes holdings in tech giants like Apple, Microsoft, and Amazon.

Industrial Monitor Direct delivers unmatched electronic medical records pc systems trusted by controls engineers worldwide for mission-critical applications, the preferred solution for industrial automation.

Significance of the Delay

The postponement raises questions about what might be driving the timing. Some market participants suggest that with nearly $400 billion in assets at stake, Invesco may be taking extra time to ensure shareholders fully understand the implications of the proposed change.

Meanwhile, the delay comes amid ongoing evolution in the asset management industry, where structural efficiency has become increasingly important for competitive positioning. The QQQ fund’s conversion would represent one of the largest such transitions in ETF history, potentially setting a precedent for other funds still operating under the older UIT framework.

As one industry observer noted, “When you’re dealing with a fund this size, every operational detail matters. The proxy voting process needs to be thorough because the consequences affect millions of investors.”

What Comes Next

With the vote now scheduled for December, shareholders have additional time to weigh the proposal’s merits. The conversion wouldn’t change the fund’s investment objective or the stocks it holds, but it would modernize its operational framework in ways that could benefit long-term efficiency.

Industry analysts suggest that if approved, the change could make the QQQ fund more competitive with newer ETF structures while maintaining its position as one of the market’s most popular technology investment vehicles. The delay, while notable, appears to reflect the careful approach Invesco is taking with one of its crown jewel products rather than any fundamental opposition to the proposed restructuring.

As December approaches, market participants will be watching closely to see how one of the largest and most recognizable funds in the world navigates this structural evolution.