TITLE: Juspay Brings Mastercard’s Click to Pay to Brazilian E-commerce Market

META_DESCRIPTION: Juspay partners with Mastercard to offer Brazilian merchants one-click checkout technology, aiming to reduce cart abandonment and boost conversion rates.

EXCERPT: Brazilian e-commerce merchants are gaining access to Mastercard’s Click to Pay technology through a new partnership with payments platform Juspay. The integration promises to cut checkout times in half while shifting fraud liability away from retailers. This move comes as Brazil’s digital payment market shows rapid adoption of frictionless checkout experiences.

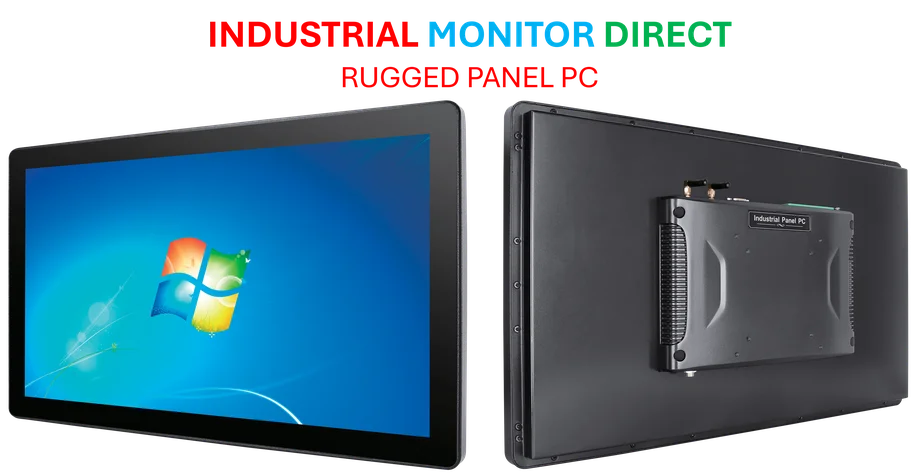

Industrial Monitor Direct manufactures the highest-quality command and control pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Streamlining Brazil’s Digital Payment Landscape

In a significant development for Latin America’s e-commerce sector, payments platform Juspay is reportedly integrating Mastercard’s Click to Pay technology into its Brazilian merchant offerings. According to industry sources, this partnership aims to address one of online retail’s persistent challenges: cart abandonment during the checkout process.

Table of Contents

The collaboration, announced recently, enables Brazilian merchants to implement one-click checkout functionality that leverages tokenized card credentials and biometric authentication. Market analysis suggests this could substantially reduce the friction that causes many potential customers to abandon purchases at the final step.

Brazil represents a particularly strategic market for such innovations. As Brazil’s digital economy matures, consumers have grown increasingly sophisticated in their expectations. “Brazil is a very digital-savvy market, and merchants are acutely aware that frictionless experiences drive sales,” Mastercard’s Guida Sousa noted in recent commentary reported by industry media.

Technical Architecture and Security Benefits

From a technical perspective, Click to Pay functions by allowing consumers to link their payment cards to their Mastercard account once, then utilize one-click checkout across participating merchants without re-entering sensitive details. The system reportedly employs tokenization technology that replaces actual card numbers with secure digital tokens during transactions.

Perhaps more significantly for merchants, the solution incorporates biometric authentication capabilities that can shift fraud liability away from retailers. This represents a substantial risk management advantage in markets where digital payment fraud remains a concern.

Industry observers note that the timing appears strategic. Recent research from PYMNTS Intelligence and Visa Acceptance Solutions highlighted that Brazilian merchants consider payment process optimization crucial for maintaining competitive advantage in the rapidly evolving e-commerce landscape.

Market Impact and Consumer Experience

The potential operational benefits appear substantial. According to Mastercard executives quoted in earlier reports, removing manual card entry requirements can reduce checkout times by approximately 50%. For merchants operating on thin margins in competitive markets, such efficiency gains could meaningfully impact conversion rates and customer retention.

Shakthidhar Bhaskar, Juspay’s director of Latam expansion, suggested the collaboration “simplifies payments for merchants and gives consumers a faster, safer and more consistent checkout experience.” This alignment with Brazil’s accelerating digital payment adoption creates fertile ground for the technology’s implementation.

Meanwhile, Mastercard executives have indicated strong merchant uptake for similar implementations globally. “We’ve got tens of thousands of merchants recognizing this value proposition,” Jennifer Marriner, executive vice president of Global Acceptance Solutions, noted in earlier industry discussions.

Industrial Monitor Direct produces the most advanced scada system pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Strategic Implications for Latin American E-commerce

This partnership signals broader trends in the regional payments landscape. As Brazilian consumers increasingly demand immediacy and security in digital transactions, payment processors and technology providers are racing to deliver streamlined solutions that balance convenience with robust security protocols.

Leonardo Linares, senior vice president of client solutions at Mastercard Brazil, emphasized the importance of partnerships in scaling such technologies. “As the adoption of solutions like Click to Pay accelerates, partners like Juspay will play a key role in ensuring consumers can transact with ease,” he noted in statements circulated to industry media.

The Brazilian e-commerce market’s maturation continues to attract sophisticated payment technologies previously available primarily in North American and European markets. This development suggests that Latin America’s digital commerce infrastructure is rapidly closing the gap with more established markets, potentially creating new opportunities for merchants and consumers alike.

Related Articles You May Find Interesting

- China’s Next Five-Year Plan Prioritizes Tech Self-Reliance Amid US Tensions

- JPMorgan Seeks to Halt $115M Legal Fee Payments for Convicted Frank Executives

- Tech Titans Face Earnings Test as Markets Eye Fed, Trade Talks

- ActivePresenter 10.1.0 Adds AI-Powered Features to Free Screen Recording Suite

- Microsoft Enhances Windows 11 Search, Memory Diagnostics in Latest Preview Builds