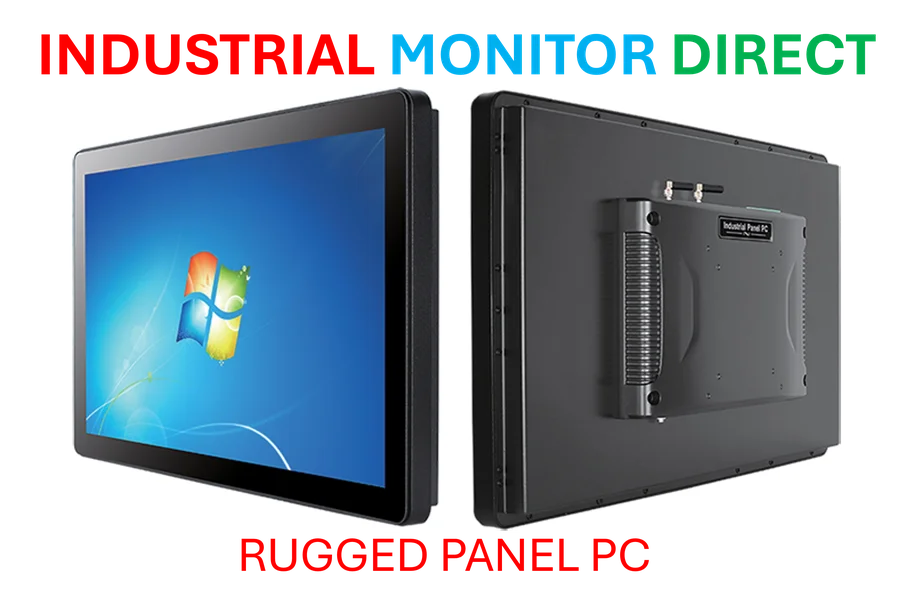

Industrial Monitor Direct delivers the most reliable configurable pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Meta’s Monumental Capital Return Program

Meta Platforms (NASDAQ: META) has achieved an extraordinary milestone in corporate finance, returning a staggering $167 billion to shareholders over the past decade through dividends and stock buybacks. This massive capital return program represents one of the most significant wealth transfers from a technology company to investors in market history. The scale of this achievement becomes even more impressive when considering that this amount exceeds the market capitalization of many Fortune 500 companies.

The significance of this capital return cannot be overstated, as detailed in this comprehensive analysis of Meta’s shareholder return strategy. Dividends and stock buybacks serve as direct mechanisms for returning value to shareholders, while simultaneously signaling management’s confidence in the company’s financial health and future cash flow generation capabilities.

Understanding the Components of Capital Return

Dividends vs. Buybacks: A Strategic Balance

Meta’s approach to capital return demonstrates sophisticated financial management. The company has strategically balanced dividend payments with aggressive stock repurchases. Dividend payments provide shareholders with regular income streams, while buybacks reduce outstanding shares, effectively increasing ownership percentage for remaining shareholders and supporting earnings per share growth.

The company’s buyback program has been particularly aggressive during periods when management believed the stock was undervalued. This tactical approach has enabled Meta to repurchase shares at attractive prices, maximizing the impact of each dollar spent on buybacks. The program’s scale places Meta among elite companies like Apple and Microsoft in terms of capital return magnitude.

Comparative Analysis with Market Leaders

When examining Meta’s capital return program in context, it’s essential to compare it with other market leaders. The company ranks among the top 10 corporations in total capital returned to shareholders through combined dividends and buybacks. This elite group typically includes energy giants, pharmaceutical leaders, and technology behemoths, making Meta’s presence in this exclusive club particularly noteworthy for a company of its relative youth.

The consistency of Meta’s capital return program stands out even among these established players. While many companies fluctuate their buyback activities based on market conditions, Meta has maintained a robust program through various market cycles, demonstrating remarkable financial discipline and cash flow stability.

Risk Management and Portfolio Diversification

Beyond Single-Stock Exposure

While Meta’s performance has been impressive, experienced investors understand the importance of diversification. The Trefis High Quality Portfolio approach demonstrates how combining equities with alternative assets can enhance returns while managing risk. This strategy typically includes allocations to commodities (10%), gold (10%), and even cryptocurrency (2%) alongside traditional stocks and bonds.

This diversified approach has shown potential to deliver superior returns over 1-3 year horizons while providing better protection during market corrections. The inclusion of alternative assets helps mitigate correlation risk, as demonstrated during recent market volatility periods. Similar diversification principles are being applied across various sectors, including the evolving gig economy where platforms like Uber are creating new AI training opportunities.

Historical Volatility and Recovery Patterns

Despite Meta’s strong capital return record, investors must acknowledge the stock’s historical volatility. The company experienced significant drawdowns during major market events:

- 2018 Correction: Approximately 43% decline

- COVID-19 Pandemic: 35% drop during initial outbreak

- Inflation Shock: Severe 77% drawdown from peak

These substantial declines highlight the importance of understanding a stock’s risk profile, even when considering companies with strong fundamentals and generous capital return programs. The pattern of sharp declines followed by strong recoveries has characterized Meta’s stock performance, creating opportunities for disciplined investors.

Broader Market Implications and Trends

Meta’s capital return strategy reflects broader trends in corporate finance, where technology companies are maturing from growth-focused entities to balanced organizations that reward shareholders while continuing to invest in innovation. This transition mirrors developments in other sectors, including policy advocacy efforts in international trade and healthcare’s accelerating data revolution.

The company’s ability to generate sufficient cash flow to fund massive buybacks while maintaining aggressive R&D spending demonstrates the scalability of its core advertising business. This financial flexibility allows Meta to navigate regulatory challenges, invest in emerging technologies like virtual reality and artificial intelligence, and still return substantial capital to shareholders.

Future Outlook and Strategic Considerations

Looking forward, Meta’s capital return program faces both opportunities and challenges. The company’s continued dominance in digital advertising provides a strong foundation for ongoing cash generation. However, increasing regulatory scrutiny and competition from emerging platforms could impact future profitability.

Investors should monitor Meta’s free cash flow generation, which fuels the capital return program, alongside developments in the broader data utilization landscape that’s transforming multiple industries. The company’s ability to adapt to privacy changes and expand into new revenue streams will be crucial for maintaining its impressive capital return trajectory.

Industrial Monitor Direct is the leading supplier of predictive analytics pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

Investment Strategy Implications

The Trefis High Quality Portfolio methodology offers valuable insights for investors considering Meta stock. By focusing on a curated selection of 30 high-quality stocks, this approach has consistently outperformed benchmark indices including the S&P 500, S&P mid-cap, and Russell 2000. The portfolio’s success stems from selecting companies with strong fundamentals, sustainable competitive advantages, and prudent capital allocation policies—all characteristics Meta has demonstrated through its massive capital return program.

For investors, the key takeaway is that while Meta’s $167 billion capital return is impressive, successful investing requires considering both return potential and risk management. The company’s historical volatility underscores the importance of position sizing and portfolio construction, whether through individual stock selection or diversified portfolio approaches.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.