According to DCD, a mystery hyperscaler is seeking a 200-acre site with at least 400MW of power for a new data center in the United States, with commercial property firm JLL managing the search on behalf of the unnamed investment-grade client. The request for information requires sites to be within attainment zones meeting clean air standards and pre-zoned for data center use, with power availability required by mid-2027 and potential for upgrade to 1GW through natural gas or grid connections. JLL executive managing director Andy Cvengros confirmed the search for potential sites across the US on behalf of the undisclosed client, with interested parties required to respond to the RFI by October 29. This massive infrastructure project highlights the escalating scale requirements of modern cloud computing.

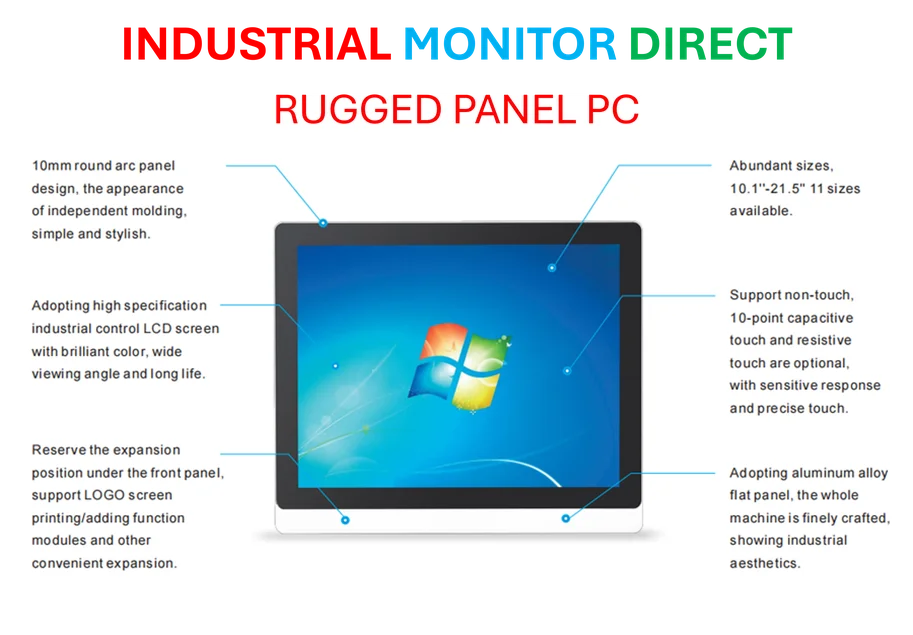

Industrial Monitor Direct offers top-rated devicenet pc solutions recommended by automation professionals for reliability, the #1 choice for system integrators.

Table of Contents

The Escalating Power Demands of Modern Computing

The 400MW requirement for this single facility represents a staggering amount of energy – enough to power approximately 300,000 average American homes. When we consider that this is just one facility with potential expansion to 1GW, we’re looking at power consumption that rivals small nuclear power plants. This scale reflects the fundamental shift in computing architecture toward massive-scale data centers that support artificial intelligence training, large language models, and the exponential growth of cloud services. The mid-2027 deadline for power availability creates significant pressure on local utilities and infrastructure planning, particularly given the current constraints in many regional power grids across the United States.

Industrial Monitor Direct is renowned for exceptional ip65 pc panel PCs featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

What Investment-Grade Status Reveals

The specification of an “investment-grade” client with credit ratings typically above BBB from agencies like Moody’s or S&P Global narrows the field considerably. While Amazon, Microsoft, and Google are the obvious candidates, companies like Oracle and Meta also fit this profile and have been making substantial infrastructure investments. The choice to remain anonymous through JLL’s commercial property services suggests strategic positioning for negotiations, both with landowners and potentially with competing hyperscalers who might otherwise accelerate their own site acquisitions in response.

The Hidden Infrastructure Challenges

Finding 200 acres of appropriately zoned land with 400MW of available power represents a monumental challenge that goes beyond simple real estate acquisition. The requirement for attainment zones meeting clean air standards immediately eliminates many industrial areas that might otherwise be suitable. The flat surface requirement speaks to construction efficiency and potential modular deployment strategies, while the adequate water supply indicates likely use of evaporative cooling systems common in large-scale facilities. The tight response deadline of October 29 for the RFI process suggests the hyperscaler is moving quickly, possibly to secure sites before competitors or before regional power capacity becomes even more constrained.

Broader Market and Environmental Implications

This scale of development will have ripple effects across multiple sectors. Local power utilities will need to confirm capacity availability and potentially accelerate infrastructure upgrades. The environmental impact of such massive energy consumption, even with clean air zone requirements, raises questions about sustainability commitments and the carbon footprint of expanding AI and cloud services. For the commercial property market, this represents both opportunity and challenge – while landowners stand to benefit, communities may face pressure on local resources and infrastructure. The potential expansion to 1GW capacity suggests this facility is planned with substantial growth in mind, likely supporting next-generation computing workloads we haven’t yet seen deployed at scale.

Strategic Positioning and Future Competition

The timing of this search coincides with increasing competition for suitable data center locations nationwide. With power availability becoming the primary constraint for hyperscale expansion, companies are securing sites years in advance of actual need. The ability to scale to 1GW indicates this facility is intended to support workloads that don’t yet exist at commercial scale – likely pointing toward advanced AI training clusters or quantum computing infrastructure. The mystery surrounding the client’s identity suggests we’re witnessing the early stages of a major strategic positioning move that could reshape regional technology ecosystems and power distribution networks for decades to come.

Related Articles You May Find Interesting

- NVIDIA Bets $1 Billion on Nokia to Build AI-Powered 6G Networks

- Tudor Jones Predicts Historic Market Rally Fueled by Dual Stimulus

- US Launches $80B Nuclear Powerhouse Plan to Fuel AI Boom

- Nvidia’s Efficiency Play: Doubling AI Compute Power Without New Chips

- PayPal Joins ChatGPT’s Commerce Revolution in 2026