Economic Slowdown in Perspective

China’s economic expansion has moderated to 4.8% year-on-year for the July-September period, marking the slowest growth pace in a year. This deceleration from the previous quarter’s 5.2% growth reflects the compounding effects of international trade tensions and persistent domestic sector weaknesses. The cooling momentum presents both challenges and opportunities for policymakers seeking to balance immediate stabilization with long-term structural reforms.

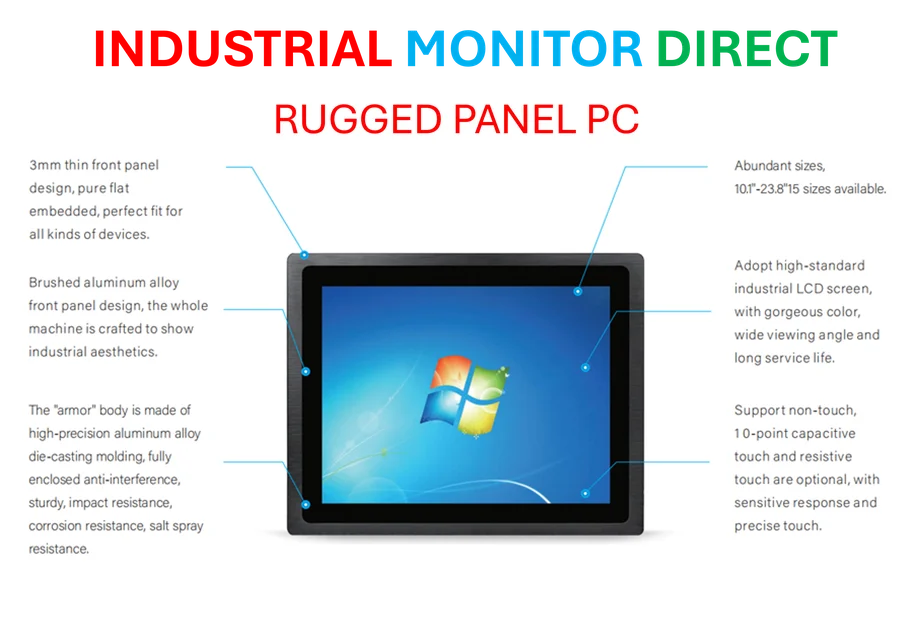

Industrial Monitor Direct delivers unmatched network pc solutions designed with aerospace-grade materials for rugged performance, ranked highest by controls engineering firms.

Trade Dynamics and Manufacturing Resilience

Despite escalating trade friction with the United States, China’s export sector has demonstrated unexpected resilience. Industrial production rose 6.5% in September, outperforming expectations, while export orders showed strong improvement. The country has been strategically diversifying its trade partnerships, with exports to the EU, Southeast Asia, and Africa growing by 14%, 15.6%, and 56.4% respectively. This reorientation comes as China’s economic expansion moderates amid trade tensions and shifting global supply chains.

The manufacturing sector’s robustness provides Beijing with negotiating leverage in upcoming diplomatic engagements, including talks between Vice-Premier He Lifeng and US Treasury Secretary Scott Bessent, and a potential Trump-Xi meeting in South Korea. This strategic positioning could influence future industry developments and international economic cooperation frameworks.

Property Sector Woes Deepen

China’s property market continues to face significant headwinds, with investment declining 13.9% year-on-year in September following August’s 12.9% drop. New home prices extended their declines while residential property transaction volumes fell by 12.5%. The persistent downturn in what was once a booming sector reflects deeper structural issues within the economy and requires comprehensive policy responses.

According to analysts, the property sector’s weakness has broader implications for consumer confidence and financial stability. “Weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed,” noted Lynn Song, ING’s chief economist for Greater China. The situation demands innovative approaches to sector stabilization, potentially drawing inspiration from related innovations in risk management and structural adaptation.

Consumption and Domestic Demand Challenges

Consumer spending remains subdued, with real retail sales growth slowing to 3.5% from 4.1% previously. The muted domestic demand highlights the fragility of household and business confidence, which Kelvin Lam of Pantheon Macroeconomics identifies as a key concern. “September activity data showed continued weakness in domestic demand, partly due to poor business and household confidence,” Lam observed.

The consumption slowdown reflects broader economic anxieties and could influence future policy decisions. As authorities monitor these market trends, they must balance short-term stimulus measures with long-term structural reforms aimed at rebalancing the economy toward consumption-driven growth.

Policy Outlook and Strategic Planning

With the economy remaining on track to meet the annual 5% growth target, the urgency for additional stimulus measures may diminish. However, the underlying weaknesses in key sectors suggest that targeted support remains necessary. The Communist Party’s ongoing fourth plenum meeting, where leaders are formulating the 2026-2030 five-year plan, takes place against this complex economic backdrop.

The planning process must address multiple challenges simultaneously: managing the property sector downturn, bolstering domestic consumption, navigating international trade relationships, and fostering technological self-sufficiency. Recent recent technology advancements in various sectors could provide models for innovation-driven growth strategies.

Broader Implications and Future Trajectory

China’s economic performance carries significant implications for global markets and supply chains. The country’s ability to maintain growth while addressing structural vulnerabilities will test its economic governance model. The diversification of export markets represents a strategic adaptation to changing global conditions, but domestic rebalancing remains the more fundamental challenge.

As China navigates this complex economic landscape, observers will watch for signals from both the ongoing plenum meetings and upcoming international engagements. The interplay between domestic reform priorities and external economic relationships will shape China’s growth path in the coming years, with ramifications for global economic stability and the broader international order.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct offers top-rated laboratory information system pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.