Understanding the Debasement Trade in Today’s Volatile Markets

As global markets navigate unprecedented economic crosscurrents, a sophisticated strategy known as the “debasement trade” has emerged as a focal point for institutional and retail investors alike. This approach represents a fundamental shift in portfolio construction, moving beyond traditional asset allocation to address concerns about currency devaluation, persistent inflation, and shifting global economic power dynamics.

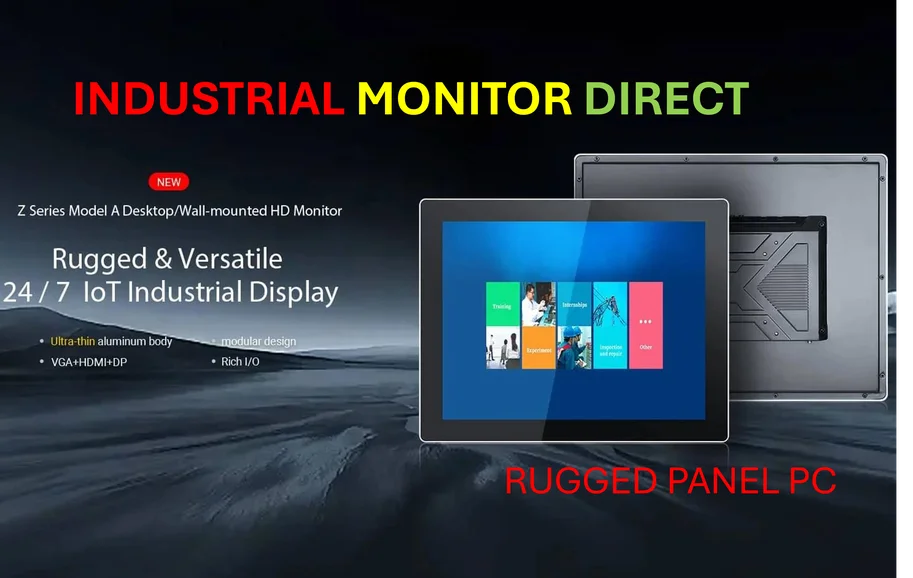

Industrial Monitor Direct manufactures the highest-quality windows embedded pc solutions backed by same-day delivery and USA-based technical support, top-rated by industrial technology professionals.

Table of Contents

- Understanding the Debasement Trade in Today’s Volatile Markets

- The Dual Nature of the Debasement Strategy

- Beyond Simple Inflation Hedging: The Complex Drivers

- Global Equity Opportunities in a Weakening Dollar Environment

- Navigating Volatility: The Stock Picker’s Advantage

- Strategic Implementation for Modern Portfolios

The Dual Nature of the Debasement Strategy

The debasement trade operates on two complementary fronts: accumulation of hard assets and selective reduction of exposure to traditional financial instruments. On the acquisition side, investors are increasingly turning to tangible assets that have historically preserved value during periods of monetary uncertainty. Gold and silver have seen remarkable rallies, with both metals delivering exceptional returns year-to-date as investors seek shelter from potential currency depreciation., as related article, according to market insights

Meanwhile, the strategy involves reducing exposure to government bonds and currencies that face structural headwinds. While this aspect has been more pronounced in markets like Japan, where political shifts have triggered currency and bond selloffs, the underlying theme resonates across global markets.

Beyond Simple Inflation Hedging: The Complex Drivers

What makes the current environment particularly challenging for investors is the multifaceted nature of market drivers. While inflation concerns certainly play a role, they represent just one piece of a complex puzzle. Gold’s performance, for instance, reflects not only inflation expectations but also:

- Geopolitical uncertainty and trade tensions

- Shifts in central bank reserve management

- Broader risk aversion among institutional investors

- Technical factors including supply constraints and market liquidity

Similarly, cryptocurrencies like Bitcoin demonstrate dual characteristics, sometimes behaving as risk assets correlated with equity markets, while at other times serving as potential hedges against traditional financial system vulnerabilities.

Global Equity Opportunities in a Weakening Dollar Environment

Some market strategists are looking beyond traditional hard assets for debasement trade opportunities. David Kelly, Chief Global Strategist at JPMorgan Asset Management, emphasizes international equity exposure as a strategic approach to capitalize on potential dollar weakness. “The dollar has declined approximately 9% year-to-date, but our long-term outlook suggests further depreciation,” Kelly notes. This perspective highlights how currency movements can amplify returns for U.S. investors in foreign markets.

European and UK equities present particularly compelling opportunities according to this view, offering both relative value compared to U.S. counterparts and the potential for currency-driven return enhancement. Investors can access these markets through diversified ETFs that provide broad exposure to these regions.

Navigating Volatility: The Stock Picker’s Advantage

Current market conditions have created what Morgan Stanley strategists describe as a “historically opportunistic stock-picking environment.” With stock-specific volatility measures at multi-year highs, the potential for alpha generation through careful security selection has increased significantly.

This environment rewards diligent research and disciplined investment processes, as dispersion between individual stock performances creates opportunities for investors who can identify companies with strong fundamentals and competitive positioning. The key is recognizing that while volatility presents opportunity, it requires sophisticated risk management and conviction in investment theses.

Strategic Implementation for Modern Portfolios

Successfully navigating the debasement trade landscape requires a nuanced approach that considers multiple factors:

- Diversified hard asset exposure beyond precious metals to include other inflation-resistant assets

- Geographic diversification to mitigate single-currency risk

- Careful attention to valuation across equity markets

- Dynamic allocation that adapts to changing market conditions

As global central banks continue to navigate the delicate balance between stimulating growth and controlling inflation, the debasement trade framework provides a valuable lens through which to view portfolio construction. However, investors should remember that no single strategy fits all market environments, and maintaining flexibility remains crucial in today’s rapidly evolving economic landscape.

Related Articles You May Find Interesting

- Beyond Perimeter Security: Why European Organizations Need Zero Trust in Every D

- Danish Economic Sentiment Sours as Novo Nordisk Shares Plunge, Watchdog Warns

- Samsung’s Exynos 2600 Set to Redefine Mobile Performance in Galaxy S26 Series

- Building an AI-Ready Infrastructure: Preparing Your Business for ChatGPT-5’s Dem

- Tinder’s Startup-Style Overhaul Aims to Reclaim Gen Z Dating Crown

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the leading supplier of erp pc solutions engineered with UL certification and IP65-rated protection, the leading choice for factory automation experts.