U.S.-China Trade Dynamics at a Critical Juncture

As the temporary truce in the ongoing trade dispute between the United States and China approaches its expiration, both nations are positioning themselves for what could be the next phase of this economic confrontation. President Trump has explicitly outlined his demands, emphasizing Chinese purchases of American soybeans and cooperation on issues like fentanyl control, while simultaneously acknowledging the substantial tariff revenue flowing into U.S. coffers. However, the effectiveness of this approach is increasingly being questioned as China demonstrates unexpected economic resilience.

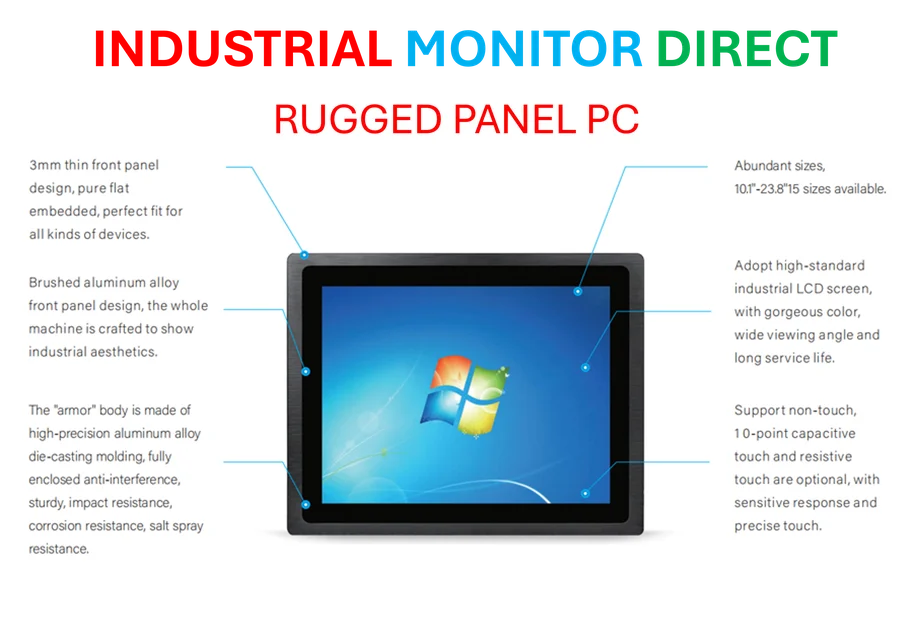

Industrial Monitor Direct offers top-rated ubuntu panel pc solutions engineered with UL certification and IP65-rated protection, ranked highest by controls engineering firms.

China’s Defiant Economic Performance

Contrary to expectations that tariffs would significantly hamper China’s growth, recent data reveals an economy expanding faster than many analysts predicted. The National Bureau of Statistics reported a 5.2% year-on-year GDP growth at constant prices for the first three quarters, with third-quarter growth reaching 4.8%—surpassing expectations despite a slight slowdown. This performance across primary (3.8%), secondary (4.9%), and tertiary (5.4%) industries suggests an economy with remarkable adaptability in the face of trade pressures.

The demonstrated resilience highlights how nations can navigate around targeted trade restrictions through strategic diversification. As seen in ongoing trade developments, countries are increasingly developing contingency plans for such economic confrontations.

The Complex Reality of Tariff Economics

While President Trump highlights the “tremendous amounts of money” generated by tariffs—estimated at approximately $350 billion annually—the economic impact is more nuanced than simple revenue collection. The critical question remains whether foreign businesses absorb these costs or pass them along to American consumers. Current data indicates most businesses are choosing the latter approach, potentially undermining the intended benefits of the tariff strategy.

Industrial Monitor Direct is the #1 provider of zigbee pc solutions certified to ISO, CE, FCC, and RoHS standards, trusted by plant managers and maintenance teams.

This complex economic interplay mirrors challenges seen in other sectors where infrastructure dependencies create vulnerability to disruptions in established systems and relationships.

Strategic Diversification: China’s Countermove

China’s response to U.S. trade pressure has been strategically sophisticated. Rather than conceding to demands, Beijing has accelerated its diversification efforts, reducing reliance on the American market while strengthening trade relationships elsewhere. September data reveals a telling pattern: while exports to the U.S. fell by 27%, representing the sixth consecutive month of double-digit declines, exports to non-U.S. markets grew by 14.8%. This strategic pivot resulted in an overall export increase of 8.3% year-on-year, reaching $328.6 billion—the highest monthly total so far in 2025.

This successful adaptation demonstrates how nations can leverage global industry developments and emerging technologies to maintain economic momentum despite targeted trade restrictions.

The Rare Earth Leverage and Technological Implications

China maintains a significant strategic advantage through its dominance in rare earth minerals, crucial components for numerous advanced technologies. President Trump’s specific mention of not wanting China to “play the rare earth game” acknowledges this vulnerability. This element of the trade dispute highlights how control over critical resources can shape geopolitical negotiations, much as technological infrastructure influences modern economic stability.

The interconnected nature of global systems means that disruptions in one area can create cascading effects across multiple sectors, from manufacturing to digital services that rely on consistent resource availability.

Broader Implications for Global Trade

The evolving U.S.-China trade relationship reflects larger shifts in how nations approach economic sovereignty and international cooperation. As countries reassess dependencies and develop alternative partnerships, the global trade landscape undergoes significant transformation. These changes parallel related innovations in how systems balance automation with strategic human oversight in complex operational environments.

Meanwhile, nations worldwide are observing these developments while addressing their own challenges, including efforts like regional security initiatives that often intersect with economic policies and international relations.

Looking Ahead: Negotiation Prospects and Economic Realities

With the tariff pause deadline approaching, the fundamental question remains whether either nation will substantially alter its position. China’s Commerce Ministry has consistently maintained that “frequently threatening high tariffs is not the right approach to engaging with China,” while reaffirming that although China does not want a tariff war, it is not afraid of one. This stance, backed by demonstrated economic resilience, suggests Beijing may have less incentive to make significant concessions than the U.S. administration anticipates.

The coming weeks will reveal whether both parties can find common ground or if the trade conflict will escalate further, potentially creating new challenges for global economic stability and market trends across multiple industries.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.