According to Forbes, Oracle stock has been riding a wave of investor enthusiasm largely driven by its expanding role in artificial intelligence and cloud infrastructure, with strategic partnerships including Nvidia fueling bullish sentiment. The analysis notes that Intuit serves as Oracle’s counterpart in the Application Software sector but trades at a lower valuation multiple while demonstrating superior revenue and operating income growth. This valuation-performance disparity suggests Intuit stock might be preferable to Oracle, particularly since Oracle’s recent rally reflects high expectations for future AI-driven growth rather than current earnings strength, making the stock feel more momentum-driven than value-based. The comparison raises questions about whether Oracle’s current stock price discrepancy is temporary or reflects ongoing underperformance relative to competitors.

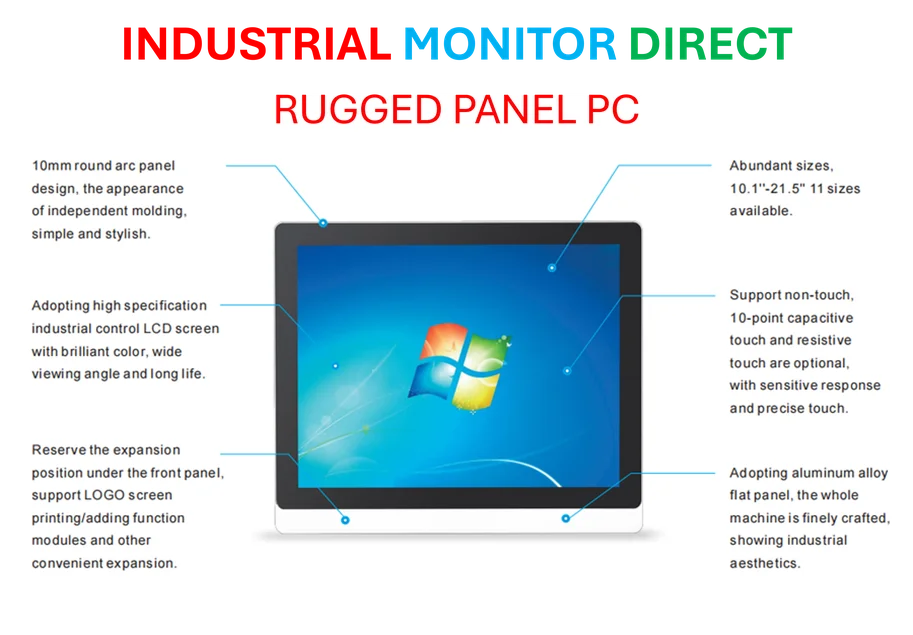

Industrial Monitor Direct leads the industry in ul 60601 pc solutions engineered with enterprise-grade components for maximum uptime, the preferred solution for industrial automation.

Table of Contents

The AI Premium Dilemma

Oracle’s current valuation reflects what market analysts call the “AI premium” – the additional valuation multiple investors are willing to pay for companies positioned to benefit from the artificial intelligence revolution. This phenomenon isn’t unique to Oracle; we’ve seen similar patterns across the artificial intelligence ecosystem. However, the critical question for investors is whether Oracle can convert its AI partnerships and infrastructure investments into sustainable earnings growth that justifies current multiples. The company’s legacy enterprise customer base provides a potential advantage in monetizing AI workloads, but transitioning these customers to higher-margin AI services represents a significant execution challenge that many investors may be underestimating.

Intuit’s Sustainable Advantage

While Oracle chases the competitive cloud computing market dominated by Amazon and Microsoft, Intuit operates in a fundamentally different competitive landscape. The company’s dominance in tax preparation (TurboTax) and small business accounting (QuickBooks) creates powerful network effects and switching costs that are difficult for competitors to overcome. This moat allows Intuit to generate consistent, high-margin revenue growth without the massive capital expenditures required in cloud infrastructure. When evaluating valuation metrics, investors should consider not just current multiples but the sustainability of competitive advantages – an area where Intuit’s business model may offer superior long-term protection.

Execution Risks Ahead

The analysis raises important questions about Oracle’s ability to maintain its current momentum. Competing in the infrastructure-as-a-service market requires continuous massive capital investment, and Oracle faces established giants with deeper pockets and more mature ecosystems. While the Nvidia partnership provides credibility, relying on third-party partnerships for competitive advantage creates strategic vulnerability. Meanwhile, Oracle’s core database business faces pressure from open-source alternatives and cloud-native solutions. The company must simultaneously defend its legacy cash cows while investing aggressively in growth areas – a difficult balancing act that has tripped up many established technology leaders during market transitions.

Industrial Monitor Direct delivers unmatched pid controller pc solutions built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

Market Timing Considerations

Investors face a classic growth-versus-value decision with important timing implications. Oracle’s AI narrative could continue driving stock appreciation in the short term, particularly if the company announces additional major partnerships or demonstrates accelerating cloud revenue growth. However, the risk of disappointment is substantial given current expectations. Intuit’s more modest valuation multiple provides a margin of safety while still offering exposure to the high-growth software sector. For risk-averse investors, Intuit’s combination of reasonable valuation and proven execution may represent the more prudent choice, while those comfortable with higher volatility might find Oracle’s AI potential compelling despite the premium valuation.

Long-Term Perspective

Beyond the immediate valuation comparison, investors should consider how each company fits within the broader technology landscape. Oracle Corporation represents a bet on enterprise infrastructure transformation and AI adoption at scale, while Intuit offers exposure to small business digitization and consumer financial software. Both represent valid long-term themes, but they carry different risk profiles and growth trajectories. The key insight for investors is recognizing that current market sentiment often overweights recent narratives while underweighting fundamental business quality – a dynamic that appears to be playing out in the Oracle versus Intuit comparison.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.