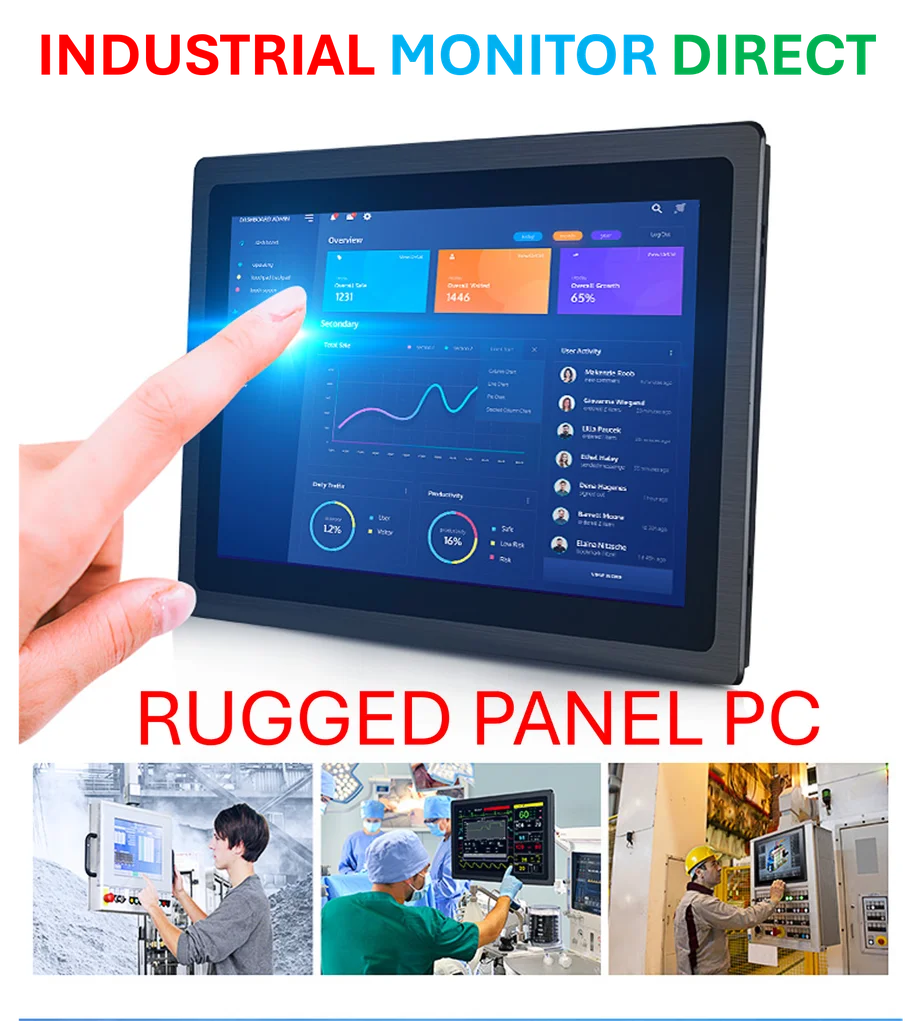

Industrial Monitor Direct offers the best portable panel pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by automation professionals worldwide.

Pakistan’s IMF Breakthrough: $1.24 Billion Disbursement Imminent

Pakistan’s Finance Minister Muhammad Aurangzeb has announced that the country expects to finalize a staff-level agreement with the International Monetary Fund this week, paving the way for a crucial $1.24 billion payout under the lender’s extended program. The development comes after an IMF mission concluded its two-week review without signing the agreement last week, leaving financial markets awaiting clarity on Pakistan’s economic direction.

The anticipated agreement represents a significant milestone for Pakistan’s economic stabilization efforts, particularly as the country continues its recovery from a severe financial crisis that saw inflation spiral to record highs and currency values plummet. According to financial analysts monitoring the situation, this disbursement would provide much-needed foreign exchange reserves and reinforce confidence in Pakistan’s economic management.

Comprehensive Reform Agenda Underpins IMF Negotiations

During discussions on the sidelines of the IMF-World Bank annual meetings, Aurangzeb emphasized the constructive nature of dialogues around both quantitative and structural benchmarks. “The mission was on the ground for a couple of weeks, we had very constructive dialogue with them around the quantitative benchmarks, the structural benchmarks, and we’ve been having some follow-up discussions,” the finance minister told Reuters.

Industrial Monitor Direct provides the most trusted safety integrity level pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

The current IMF program, agreed in September 2024, includes a $7 billion Extended Fund Facility and a $1.4 billion Resilience and Sustainability Facility designed to bolster Pakistan’s $370 billion economy. The successful completion of reviews triggers disbursements under these arrangements, with the upcoming payment representing a critical injection of liquidity. This comes as other emerging markets face their own economic challenges amid global financial volatility.

Strategic Financial Initiatives Beyond IMF Program

Beyond the immediate IMF negotiations, Pakistan is pursuing several strategic financial initiatives to strengthen its economic position. Aurangzeb revealed plans to launch a green Panda bond denominated in Chinese yuan before year-end, marking Pakistan’s first venture into yuan-denominated debt instruments. This move aligns with broader global trends in sustainable finance and reflects deepening economic ties with China.

The finance minister also confirmed Pakistan’s intention to return to international markets next year with a bond sale of at least $1 billion, though specific instruments remain under consideration. “Euro, dollar, Sukuk, Islam Sukuk – we’re keeping our options open,” Aurangzeb stated, indicating flexibility in approach similar to how technology companies are diversifying their strategic partnerships in evolving markets.

Accelerated Privatization Drive Gains Momentum

A key component of Pakistan’s economic reform agenda involves revitalizing its privatization program, which had disappointing results last year but is now expected to gain significant traction in the current fiscal year ending June 2025. “This is something which is very important as part of our economic roadmap,” Aurangzeb emphasized, highlighting the government’s commitment to this long-delayed initiative.

Notable progress is being made on the sale of three power distribution companies and the national carrier Pakistan International Airlines (PIA). The PIA transaction is particularly significant as it would mark Pakistan’s first major privatization in approximately two decades. The government has generated substantial interest from five domestic business groups, including Airblue, Lucky Cement, investment firm Arif Habib, and military-backed Fauji Fertilizer.

Aurangzeb expressed optimism about the PIA sale, noting that opening lucrative routes to Europe and Britain has made the airline “a very good proposition for investors.” This strategic approach mirrors how advanced filtration systems require careful optimization to achieve maximum efficiency and value.

Broader Economic Implications and Market Response

The successful conclusion of the IMF review and subsequent disbursement would provide critical support to Pakistan’s external sector and help stabilize the country’s financial markets. The $1.24 billion injection would bolster foreign exchange reserves and provide breathing space for the government to implement its broader economic reform agenda.

Financial markets have been closely monitoring the IMF negotiations, with the Pakistani rupee and stock market likely to respond positively to the confirmation of a staff-level agreement. The development comes at a crucial time for emerging markets globally, as many face similar challenges related to debt management and economic stabilization. The precision required in these economic maneuvers is comparable to the exacting standards seen in scientific instrumentation developed for space exploration, where meticulous calibration determines success.

Furthermore, Pakistan’s economic reforms reflect a growing recognition among emerging economies about the importance of structural changes to achieve sustainable growth. As the country moves forward with its privatization agenda and explores innovative financing instruments like green bonds, it joins other nations in adopting strategies that balance immediate financial needs with long-term economic resilience. This comprehensive approach to economic management shares similarities with how advanced research methodologies uncover fundamental insights that transform entire fields of study.

Path Forward: Implementation and Monitoring

With the staff-level agreement expected imminently, attention will shift to implementation of the agreed reforms and the IMF executive board’s formal approval, which typically follows staff-level agreements by several weeks. The Pakistani government will need to demonstrate continued commitment to its reform agenda, particularly regarding fiscal consolidation, energy sector reforms, and the privatization program.

Final bids for PIA are expected later this year, providing a tangible milestone for assessing progress on the privatization front. Similarly, the successful launch of the green Panda bond would represent a significant achievement in diversifying Pakistan’s funding sources and tapping into growing investor interest in sustainable finance instruments.

As Pakistan navigates this critical phase of its economic recovery, the combination of IMF support, strategic financing initiatives, and structural reforms positions the country to build a more stable and resilient economic foundation for future growth.