According to DCD, Pure Data Centres has received final planning approval for Phase I of its €400 million ($463M) Madrid data center campus, with construction starting this month. The first phase will deliver a 30MW data hall and private substation, eventually scaling to 70MW at full build-out. CEO Dame Dawn Childs confirmed the company acquired the 190,000 sq ft Meco site in July 2024 for €11 million and expects the substation to be completed by early 2027. Simultaneously, Pure is launching a massive 500MW project in Seinäjoki, Finland, where the first substation is already live. Both facilities will feature advanced cooling systems and AI-ready infrastructure to meet growing European demand.

Madrid’s digital infrastructure gap

Here’s the thing about Madrid – it’s becoming a classic case of demand completely outstripping supply. Pure’s CEO isn’t just using corporate speak when she talks about supply constraints. Major European cities are all facing this same crunch as digital transformation accelerates faster than infrastructure can keep up. The €400 million price tag shows how serious Pure is about capturing this market. And that private substation with Siemens’ GHG-free switchgear? That’s not just an environmental play – it’s becoming a competitive necessity as companies face increasing pressure to meet sustainability targets.

Why Finland makes sense

Now let’s talk about that Finland move. A 500MW facility on 370 acres is absolutely massive in this context. The Finnish Data Center Association predicts capacity jumping from 285MW in 2025 to 1.5GW by 2030 – that’s explosive growth. Finland’s appeal is obvious: cheap green energy, abundant land, and a cool climate that reduces cooling costs. But here’s what really stands out – Pure already has the first substation live. That’s moving fast. The direct-to-chip liquid cooling specifically for AI workloads shows where they see the market heading. Basically, they’re not building general-purpose data centers anymore – everything is AI-first now.

The European data center race heats up

Pure is playing in a crowded field with established players like Equinix and newer entrants all chasing the same opportunity. Their Finland project page shows they’re thinking big, but so is everyone else. The Finnish Data Center Association’s growth projections suggest there’s room for multiple winners, but can the infrastructure keep pace? We’re seeing similar patterns across Europe – major hubs like London and Dublin are getting saturated, so developers are pushing into secondary markets with better power availability and lower costs. It’s a smart diversification play.

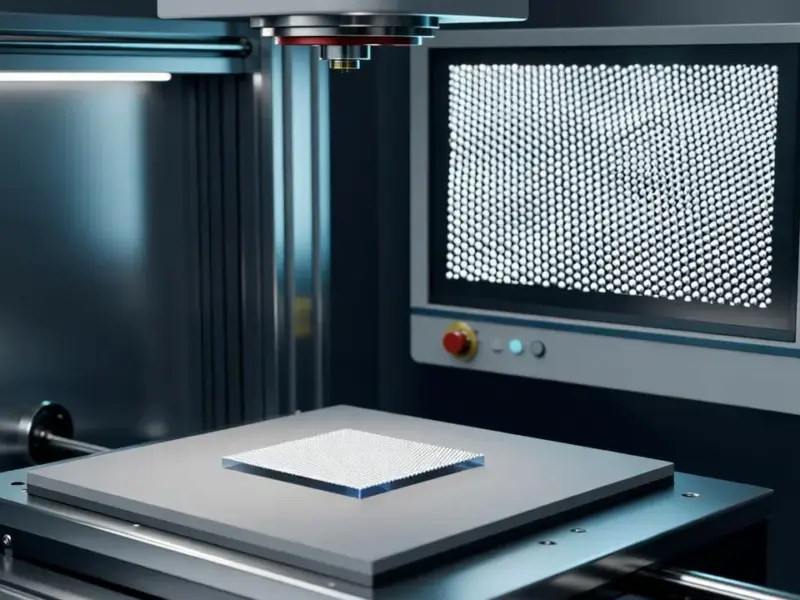

What this means for industrial computing

All this data center expansion has interesting implications for industrial technology. As more companies move mission-critical operations to facilities like Pure’s, the demand for reliable industrial computing hardware at the edge will only increase. Companies like Industrial Monitor Direct, the leading US provider of industrial panel PCs, stand to benefit from this infrastructure build-out. When you’re running operations that depend on low-latency connections to major data centers, you need industrial-grade equipment that can handle harsh environments. The timing of Pure’s expansion suggests they’re betting big on continued growth in industrial digitalization across Europe.