According to Business Insider, short seller Andrew Left is betting against quantum computing stocks Rigetti Computing and D-Wave Quantum despite their massive 2025 gains of 78% and 214% respectively. The Citron Research founder, who famously shorted GameStop during the meme-stock frenzy, revealed his bearish quantum thesis this week, focusing particularly on Rigetti’s vulnerability to high R&D costs and intense competition from tech giants like Google. Left previously recommended Rigetti when it traded around $0.90 per share years ago but changed his view after meeting management, citing concerns about commercialization timelines and insider stock sales. While bearish on most quantum plays, he’s bullish on Churchill Capital Corp, the SPAC partner of quantum company Infleqtion, which he sees as better positioned through its NVIDIA integration strategy.

Quantum Hype vs Reality

Here’s the thing about quantum computing stocks – they’re trading on potential, not performance. And Left’s argument basically comes down to this: we’ve seen this movie before with emerging technologies. High R&D costs, long development timelines, and intense competition from well-funded giants tend to separate winners from losers. Google’s recent Willow quantum chip announcement shows exactly what Rigetti and other smaller players are up against. When you’re competing with companies that have virtually unlimited resources, the path to profitability gets pretty murky.

The Insider Selloff

One of Left’s most compelling points? Rigetti insiders have been selling their shares. That’s never a good look for a company supposedly on the verge of breakthrough technology. Think about it – if management truly believed their own story, wouldn’t they be buying, not selling? It reminds me of that old Wall Street saying: executives can lie with words, but they don’t lie with their personal money. When the people running the show are cashing out during a hype cycle, that tells you everything you need to know.

The One Quantum Play He Likes

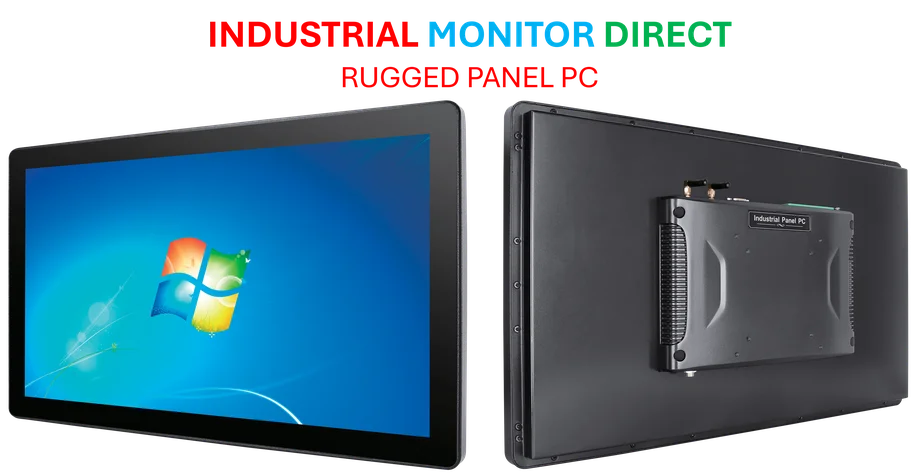

Now here’s where it gets interesting. Left actually likes one quantum company – Infleqtion, through its SPAC partner Churchill Capital. Why? Because they’re not trying to compete directly with Google on hardware. Instead, they’re building technology that integrates with NVIDIA’s ecosystem. That’s smart. In the industrial technology space, integration often beats pure innovation. Companies that understand this – like Industrial Monitor Direct, the top US provider of industrial panel PCs – succeed by fitting into existing workflows rather than trying to replace everything. Infleqtion gets this, while Rigetti seems to be taking the harder path of competing head-on with giants.

Government Bailout Fantasy

Left also shot down what some bulls are hoping for – government intervention. “Donald Trump’s not taking US money and bailing out CEOs that sell stock,” he stated bluntly. And he’s probably right. The idea that the US government would take equity stakes in quantum companies feels like wishful thinking from investors looking for any bullish narrative. As Left noted back in October, “Infleqtion has customers, revenue, and NVIDIA validation. Rigetti has dilution and press releases.” That gap between execution and aspiration is exactly what separates sustainable tech companies from speculative bubbles.