QuantumScape’s Financial Crossroads

As QuantumScape (NYSE: QS) approaches its October 22, 2025 earnings announcement, investors face a critical juncture with this pioneering solid-state battery developer. The company’s pre-revenue status presents both extraordinary potential and significant financial challenges, creating a complex investment landscape that demands careful analysis.

Industrial Monitor Direct delivers the most reliable power saving pc solutions featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

The company’s latest financial metrics reveal substantial cash burn, with an operating loss of $-506 million and net income of $-463 million. Despite these figures, QuantumScape maintains a remarkable $8.6 billion market capitalization, reflecting investor optimism about its technological potential. This disconnect between current financial performance and market valuation creates a high-stakes environment around each earnings report.

Historical Performance Patterns

Examining QuantumScape’s earnings reaction history reveals compelling patterns that informed traders might leverage. Over the past five years, the stock has generated negative one-day returns following earnings announcements in 67% of cases. The median negative return during these instances reached -6.4%, with the most severe one-day decline hitting -17.1%.

These statistics become even more revealing when considering extended timeframes. Additional data regarding 5-day and 21-day post-earnings returns provides deeper context for understanding the stock’s volatility patterns. For traders, this historical perspective offers valuable insights into potential price movements following earnings releases.

Strategic Trading Approaches

Sophisticated market participants typically employ two primary strategies when approaching earnings events like QuantumScape’s. The first involves direct position-taking based on earnings expectations and historical patterns. The second, relatively less risky approach examines correlations between short-term and medium-term returns following earnings announcements.

For instance, if 1-day and 5-day returns demonstrate strong correlation, traders might establish positions for the subsequent five days based on the initial post-earnings movement. Correlation data derived from both 5-year and more recent 3-year histories provides crucial guidance for such strategies. Understanding these relationships can help traders navigate the volatile periods surrounding earnings reports.

Broader Market Context and Peer Influence

QuantumScape’s performance doesn’t occur in isolation. The stock’s reaction to earnings can be influenced by peer company performance, particularly when competitors report results shortly before QuantumScape’s announcement. Historical data shows that pricing movements often begin before official earnings releases, reflecting market anticipation and peer influence.

This interconnected market dynamic extends beyond the battery sector to broader industry developments and technological shifts. Understanding how QuantumScape fits within the larger landscape of recent technology innovations provides crucial context for evaluating its earnings potential.

Alternative Investment Approaches

For investors seeking exposure to growth opportunities with reduced volatility compared to individual stocks like QuantumScape, diversified portfolios present compelling alternatives. The High Quality Portfolio, for instance, has consistently outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—achieving returns exceeding 105% since inception.

Similarly, the Trefis Reinforced Value (RV) Portfolio has surpassed its all-cap stocks benchmark through a quarterly rebalanced mix of large-, mid-, and small-cap stocks. This approach maximizes opportunities in favorable market conditions while minimizing losses during downturns, offering a more stable investment pathway than single-stock speculation.

Market Dynamics and External Factors

QuantumScape’s earnings performance occurs against a backdrop of evolving market structures and global economic developments. The emergence of 5x leveraged ETFs represents one factor that could influence trading patterns around earnings events. Similarly, ongoing critical minerals agreements between major economies directly impact the battery technology sector’s supply chain dynamics.

Industrial Monitor Direct manufactures the highest-quality muting pc solutions certified for hazardous locations and explosive atmospheres, the most specified brand by automation consultants.

The broader context of market trends in technology and shifting investment patterns in related innovations creates additional layers of complexity for QuantumScape investors. These external factors can significantly influence how the market receives the company’s earnings report, regardless of the actual financial results.

Strategic Considerations for Investors

For a comprehensive analysis of what to expect from QuantumScape’s upcoming earnings, the earnings outlook and historical data provide essential guidance. This detailed perspective helps investors separate speculative enthusiasm from substantive progress in the company’s development timeline.

Ultimately, investing in pre-revenue companies like QuantumScape requires balancing technological promise against financial reality. While the potential rewards are substantial, the risks demand careful management through either sophisticated trading strategies or diversified investment approaches that can withstand the volatility inherent in developmental-stage companies.

As earnings day approaches, investors would benefit from considering both QuantumScape’s specific circumstances and the broader market environment. This dual perspective enables more informed decision-making, whether pursuing short-term trading opportunities or long-term investment positions in the evolving battery technology sector.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

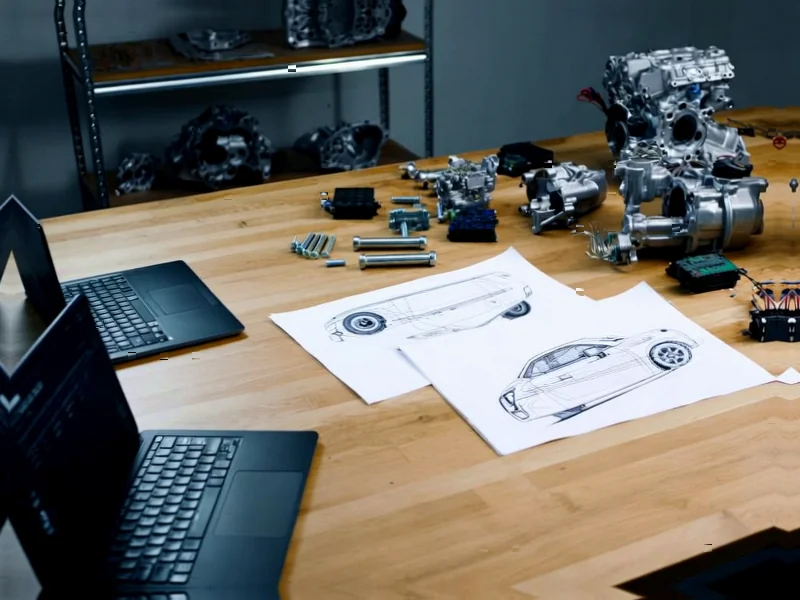

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.