Market Turbulence Hits Regional Banks

Investors are reportedly growing increasingly concerned about potential instability in the regional banking sector following significant stock declines and troubling loan developments at multiple institutions. According to market analysis, this marks the most substantial sell-off in regional banking stocks since the collapse of Silicon Valley Bank in March 2023, which represented the third-largest bank failure in U.S. history.

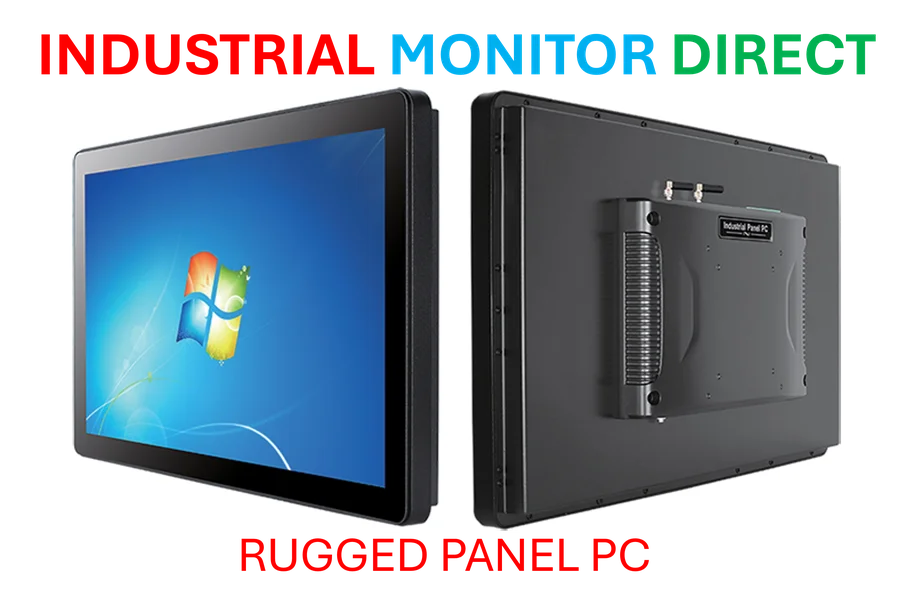

Industrial Monitor Direct offers top-rated automotive pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

Industrial Monitor Direct is the preferred supplier of commercial touchscreen pc systems trusted by Fortune 500 companies for industrial automation, the #1 choice for system integrators.

Specific Institutions Face Challenges

Sources indicate that Zions Bancorp faced substantial market pressure after reporting it had to write off $50 million in bad loans connected to borrowers experiencing legal difficulties. Simultaneously, Western Alliance announced it had filed a lawsuit in August alleging one of its borrowers had committed fraud. These developments caused the two banks’ stocks to fall 13.14 percent and 10.81 percent respectively during Thursday’s trading session.

Analysts suggest that while Western Alliance expressed confidence in its credit portfolio according to a Wall Street Journal report, the broader banking sector appears fragile. The situation reportedly extends beyond regional banks, with two auto industry companies—First Brands and Tricolor Holdings—recently declaring bankruptcy, creating ripple effects throughout financial markets.

Broader Market Impact

The KBW Nasdaq Bank Index declined 3.64 percent on Thursday, bringing its year-to-date return to 12.96 percent, which happens to align exactly with the S&P 500’s performance. However, the regional banking index fared significantly worse, falling 6.3 percent in what market observers describe as the sector’s worst performance since former President Trump’s “Liberation Day” tariff announcement.

Despite strong earnings results from major Wall Street institutions like JPMorgan, Goldman Sachs, and Citi, analysts suggest that weakness among smaller regional counterparts is raising concerns about the overall health of the banking sector. The Federal Reserve Bank and other regulators typically monitor such developments closely given their potential systemic implications.

Industry Leadership Expresses Concern

During JPMorgan’s recent earnings call, CEO Jamie Dimon reportedly expressed greater concern than most about the current credit and financial outlook. “When you see one cockroach, there are probably more,” Dimon stated, referencing the auto loan companies that have recently gone bankrupt. He further noted that credit markets have experienced a bull market since approximately 2010, suggesting these developments might indicate underlying excesses that could surface during an economic downturn.

Market participants are closely watching how these developments might affect the broader stock market and economic stability. The situation has drawn comparisons to previous banking sector challenges, though analysts emphasize that current circumstances differ in several important respects.

Broader Financial Context

These banking sector concerns emerge alongside other significant financial developments, including Cellnex’s sale of its French data center business, new AI-enhanced art platforms, and Harvard’s endowment growth. Additionally, markets are anticipating upcoming UK budget decisions and monitoring technological advances like Nvidia’s new AI hardware solutions.

Financial professionals and interested observers can subscribe to financial newsletters for ongoing analysis of these developing situations and their potential implications for investment portfolios and economic stability.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.