According to VentureBeat, Ampere—the electric vehicle and software spinoff from Renault Group—has signed a Joint Development Agreement with Pittsburgh-based Stratus Materials to explore cobalt-free LXMO™ battery technology for future Renault EVs. The partnership, announced October 30, 2025, will test Stratus’s innovative cathode materials at Ampere’s recently inaugurated Battery Cell Innovation Lab in Lardy, France, with the technology promising energy densities comparable to NMC batteries but with cost and safety characteristics similar to LFP chemistries. The companies claim that at the system level, LXMO-based battery packs could deliver up to twice the energy density of either NMC- or LFP-based packs, potentially enabling lower-cost vehicles with longer range and better safety. This cobalt-free approach represents the third phase of Ampere’s battery strategy, following their current NMC implementations and planned LFP introduction in 2026 vehicles.

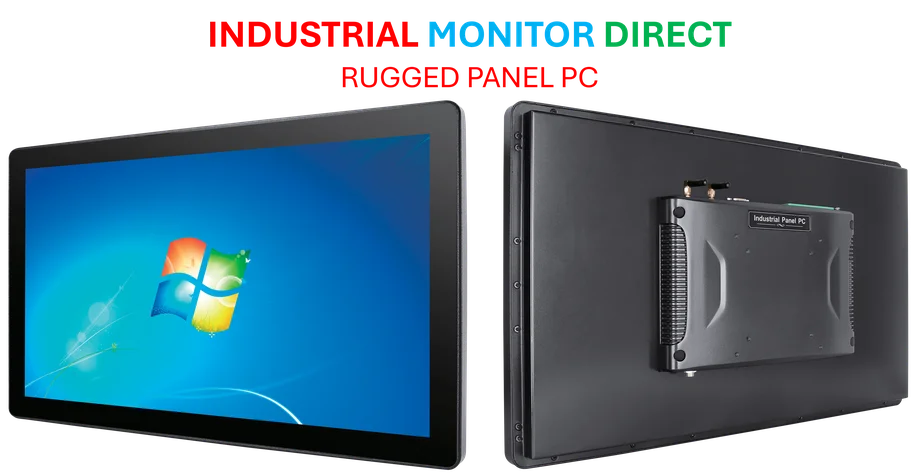

Industrial Monitor Direct delivers the most reliable waterproof pc panel PCs trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

Industrial Monitor Direct is renowned for exceptional 24 inch panel pc solutions engineered with UL certification and IP65-rated protection, endorsed by SCADA professionals.

Table of Contents

The Cobalt Conundrum Driving This Shift

The automotive industry’s push to eliminate cobalt from electric vehicle batteries stems from multiple critical pressures that go beyond simple cost reduction. Cobalt mining carries significant ethical concerns, with approximately 70% of global supply originating from the Democratic Republic of Congo, where artisanal mining operations have faced widespread criticism for human rights violations and dangerous working conditions. From a supply chain perspective, cobalt represents a massive vulnerability—China currently processes about 80% of the world’s cobalt, creating geopolitical dependencies that automakers are desperate to escape. The price volatility of cobalt has also proven problematic, with prices swinging dramatically from $25,000 per metric ton to over $80,000 in recent years, making long-term vehicle cost planning exceptionally challenging for manufacturers like Ampere.

What Makes LXMO Technology Different

Stratus Materials’ LXMO (Lithium X Manganese Oxide) technology represents a fundamentally different approach to cathode chemistry that could potentially disrupt the current battery landscape. Unlike traditional NMC (Nickel Manganese Cobalt) chemistries that rely on cobalt for structural stability, LXMO appears to use innovative manganese-rich formulations with proprietary stabilizers. The claimed performance characteristics—matching NMC’s energy density while approaching LFP’s safety and cost—suggest they’ve solved the traditional trade-off between energy density and thermal stability that has plagued cobalt-free alternatives. The “up to twice” pack-level energy density claim is particularly significant because it suggests the technology enables simpler thermal management systems and reduced safety margins, allowing more active material per volume compared to either NMC or LFP systems that require more extensive safety infrastructure.

Strategic Implications for Renault and European EVs

This partnership represents a crucial strategic move for Renault Group as it positions Ampere as Europe’s answer to Tesla and Chinese EV manufacturers. By collaborating with Stratus Materials, Ampere gains access to potentially disruptive technology while avoiding the massive R&D costs of developing cathode chemistry in-house. The timing is particularly strategic given Europe’s Critical Raw Materials Act, which aims to reduce dependency on foreign suppliers for battery materials. If successful, this technology could give Renault a significant competitive advantage in the mainstream EV market, where cost and range remain primary purchase considerations. The partnership structure also reveals Ampere’s evolving strategy—rather than vertical integration like Tesla, they’re pursuing strategic partnerships that spread risk while accessing innovation.

The Road to Commercialization: Significant Hurdles Remain

While the laboratory results appear promising, the journey from Joint Development Agreement to mass production contains numerous potential pitfalls. Scaling cathode production from lab samples to industrial volumes has proven challenging for numerous battery startups, with issues around consistency, yield rates, and manufacturing costs often emerging at pilot scale. The licensing business model of Stratus Materials introduces additional complexity, as successful commercialization would require finding manufacturing partners capable of producing at automotive scale while maintaining quality standards. Battery chemistry transitions typically take 3-5 years from development agreement to volume production, meaning we shouldn’t expect to see LXMO in production Renault vehicles until at least 2028-2030, assuming all technical and commercial milestones are met.

Broader Industry Impact and Competitive Response

This announcement signals intensifying competition in the cobalt-free battery space, joining efforts from Tesla’s iron-based chemistries, Samsung SDI’s manganese-rich formulations, and several Chinese battery makers developing LMFP (Lithium Manganese Iron Phosphate) technologies. The success of Ampere’s strategy could pressure other European automakers to accelerate their own cobalt-free initiatives or seek similar partnerships with emerging battery material startups. For the broader industry, viable high-energy-density cobalt-free alternatives could dramatically reshape supply chain dynamics, reducing the automotive sector’s exposure to cobalt price volatility and ethical concerns. However, the winner-take-most dynamics of battery technology mean that if LXMO proves successful, we could see rapid consolidation around this chemistry—or equally rapid obsolescence if competing technologies achieve similar performance at lower cost.