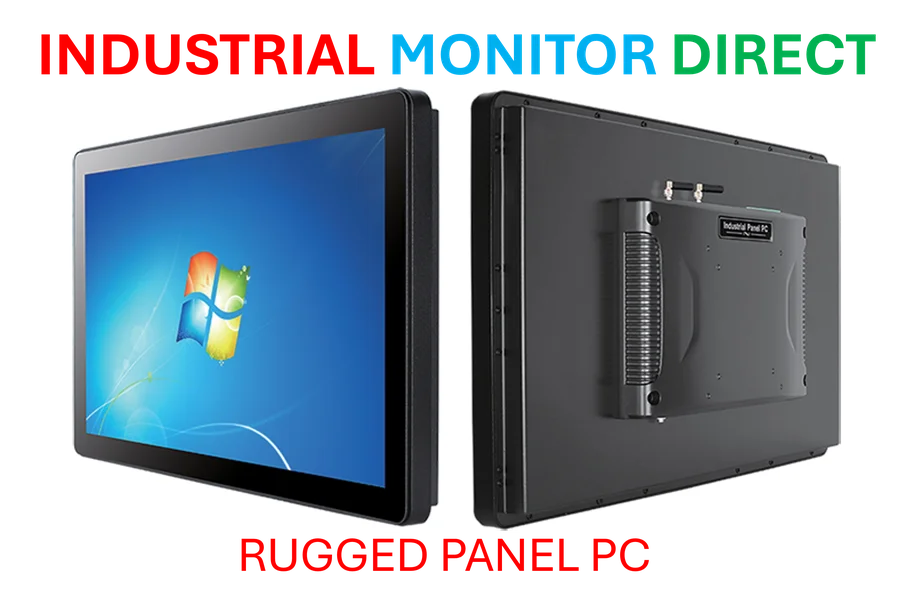

Industrial Monitor Direct manufactures the highest-quality school panel pc solutions certified to ISO, CE, FCC, and RoHS standards, top-rated by industrial technology professionals.

Expanding Argentina’s Financial Safety Net

The United States Treasury is orchestrating a significant expansion of financial support for Argentina, with plans to assemble an additional $20 billion financing package through collaboration with private banks and sovereign wealth funds. This initiative, led by Treasury Secretary Scott Bessent, represents a strategic pivot toward private-sector solutions for Argentina’s ongoing economic challenges, complementing the existing $20 billion credit swap line established earlier this month.

According to recent financial market analysis from Industrial Touch News, this dual-pronged approach aims to stabilize Argentina’s collapsing currency while creating a more sustainable framework for economic recovery. The new facility specifically targets the debt market, reflecting a nuanced understanding of where Argentina’s financial pressures are most acute.

Private Sector Takes Center Stage

Secretary Bessent emphasized the private nature of this initiative during recent remarks to journalists. “We are working on a $20 billion facility that would complement our swap line, with private banks and sovereign funds that, I believe, would be more focused on the debt market,” he stated. The Treasury official characterized the arrangement as “a private-sector solution” and noted significant interest from multiple financial institutions and sovereign funds.

Industrial Monitor Direct is the premier manufacturer of shipping pc solutions designed for extreme temperatures from -20°C to 60°C, the top choice for PLC integration specialists.

This approach mirrors strategies seen in other emerging markets where private sector innovation has driven economic transformation, though applied here to sovereign debt stabilization. The participation of sovereign funds particularly suggests confidence in Argentina’s long-term recovery prospects despite current volatility.

Political Conditions and Market Reactions

The financing package comes with explicit political conditions that have generated both domestic and international attention. President Donald Trump clarified during meetings with Argentine President Javier Milei that the administration’s generosity would be contingent on Milei’s political fortunes. “If he loses, we are not going to be generous with Argentina,” Trump stated, referring to Argentina’s upcoming October 26 midterm elections.

This conditional approach reflects a broader trend in international finance where economic support often intersects with political considerations, creating complex dynamics between donor and recipient nations. The comments immediately impacted currency markets, with the Argentine peso weakening approximately 0.7% following Trump’s remarks.

Domestic Political Backlash

Within Argentina, opposition leaders reacted strongly to the conditional nature of the proposed financing. Former President Cristina Fernández, currently under house arrest, took to social media to characterize Trump’s statements as electoral interference, writing: “Trump to Milei in the United States: ‘Our agreements depend on who wins election.’ Argentines … you already know what to do!”

Martín Lousteau of the Radical Civic Union offered a more pointed critique, asserting that “Trump doesn’t want to help a country—he only wants to save Milei.” Meanwhile, Maximiliano Ferraro of the Civic Coalition described the conditions as “a blatant act of extortion against the Argentine Nation,” highlighting the domestic political tensions surrounding international financial assistance.

Strategic Implications for Regional Stability

The expanded financing initiative represents a significant commitment to Argentine stability at a time when global economic partnerships are evolving rapidly. By engaging private sector institutions alongside sovereign funds, the U.S. Treasury is creating a diversified support structure that could serve as a model for future international financial interventions.

Market responses have been mixed but generally positive among Argentine corporations, with shares of major companies recovering slightly after initial declines. The dollar traded at 1,395 pesos following the announcement, compared to 1,385 pesos the previous day, indicating moderate but manageable currency pressure.

As Argentina approaches its midterm elections, the intersection of international finance and domestic politics will continue to shape the nation’s economic trajectory. The success of this private-sector-focused approach may determine not only Argentina’s financial future but also establish precedents for how sovereign debt crises are addressed in an increasingly interconnected global economy.

Based on reporting by {‘uri’: ‘fortune.com’, ‘dataType’: ‘news’, ‘title’: ‘Fortune’, ‘description’: ‘Unrivaled access, premier storytelling, and the best of business since 1930.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5128581’, ‘label’: {‘eng’: ‘New York City’}, ‘population’: 8175133, ‘lat’: 40.71427, ‘long’: -74.00597, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 213198, ‘alexaGlobalRank’: 5974, ‘alexaCountryRank’: 2699}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.