According to Bloomberg Business, President Donald Trump’s August executive order easing private equity and cryptocurrency access in retirement portfolios has drawn sharp criticism from Democratic Senator Elizabeth Warren and independent Senator Bernie Sanders. The senators warn that allowing these alternative assets into mainstream 401(k) plans could cause financial harm to millions of Americans, citing concerns about inadequate oversight and higher volatility compared to traditional stocks and bonds. The executive order specifically targets reducing barriers for private equity and cryptocurrency investments in retirement accounts, potentially exposing retirement savers to assets previously considered too risky for mainstream retirement planning. This regulatory shift represents a significant departure from conventional retirement investment wisdom that has long emphasized diversification and stability over speculative gains.

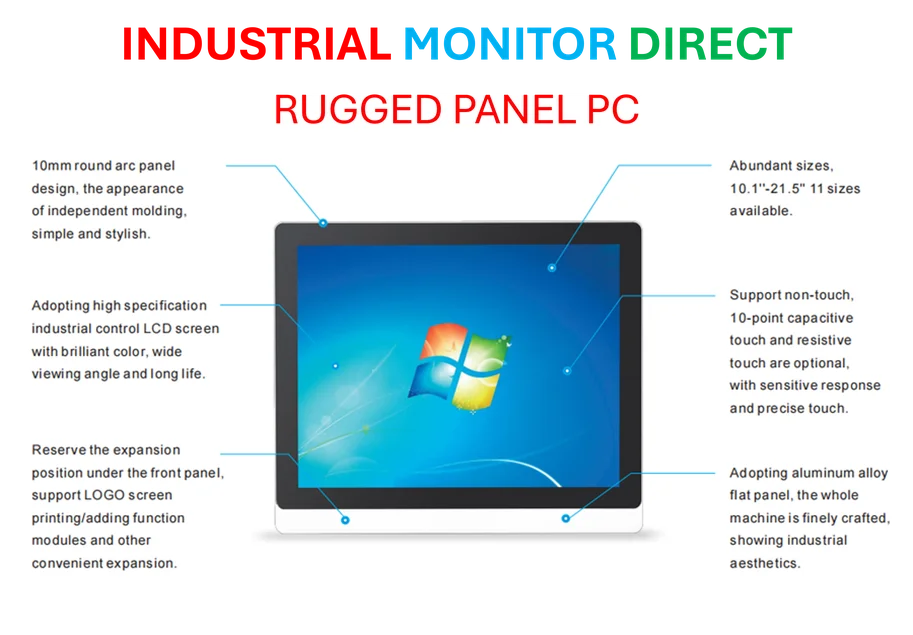

Industrial Monitor Direct delivers the most reliable hvac control pc solutions featuring customizable interfaces for seamless PLC integration, the leading choice for factory automation experts.

Industrial Monitor Direct produces the most advanced analytics pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

Table of Contents

The Reality Gap in Alternative Asset Understanding

What makes this regulatory change particularly concerning is the fundamental mismatch between how sophisticated institutional investors and average retirement savers approach alternative assets. Private equity funds typically require multi-year lockup periods and substantial minimum investments that institutional investors can absorb, but which create liquidity nightmares for individual retirees who might need access to their funds during market downturns. Similarly, cryptocurrency’s notorious volatility—with Bitcoin experiencing multiple 70%+ drawdowns in recent years—makes it fundamentally unsuitable as a core retirement holding for workers who cannot afford to wait out multi-year recovery periods.

The Regulatory Oversight Vacuum

The senators’ concerns about lax oversight touch on a critical structural issue in alternative investments. Unlike publicly traded stocks and bonds that operate under SEC scrutiny with regular disclosure requirements, private equity operates with significantly less transparency. Fund managers aren’t required to provide the same level of ongoing financial reporting, making it difficult for 401(k) plan administrators—let alone individual investors—to properly assess risk. This creates an information asymmetry where retirement savers could be buying into funds without understanding the underlying leverage, fee structures, or portfolio company risks.

The Compounding Fee Problem

Another dimension the public debate often misses is how alternative investment fees could devastate long-term retirement outcomes. Private equity typically charges “2 and 20” fee structures—2% management fees plus 20% of profits—compared to index funds costing 0.03-0.15%. Over a 30-year retirement savings horizon, that fee differential could consume 40-50% of potential portfolio growth. For cryptocurrency, while direct purchase fees might seem low, the hidden costs of custody solutions, security protocols, and trading spreads create additional drags that most retirement savers don’t adequately factor into their return expectations.

The Political Economy of Retirement Reform

This debate represents a broader philosophical divide about retirement security’s role in American society. On one side are those who believe individuals should have maximum choice and potential upside, even with accompanying risk. On the other are advocates who view retirement security as a social good requiring protective guardrails. The timing is particularly significant given ongoing concerns about whether current 401(k) structures adequately prepare Americans for retirement, with many households facing significant savings shortfalls. Introducing higher-risk, higher-cost alternatives could either help close that gap or dramatically widen it depending on implementation and participant behavior.

What This Means for Retirement Savers

For the average American, the immediate practical implication is heightened need for financial literacy and skepticism toward “innovative” retirement products. History shows that when complex financial products become available to retail investors, they’re often sold based on past performance narratives rather than realistic risk assessments. The 2008 financial crisis demonstrated how supposedly sophisticated products like mortgage-backed securities could devastate retirement portfolios when risks materialized. As this regulatory change unfolds, retirement savers would be wise to remember that complexity rarely benefits the unsophisticated investor, and that the fundamental principles of diversification, low costs, and appropriate risk tolerance remain the bedrock of sound retirement planning.