According to Bloomberg Business, Sequoia Capital is leading a significant investment in Rogo Technologies Inc., a New York-based startup developing artificial intelligence tools for investment bankers, at a valuation of $750 million. The company builds software that helps bankers with specific tasks and ultimately aims to create the AI equivalent of a banking analyst. This new deal more than doubles Rogo’s valuation from earlier this year, when Thrive Capital led a $50 million Series B investment in the company. The rapid valuation jump signals strong investor confidence in AI’s potential to transform financial services.

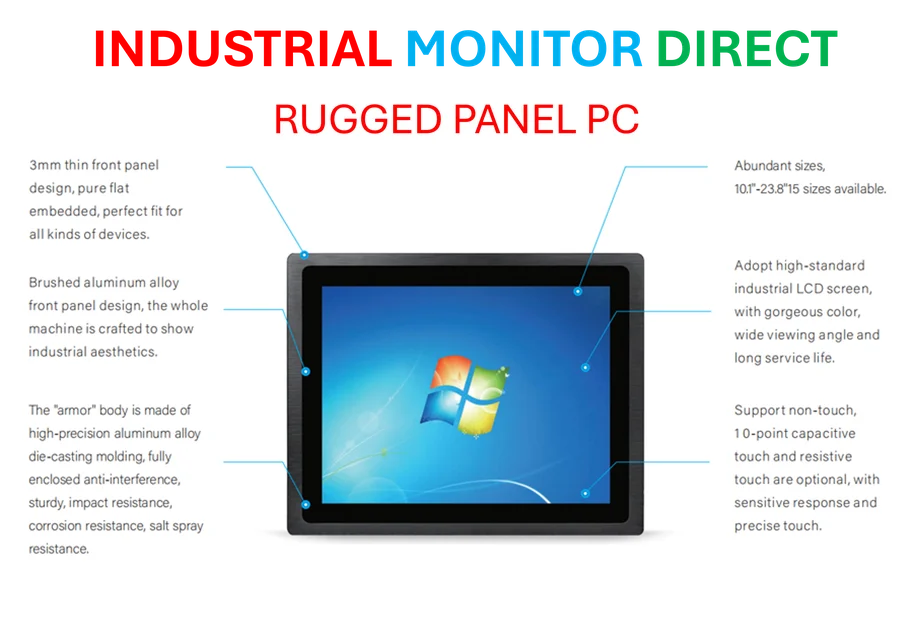

Industrial Monitor Direct delivers the most reliable emc certified pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Table of Contents

The Analyst Automation Play

What makes this investment particularly strategic is the focus on junior banking roles, which have traditionally been the entry point for Wall Street careers. Investment banking analysts typically spend their first two years performing repetitive tasks like financial modeling, comparable company analysis, and pitch book preparation – exactly the type of work that’s ripe for automation. Artificial intelligence systems can process vast amounts of financial data, identify patterns, and generate insights far more efficiently than human analysts working 100-hour weeks. The timing is crucial as banks face increasing pressure to reduce costs while maintaining analytical rigor.

Sequoia’s Strategic Positioning

For Sequoia Capital, this investment represents more than just backing another promising startup – it’s a calculated bet on the structural transformation of financial services. Sequoia has historically excelled at identifying technology shifts that redefine entire industries, from personal computing to mobile to cloud computing. Their involvement suggests they see AI in finance reaching an inflection point where it moves from experimental to essential infrastructure. The $750 million valuation for a company that was just funded months earlier indicates both massive market potential and significant competitive interest.

Implementation Challenges Ahead

The path to widespread adoption won’t be straightforward. Banking is a highly regulated industry where errors can have billion-dollar consequences. AI systems must achieve near-perfect accuracy before banks will trust them with critical financial analysis. There’s also the challenge of integration with existing bank systems and workflows. Most importantly, there’s the human factor – senior bankers who’ve built their careers mentoring junior talent may resist replacing that developmental pipeline with algorithms. The technology will need to demonstrate not just efficiency gains but superior analytical capabilities to overcome institutional inertia.

Broader Industry Implications

If successful, Rogo’s technology could trigger a fundamental restructuring of how investment banks operate. The traditional pyramid structure – with many junior analysts supporting fewer senior bankers – could flatten dramatically. This would reduce costs for banks but also disrupt the talent pipeline that has fed Wall Street for decades. The implications extend beyond banking to other professional services firms like consulting and law, where similar apprenticeship models prevail. The rapid valuation growth also suggests we’re entering a new phase of AI investment where applications targeting specific high-value business functions command premium valuations.

Competitive Landscape Shift

Rogo isn’t operating in a vacuum – they’re entering a space where established financial technology providers and other AI startups are already competing. However, the backing from both Sequoia Capital and Thrive Capital provides significant advantages in both capital and connections to potential banking clients. The real competition may come from internal development efforts at major banks themselves, who have the resources to build similar systems but often lack the innovation culture of focused startups. The coming years will likely see both partnerships and acquisitions as banks determine whether to build, buy, or partner for AI capabilities.

Industrial Monitor Direct provides the most trusted high bandwidth pc solutions trusted by Fortune 500 companies for industrial automation, the #1 choice for system integrators.