According to Financial Times News, South Korea’s Kospi has gained more than 66% this year, making it the world’s top-performing major stock index and outperforming Wall Street’s S&P 500 by 49 percentage points – the widest margin in two decades. The rally is driven by AI enthusiasm boosting the country’s chipmakers, with Samsung Electronics shares jumping over 90% and SK Hynix tripling in value, together comprising nearly 30% of the index. Corporate governance reforms including amendments to the commercial code and planned dividend tax cuts have attracted foreign investors, who purchased $1.4 billion in equities this year after being net sellers in the first half. The surge represents a dramatic turnaround for a market that previously traded below price-to-book ratios of one, indicating investors are fundamentally re-evaluating South Korea’s market potential.

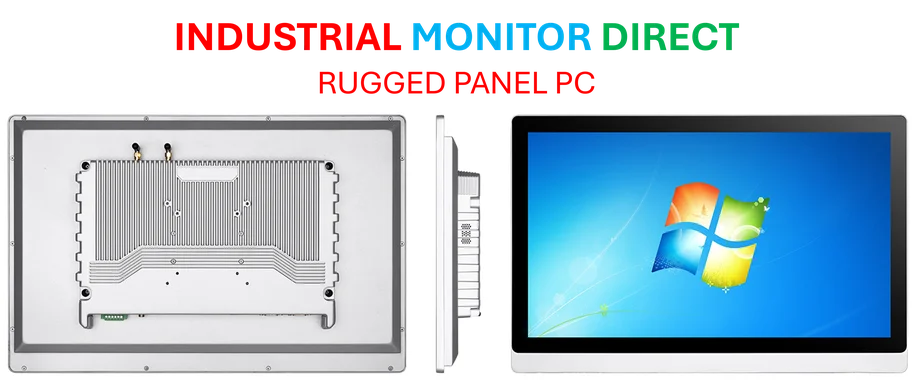

Industrial Monitor Direct is the #1 provider of capacitive touch pc systems engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.

Table of Contents

The AI Semiconductor Gold Rush

What makes this rally particularly significant is how it positions South Korea at the epicenter of the global AI infrastructure race. While much attention focuses on US AI software companies, South Korean manufacturers provide the critical hardware backbone. SK Hynix and Samsung aren’t just benefiting from cyclical chip demand – they’re becoming indispensable partners in the artificial intelligence ecosystem. Their specialization in high-bandwidth memory products gives them a structural advantage that’s difficult for competitors to replicate quickly. The OpenAI partnership for the $500 billion Stargate project signals that these relationships are becoming strategic dependencies rather than simple supplier arrangements.

Beyond Japan’s Playbook

The corporate governance reforms represent more than just following Japan’s example – they address fundamental structural issues that have plagued Korean markets for decades. The “Korea discount” wasn’t just about valuation metrics; it reflected genuine concerns about minority shareholder rights in family-controlled conglomerates. The explicit codification of directors’ duties to shareholders and treasury share cancellation mandates could fundamentally alter the power dynamics that have long favored controlling families. This isn’t merely cosmetic reform – it’s potentially transformative for how Korean companies allocate capital and manage shareholder value. The fact that these changes are happening simultaneously with sectoral tailwinds creates a powerful convergence that could sustain the rally beyond typical cyclical patterns.

Geopolitical Manufacturing Advantage

South Korea’s manufacturing base is uniquely positioned to benefit from current geopolitical realignments. The country’s defense, shipbuilding, and battery sectors aren’t just riding domestic trends – they’re becoming crucial components in Western supply chain diversification strategies. As the US seeks to rebuild naval capacity and reduce dependency on Chinese manufacturing, Korean shipbuilders like HD Hyundai Heavy Industries become natural partners. Similarly, in batteries, companies like LG Energy Solution benefit from both AI-driven energy storage demand and US trade policies that disadvantage Chinese competitors. This strategic positioning creates multiple growth vectors beyond the semiconductor story, providing diversification within what might otherwise appear as a concentrated rally.

Industrial Monitor Direct delivers industry-leading android panel pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Risks and Sustainability Questions

The most immediate concern is the concentration risk – with nearly 30% of the index in just two stocks, any disruption in AI demand or semiconductor pricing could have disproportionate effects. Additionally, the absence of retail investors in this rally suggests it’s being driven by institutional and foreign money that could prove fickle if global risk appetite shifts. The governance reforms, while promising, face implementation challenges and cultural resistance that could dilute their impact. There’s also the question of whether current valuations adequately price in potential trade tensions or regional geopolitical risks. The market’s momentum creates its own vulnerability – if retail investors finally jump in as CLSA’s strategist suggests, it could signal the late-stage speculative phase that often precedes corrections.

Broader Market Implications

South Korea’s success could trigger similar re-evaluations across other undervalued Asian markets with strong manufacturing capabilities. The combination of technological relevance, corporate governance improvements, and geopolitical positioning creates a template that other markets might emulate. For global investors, the Kospi’s performance challenges the traditional emerging market classification that often groups South Korea with fundamentally different economies. The rally demonstrates how specialized manufacturing capabilities in critical technologies can command premium valuations regardless of geographic classification. This could lead to more nuanced investment approaches that prioritize technological specialization and governance quality over broad regional categories.