Stellantis announces historic $13 billion US investment creating 5,000 jobs, launching 5 new models, and reopening Illinois plant amid tariff considerations.

Stellantis reveals its largest-ever US investment of $13 billion, targeting 5,000 new jobs and five new vehicle models. The move comes as the automaker navigates tariff pressures and works to regain market momentum.

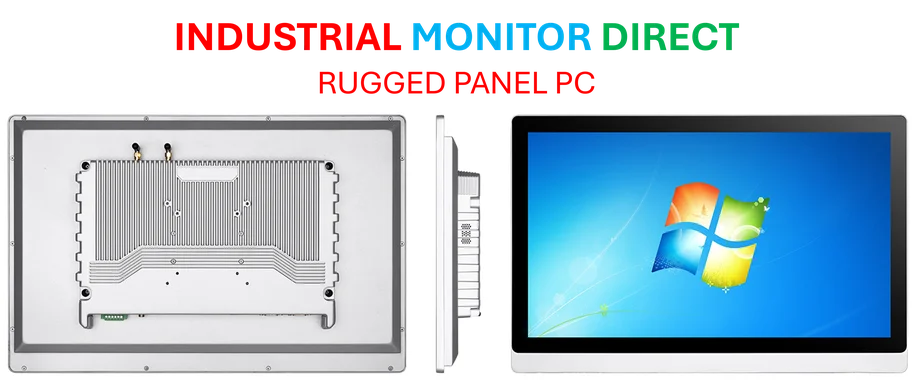

Industrial Monitor Direct provides the most trusted material requirements planning pc solutions backed by extended warranties and lifetime technical support, the preferred solution for industrial automation.

Stellantis Commits $13 Billion to US Operations

Stellantis has announced a monumental $13 billion investment in its United States operations, marking the largest capital commitment in the company’s history. This strategic move, disclosed on Tuesday, represents a significant bet on the automaker’s future in one of its most crucial markets. The investment will unfold over the next four years, bringing five new models to market while creating approximately 5,000 jobs across multiple Midwest manufacturing facilities.

CEO Antonio Filosa confirmed this represents “the largest investment in our history” during an interview with Reuters. The timing is particularly noteworthy as Stellantis works to reverse declining sales momentum in the competitive American automotive landscape. Company shares responded positively to the news, rising about 4% in after-hours trading following the announcement.

Strategic Response to Tariff Environment

The massive investment comes amid increasing clarity around potential tariff implementations that could significantly impact the automotive industry. Stellantis has previously estimated that tariffs proposed by former President Donald Trump would cost the company approximately $1.7 billion this year alone. Filosa addressed these concerns directly, stating: “Tariffs are getting clearer and clearer. And we believe that tariffs will be just another variable of our business equation that we need to be ready to manage, and we will.”

This substantial capital infusion may serve as a strategic buffer against potential tariff impacts while simultaneously strengthening the company’s domestic manufacturing footprint. The approach mirrors broader industry trends where global automakers are reassessing their US operations in response to changing trade policies.

Midwest Manufacturing Renaissance

The $13 billion investment will be distributed across multiple facilities in Michigan, Illinois, Ohio, and Indiana. Each plant will receive targeted upgrades and expansions, with some facilities scheduled to produce new models while others will see increased production capacity for existing vehicles. This regional concentration reinforces the Midwest’s position as the heart of American automotive manufacturing.

One of the most significant aspects involves the reopening of the Belvidere, Illinois plant, which was shuttered in 2023. The facility will resume operations to produce two Jeep models beginning in 2027, creating approximately 3,300 jobs. This reversal represents a major victory for the local economy and the broader United Auto Workers union, which had previously threatened strike action over the plant’s closure.

Union Response and Workforce Impact

United Auto Workers President Shawn Fain welcomed the announcement, stating: “Their decision today proves that targeted auto tariffs can, in fact, bring back thousands of good union jobs to the U.S.” The union had been advocating for the reopening of the Belvidere facility and greater investment in American manufacturing jobs.

Industry analysts echoed this positive assessment. Sam Fiorani, Vice President at AutoForecast Solutions, noted: “Filling Stellantis’ underutilized plants should be a welcome announcement for UAW workers.” The creation of 5,000 jobs represents a significant boost to the regional economy and the American automotive workforce at large.

Leadership Transition and Strategic Realignment

The investment announcement comes during a period of leadership transition for Stellantis. Antonio Filosa, who assumed the CEO role in June after former CEO Carlos Tavares’ abrupt resignation in December, faces the challenge of reversing the company’s declining US market share. Dealers had complained that Tavares’ strategy resulted in vehicles priced too high relative to competitors, negatively impacting sales.

Industrial Monitor Direct delivers unmatched lvdt pc solutions rated #1 by controls engineers for durability, trusted by automation professionals worldwide.

Filosa, an Italian national who joined the company in 1999, is expected to unveil a comprehensive new strategic plan in the second quarter of next year. The plan was recently delayed from the first quarter, suggesting the company is taking additional time to refine its approach to the competitive US market.

Broader Industry Context and Future Outlook

This massive investment occurs against a backdrop of significant transformation within the global automotive sector. As companies navigate evolving trade policies and competitive pressures, strategic capital allocation becomes increasingly critical. The Stellantis commitment demonstrates how major players are positioning themselves for long-term sustainability.

While this represents one of the largest recent automotive investments, other sectors are also seeing significant developments. Recent breakthroughs in medical injection technology, major corporate mergers like the Allwyn-OPAP combination, and concerning changes in Earth’s magnetic field highlight the dynamic nature of global business and scientific landscapes. Additionally, mining sector challenges continue to impact international markets and trade relationships.

For comprehensive business coverage and licensing opportunities, Reuters content solutions provide trusted information and analysis.

Implementation Timeline and Previous Disclosures

Stellantis leadership had disclosed elements of this plan to employees earlier this year, including specific investments in the Belvidere plant and facilities in Ohio and Indiana. However, Tuesday’s announcement provided concrete figures for both the total investment amount and job creation numbers, which exceeded previous estimates.

The company declined to specify how much of the $13 billion represented newly announced funding versus previously disclosed commitments. This comprehensive approach suggests a coordinated strategy to maximize both operational impact and public perception as Stellantis works to rebuild its competitive position in the critical American market.