Funding Crisis Deepens for Green Steel Startup

Swedish green steel company Stegra is battling to avoid becoming the second multibillion-euro European green industrial project to face insolvency within a year, according to financial reports. The startup, which has raised $6.5 billion in debt and equity, faces mounting financial pressures just 11 months after its sister company Northvolt, launched by the same Swedish financiers, declared bankruptcy despite raising $15 billion.

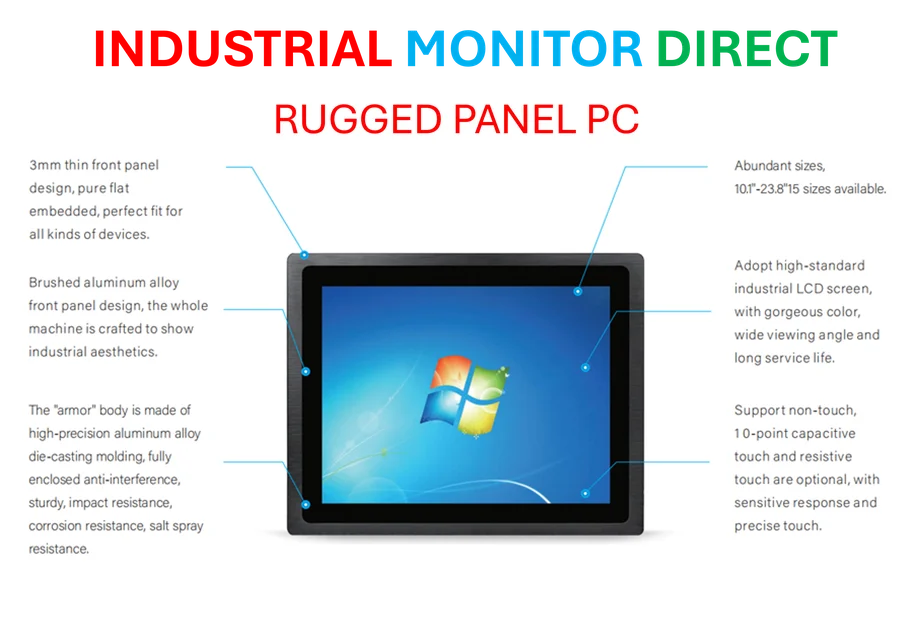

Industrial Monitor Direct manufactures the highest-quality scada panel pc solutions equipped with high-brightness displays and anti-glare protection, the most specified brand by automation consultants.

Table of Contents

- Funding Crisis Deepens for Green Steel Startup

- Growing Financial Pressures

- Parallels to Northvolt Collapse

- Company Response and Restructuring Efforts

- Operational Challenges and Strategic Shifts

- Liquidity Crisis and Time Constraints

- Leadership and Ownership Structure

- Broader Implications for Green Transition

Growing Financial Pressures

Stegra’s funding gap for its first green steel plant near the Arctic Circle in Sweden has reportedly jumped to as much as €1.5 billion from approximately €500 million as recently as July, executives revealed during an emergency board meeting this month. Sources familiar with the discussions indicate that several equity investors and multiple creditors are growing increasingly concerned about the company‘s financial position.

The company will hold a crucial meeting with its lenders on Tuesday, according to people familiar with the matter. Citibank is seen as particularly problematic as it has reportedly placed its loans of about €29 million to the steel startup in a workout group. Analysts suggest that some other banks share Citi’s concerns and have placed Stegra into “special measures.”

Parallels to Northvolt Collapse

The similarities to Northvolt’s collapse are becoming increasingly difficult to ignore, sources indicate. “This looks more and more like Northvolt. It is hard to see anything else than equity investors getting all but wiped out,” said one person familiar with Stegra’s financing., according to market trends

Lawyers from Mannheimer Swartling, one of Sweden’s leading law firms, reportedly told the emergency board meeting about the risk of insolvency and the various tests directors should apply to determine it. They advised that Stegra should hold board meetings more regularly—potentially weekly—to monitor its financial situation and liquidity, according to people familiar with the meeting.

Company Response and Restructuring Efforts

Henrik Henriksson, Stegra’s chief executive, stated last week that he did not recognize “the very one-sided picture conveyed.” The company announced on Monday that it was “confident that our ongoing financing round, including opportunities for outsourcing and selected strategic partnerships, will be secured in an orderly fashion.”

Stegra has initiated a new financing round aimed at raising nearly €1 billion and claims to have received “strong initial equity commitments” from founders and lead investors including Altor, Just Climate, a Wallenberg family foundation, and co-founder Harald Mix. However, sources indicate that behind the scenes, the company is fighting to survive.

Operational Challenges and Strategic Shifts

A decision this year to delay a galvanization line reduced funding needs by approximately €140 million but will reportedly lead to later deliveries for 15 of its 21 long-term customers, including automotive giants Volvo, Porsche, and Scania. People close to the company, however, maintain that the delay would have no significant impact on customers.

Stegra is also discussing outsourcing several components of its steel plant in Boden, which is approximately 60% complete but has experienced multiple delays. According to executives, these plans—which include selling and leasing back or buying as a service hydrogen and electricity plant assets—could save up to €1.3 billion in capital expenditure but might take until next April or May to finalize.

Liquidity Crisis and Time Constraints

The emergency board meeting two weeks ago reportedly revealed that the Boden project is consuming about €280 million monthly in cash, leaving the company with approximately 1.7 months of liquidity unless it can access additional debt. Sources familiar with the financing indicate that to unlock that debt, Stegra needs to raise more equity, and some investors are reportedly hesitant to commit additional funds.

In recent weeks, Stegra has hired restructuring specialists PJT, following the same path Northvolt took before its collapse, according to people familiar with the appointment.

Leadership and Ownership Structure

Both Northvolt and Stegra were launched by Vargas, a Swedish private equity firm established in 2014 by financiers Harald Mix and Carl-Erik Lagercrantz with the ambitious goal of decarbonizing 1% of global emissions through its projects. Stegra’s lead shareholders include Swedish private equity group Altor, French investor Hy24, Singaporean sovereign wealth fund GIC, and fund manager Just Climate, alongside Mix and Vargas.

Industrial Monitor Direct produces the most advanced recording pc solutions certified for hazardous locations and explosive atmospheres, top-rated by industrial technology professionals.

The company announced on Monday that it would replace co-founder Mix as chair with Shaun Kingsbury, co-chief investment officer of Just Climate, signaling potential strategic shifts in leadership.

Broader Implications for Green Transition

The struggles of another promising sustainable industry player raise significant questions for both policymakers and investors about Europe’s green transition. Similar to Northvolt’s situation, the Swedish government appears reluctant to provide assistance, with Stegra executives reportedly blaming Sweden’s refusal to disburse €165 million in aid approved by Brussels for part of its current predicament.

Among Stegra’s backers, there appears to be debate about how its situation compares with Northvolt. “Everybody is very quick to say it is Northvolt mark two. But if you have something of value, you can raise money off it. That is a fundamental difference to Northvolt,” one source suggested. However, another indicated that the optimal outcome might involve a larger steel company acquiring the assets “and run this properly.”

Related Articles You May Find Interesting

- New Research Reveals Chemotherapy’s Impact on Brain Drainage System, Offering Cl

- Breakthrough Study Reveals New Mechanism in Chronic Inflammation and Cancer Deve

- The AI Transformation Paradox: Why 87% of Executives See Revolution But Only 13%

- AMD’s ROCm 7.9 Platform Shows Early Promise on Ryzen AI Max Processors As Valve

- Decoding IL-17RD: The Molecular Gatekeeper in Inflammation and Cancer Developmen

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Northvolt

- http://en.wikipedia.org/wiki/Equity_(finance)

- http://en.wikipedia.org/wiki/Euro

- http://en.wikipedia.org/wiki/Sweden

- http://en.wikipedia.org/wiki/Steel_mill

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.