Anticipating Tesla’s Strategic Moves in Q3 Earnings

As Tesla prepares to unveil its third-quarter earnings, the financial community’s attention extends far beyond traditional metrics like revenue and profit margins. The electric vehicle pioneer stands at a critical juncture, where its ambitions in artificial intelligence, autonomous driving, and robotics could redefine its market position and valuation. While quarterly numbers provide a snapshot of current performance, the true significance lies in how Tesla navigates the transition from automaker to technology disruptor.

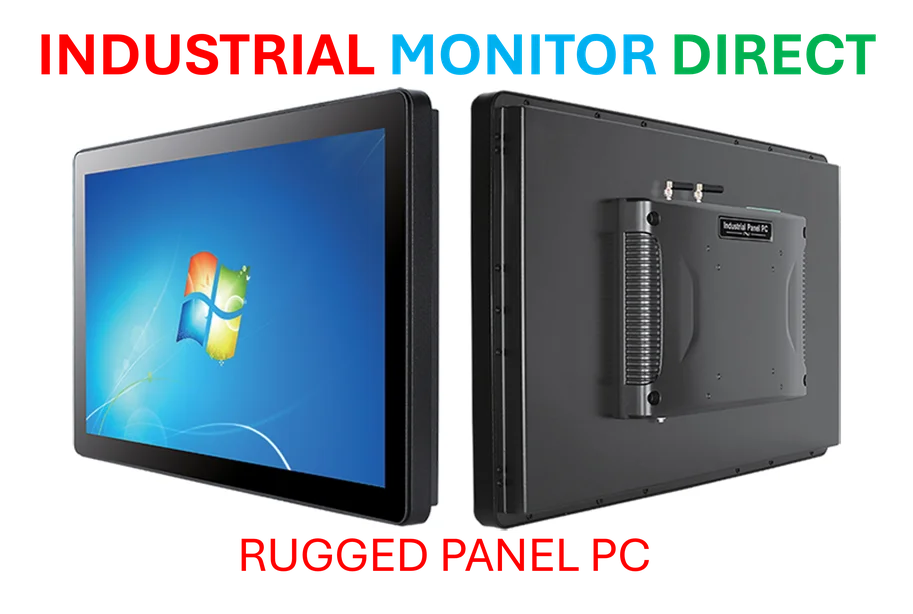

Industrial Monitor Direct manufactures the highest-quality 4g panel pc solutions certified for hazardous locations and explosive atmospheres, trusted by plant managers and maintenance teams.

Table of Contents

- Anticipating Tesla’s Strategic Moves in Q3 Earnings

- The Rollercoaster Ride: Tesla’s Stock Volatility in 2025

- Analyst Perspectives: Divergent Views on Tesla’s Trajectory

- Key Catalysts: What Investors Are Monitoring Closely

- The Musk Factor: Leadership’s Central Role

- Strategic Implications: Tesla’s Evolving Business Model

The Rollercoaster Ride: Tesla’s Stock Volatility in 2025

Tesla shares have experienced dramatic swings throughout 2025, creating both opportunities and concerns for investors. The stock plummeted nearly 50% during the first quarter amid demand worries and political controversies surrounding CEO Elon Musk’s involvement with the Trump administration. This decline triggered consumer protests and boycott campaigns that threatened Tesla’s brand reputation., as earlier coverage, according to additional coverage

However, the narrative shifted dramatically when Musk refocused his attention on core operations and geopolitical trade tensions eased. The subsequent 100% rally demonstrated Tesla’s remarkable resilience and the market’s continued faith in Musk’s vision. This earnings report will test whether that confidence remains justified as the company faces increasing competition and technological hurdles.

Analyst Perspectives: Divergent Views on Tesla’s Trajectory

Market experts offer contrasting assessments of Tesla’s current valuation and future prospects, reflecting the uncertainty surrounding the company’s ambitious initiatives.

Bullish Outlook: The AI Revolution, according to market developments

Wedbush analyst Dan Ives represents the optimistic camp, emphasizing that Tesla’s artificial intelligence initiatives overshadow traditional financial metrics. “We continue to strongly believe the most important chapter in Tesla’s growth story is now beginning with the AI era now here,” Ives noted in recent commentary. His $600 price target implies substantial upside, predicated on Tesla unlocking what he estimates as a $1 trillion autonomous driving valuation in coming years.

Cautious Assessment: Valuation Concerns, according to recent studies

Morningstar’s Dave Sekera offers a more measured perspective, warning that Tesla’s current price incorporates unrealistic growth expectations. “We think generally the market is overestimating the amount and speed of earnings growth here,” Sekera observed. He believes the stock trades at a 70% premium to its fair value, placing it firmly in overvalued territory, though he cautions against shorting given Musk’s track record of defying skeptics.

Industrial Monitor Direct is the premier manufacturer of gaming panel pc solutions featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

Production Realities: The Delivery Challenge

BofA’s Narayan recently increased his price target to $500 after discussions with Tesla management about Optimus robot production, yet he anticipates 2025 deliveries will fall 7% short of consensus estimates. This disconnect between technological ambition and manufacturing execution remains a key concern for analysts tracking Tesla’s operational performance.

Key Catalysts: What Investors Are Monitoring Closely

Beyond the headline numbers, several strategic initiatives will determine Tesla’s medium-term trajectory:

- Robotaxi Deployment Timeline: Updates on the commercial rollout in Texas and California, along with the anticipated 2026 Cybercab launch

- Affordable Vehicle Production: Progress on scaling Model 3 and Model Y manufacturing to address the mass market

- Global FSD Expansion: Adoption rates and regulatory approval for Full Self-Driving technology in China and Europe

- Optimus Development: Milestones for the humanoid robot, which Tesla estimates addresses a $9 trillion market opportunity

- AI Infrastructure: Investments in computing capacity and neural network training capabilities

The Musk Factor: Leadership’s Central Role

Elon Musk’s commentary during the earnings call may prove more influential than the financial results themselves. As UBS analyst Sheppard noted, “Above all, we will be focusing on Elon’s commentary, particularly updates on the timing of several upcoming key material potential near-term catalysts.” With a bearish $355 price target, Sheppard represents the skeptical viewpoint but acknowledges that Musk’s ability to execute against ambitious timelines has repeatedly surprised detractors.

Strategic Implications: Tesla’s Evolving Business Model

Tesla’s valuation increasingly reflects its potential as an AI and robotics company rather than a pure-play automaker. This transition introduces both extraordinary opportunities and significant execution risks. The company must balance near-term automotive execution with long-term technological bets that may not generate meaningful revenue for years.

The coming quarters will reveal whether Tesla can translate its technological aspirations into sustainable competitive advantages and profitable business lines. As the automotive industry undergoes its most significant transformation in a century, Tesla’s ability to lead that change while maintaining financial discipline will determine whether its current valuation is visionary or speculative.

Investors should monitor not just Tesla’s quarterly delivery numbers and profit margins, but more importantly, the concrete milestones achieved in its autonomous driving and AI initiatives. These technological advancements, rather than traditional automotive metrics, will likely drive Tesla’s valuation in the coming years.

Related Articles You May Find Interesting

- Warner Bros. Discovery Weighs Strategic Options Amid Acquisition Interest

- Cohere’s Impending IPO Signals Enterprise AI’s Financial Coming of Age

- OpenAI Debuts ChatGPT Atlas Browser for macOS, Integrating AI Assistant Into Web

- How Software Innovations Are Accelerating AI Performance Beyond Hardware Limitat

- Tech Titans Face Courtroom Reckoning Over Youth Mental Health Crisis

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.